BASF SE NA O.N.

Commented by André Will-Laudien on July 4th, 2023 | 07:50 CEST

Nucera IPO boosts Greentech shares: Varta, Manuka Resources, BASF and ThyssenKrupp on the buy list

Many companies have set themselves the goal of contributing to offsetting man-made emissions and combating climate change. One proven means is gradual decarbonization, for example, in the energy-intensive heavy industry sector. The IPO of ThyssenKrupp's hydrogen subsidiary, Nucera, is important from this perspective because the newly raised funds will be used to advance green steel production. It is a German project that could set an international precedent. We take a deeper look into an emerging sector.

ReadCommented by André Will-Laudien on June 29th, 2023 | 08:50 CEST

100% with Clean Energy! BYD, Regenx Technologies, BASF, Siemens Energy - Recycling is becoming a challenge!

As Western governments finally take climate protection seriously, the media has focused on the areas of energy, mobility, and health. It is clear to all participants that the changes in the world's climate will lead to undesirable developments. Glaciers are melting, the Earth's temperature is rising, and our oceans are already too warm for many species. Huge investments are being made in renewable power generation and modern mobility solutions. The high growth requires access to metals. Recycling also plays a major role because it conserves valuable resources and brings raw materials back into the cycle. Some companies are making a name for themselves, and shareholders can benefit from this.

ReadCommented by Juliane Zielonka on June 28th, 2023 | 07:40 CEST

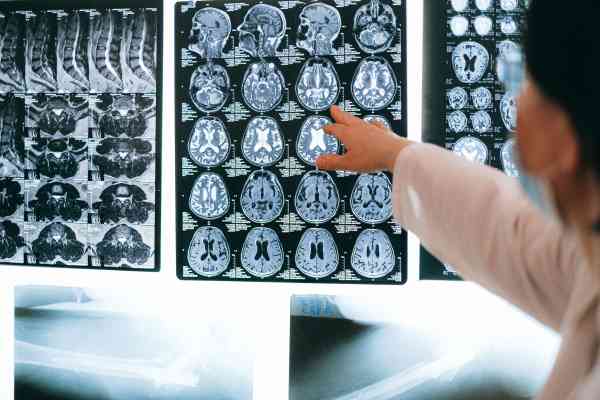

Cardiol Therapeutics, Bayer, BASF - Sensational breakthroughs in medicine and sustainability

A study in the JACC journal shows that cardiovascular risk factors and diseases will increase sharply in the US. Ischemic heart disease is projected to increase by 31.1%, heart failure by 33.0% and myocardial infarction by 30.1%. Cardiol Therapeutics, a Canadian company specializing in cardiovascular diseases, is thus rapidly gaining in importance. Bayer goes AI and partners for the first time with a Swiss hospital for a digital solution that supports radiologists in diagnosis and treatment. BASF invests with its venture arm in the Swiss startup DePoly, which has developed an innovative chemical recycling technology. Discover the sustainable solution behind this investment here.

ReadCommented by Nico Popp on June 22nd, 2023 | 09:05 CEST

Isolation and e-car crash - A new China shock for markets? BASF, NIO, Power Nickel

It was a profit warning with a signal effect: Lanxess shares plunged on Tuesday after a gloomy outlook. The BASF share also came under pressure as a result. Once again, developments around China are causing concern. While the major economies are increasingly isolating themselves and relying on autarky and protectionism, the collateral damage is increasing. But there are also profiteers. We shed light on the opportunities and risks.

ReadCommented by André Will-Laudien on June 20th, 2023 | 07:30 CEST

Blackout! Energy shares urgently sought: Plug Power, Varta, Altech Advanced Materials, BASF - Solar, wind or hydrogen?

Now things are becoming clearer. Germany is unlikely to experience an energy shortage like a blackout, and gas supplies for the winter also seem secure, given a 20% drop in gas consumption compared to the average figures from 2018 to 2021. However, household prices remain significantly above the long-term average. Currently, energy suppliers are not passing on the purchasing advantages from the Leipzig power exchange to their customers. Wholesale gas prices have fallen by 85% since mid-2022, but these lower conditions are not reaching customers. What opportunities are there for resourceful investors?

ReadCommented by Juliane Zielonka on June 16th, 2023 | 07:00 CEST

Defiance Silver Corp., BASF, Ballard Power - Precious metals drive renewable energy to peak performance

Silver is essential to booming industries and is characterized by high conductivity of heat and electricity. Defiance Silver Corp., a Canadian exploration company, has achieved the broadest and highest-grade mineralization to date in its drilling at the San Acacio project in Mexico. Results from 4 of the 6 drill holes confirm the promising potential in the Veta Grande area. Meanwhile, BASF is collaborating with a Chinese green shipping partner to deploy its onboard CO2 capture system for decarbonization. Ballard Power is considering just the opposite. The Canadian battery manufacturer has doubts about China being a reliable partner. The call for money in the form of government subsidies makes them hesitant.

ReadCommented by Nico Popp on May 18th, 2023 | 09:30 CEST

Climate protection as an investment: BASF, Commerzbank, GoviEX Uranium

Fewer CO2 emissions, more climate protection. Every DAX-listed company is committed to more sustainability in some form or another. But what is the truth of these promises? And are the supposed climate shares a sustainable investment at all? We do the check and take a detailed look at three exciting stocks from different sectors and regions.

ReadCommented by André Will-Laudien on May 9th, 2023 | 09:10 CEST

Turnaround stocks with a 300% chance do not come along every day - BASF, Defiance Silver and TUI

Whenever the stock market reaches new highs, investors look for lagging stocks. This is not so easy because a weak price performance has its reasons. But often, things are simply overlooked. We present three stocks with a good story to tell but have been left behind. BASF, Defiance Silver and TUI were conspicuously undercut. And amid all the turbulence in the financial system, silver is stealthily making its way upwards and easily overcoming the USD 25 mark. Watch out at the edge of the platform!

ReadCommented by Fabian Lorenz on May 4th, 2023 | 08:10 CEST

Buy or sell? TUI, BASF and Defence Therapeutics

BASF share a buy or sell? Analyst opinions on the chemical giant diverge widely. The DAX-listed company has just reported quarterly figures, but it did not provide clarity about the prospects. However, some speculate on a forecast increase. Analysts have not commented on TUI for quite some time. After the turbulence surrounding the capital increase, new impulses are being sought, perhaps through a deal with the German government? There is plenty of impetus for rising prices at Defence Therapeutics. The biotech high-flyer of the past months is increasingly positioning itself as a partner to BioNTech, Moderna and Co - and perhaps even a takeover candidate.

ReadCommented by André Will-Laudien on April 26th, 2023 | 07:50 CEST

Tesla, BYD and Volkswagen are all looking for the perfect battery. First Phosphate, BASF and Varta in focus

The battery is becoming the linchpin of e-mobility. As the batteries age, their performance diminishes, which will soon affect this technology's first buyers. Although there are fewer wearing parts on an electric vehicle than on a conventional combustion engine, the battery is one of the most expensive components. Therefore, its replacement is anything but cheap. Meanwhile, big manufacturers like Tesla, BYD and VW are working on the ultimate battery with increased power and range. Volkswagen is investing EUR 10 billion in a new gigafactory near Valencia. The sector is betting on the new mobility, and the industry is adapting accordingly. Which shares have their noses in the wind?

Read