First Hydrogen Corp.

Commented by Fabian Lorenz on October 24th, 2025 | 07:25 CEST

Yesterday +16%! D-Wave explodes again! Siemens Energy and First Hydrogen shares benefit from AI's energy hunger

What a bounce for D-Wave. After a sharp correction yesterday, the quantum stock rose 16%. Is the Trump administration getting involved in quantum companies? That is the rumor making the rounds. Meanwhile, the energy hunger of AI data centers is also keeping the stock market on tenterhooks. One beneficiary from Germany is Siemens Energy. The stock is running like clockwork. Small modular reactors (SMRs) are a huge topic in North America. The Canadian government is providing massive support to industry, which should benefit First Hydrogen. The Company plans to combine its hydrogen expertise with SMR technology. So - buy now?

ReadCommented by Nico Popp on October 13th, 2025 | 07:00 CEST

Hydrogen as an explosive mixture: First Hydrogen, Plug Power, Amazon

Hydrogen continues to shine as a beacon of opportunity for industry and logistics. Experts remain optimistic despite the challenges of scaling up hydrogen production in Germany. Market observers, such as McKinsey, anticipate that the cost of green hydrogen will fall rapidly in the coming years, potentially turning many projects, still debated by experts today, into profitable ventures. Companies already established in the sector stand to benefit the most. We present three hydrogen visionaries and examine whether the associated stocks can benefit from the hydrogen boom.

ReadCommented by Armin Schulz on October 7th, 2025 | 07:05 CEST

Steel, hydrogen, SMRs, renewable energy: How to cover all the megatrends with thyssenkrupp, First Hydrogen and RWE

The global industry is undergoing a radical transformation. Drivers include volatile supply chains, ambitious climate targets, and technological change. This tension is giving rise to new markets and unexpected winners. Some pioneers are already showing how this transformation can be turned into profit. They combine deep structural change with a green hydrogen economy and groundbreaking energy research. Three companies exemplify how this transformation can not only be mastered but also leveraged as an opportunity: thyssenkrupp, First Hydrogen, and RWE.

ReadCommented by André Will-Laudien on September 22nd, 2025 | 07:20 CEST

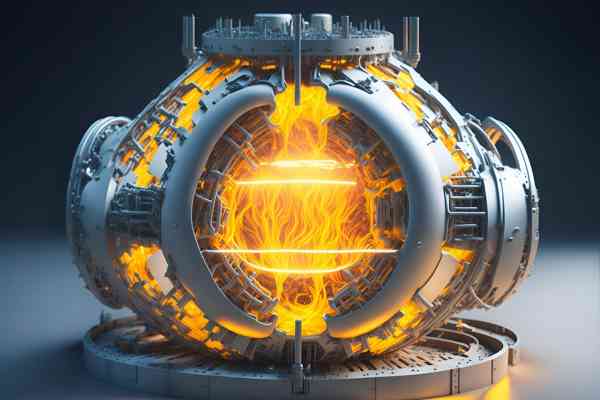

SMR nuclear power on the rise! 100% with Oklo, First Hydrogen, E.ON, and Plug Power

Since Fukushima, nuclear power seemed to be on the decline, but with the energy transition, it is now experiencing a spectacular comeback, with small modular reactors (SMRs) taking center stage. Although this topic is only sporadically addressed in Europe, the US, under Donald Trump, recently approved a program to quadruple domestic nuclear power by 2050. While Brussels is still hesitating, the technology is advancing in Poland, France, Finland, and Czechia. These innovative countries are planning concrete SMR projects, while France even classifies the reactors as a pillar of future energy supply. Of course, large amounts of electricity are also supplied to Germany at high prices. Canada has already started approval processes for its first plants, and British energy giant Rolls-Royce is working on the series production of its own SMR technology. Even the International Atomic Energy Agency (IAEA) is now talking about a turning point. Which companies are currently at the forefront of this nuclear revolution?

ReadCommented by Fabian Lorenz on September 18th, 2025 | 07:10 CEST

MAJOR DEVELOPMENTS for megatrend stocks: Rheinmetall, BioNTech, First Hydrogen

Rheinmetall is going full throttle: on land, at sea, in the air, and even in space. Its latest bombshell is the announced takeover of Lürssen's naval division. Will this provide the tailwind the stock needs to break through the EUR 2,000 mark on a sustained basis? Analysts view the transaction positively, though some cautionary voices remain. Meanwhile, a major development in Canada is boosting sentiment around First Hydrogen. North Americans aim to be at the forefront of the small modular reactors (SMRs) movement. The potential is enormous. BioNTech also holds significant promise in the fight against cancer. However, challenges have emerged - ironically in the world's largest pharma market. The US government plans to cut or even stop funding for new mRNA vaccine development. BioNTech shares reacted accordingly and may break through their sideways trend downwards.

ReadCommented by Nico Popp on September 10th, 2025 | 07:10 CEST

Hydrogen – New paths through the funding jungle: ITM Power, NEL, First Hydrogen

Europe has ambitious goals for the hydrogen economy, but its implementation is often hampered by complex regulations and bureaucratic funding processes. "We have ambitious goals in Europe, but implementation is stalling because we are getting lost in the details of the rules. Instead of triggering investment, we are creating complexity," criticizes Jorgo Chatzimarkakis from the Hydrogen Europe association in an interview with Telepolis. Many projects are still on hold due to unclear approvals or subsidy details. While large energy corporations can navigate the bureaucratic jungle, agile specialists are looking for niche opportunities. We shed light on the business models of NEL, ITM Power, and First Hydrogen.

ReadCommented by Armin Schulz on September 4th, 2025 | 07:20 CEST

BYD under fire: How First Hydrogen, SMR Technology, and Nel ASA aim to disrupt the Hydrogen Market

The mobility of the future will be shaped by more than just one technology. While electric batteries dominate in passenger vehicles, hydrogen offers enormous potential in heavy-duty transport, light commercial vehicles, and industrial applications. Its breakthrough depends on affordable, green production. Innovative small modular reactors (SMRs) could be the game changer here, radically reducing costs and guaranteeing long-term production. In this context, we take a closer look at BYD, the industry leader in electric mobility. First Hydrogen has already tested hydrogen-powered vehicles on the road and is now increasingly focusing on SMR development. Last but not least, we analyze hydrogen veteran Plug Power.

ReadCommented by André Will-Laudien on August 20th, 2025 | 07:05 CEST

Rethinking energy! Siemens Energy, First Hydrogen, VW, and BYD for the winning portfolio

For a long time, it seemed that nuclear energy was disappearing from the global energy mix, but now there are clear signs of a change of course. The US, in particular, is pushing for a restart. The government has adopted an ambitious plan to quadruple nuclear power capacity. The focus is on small modular reactors (SMRs) - compact reactors that can be used in decentralized locations, are considered efficient and safe, and can also be built more quickly than conventional large-scale power plants. In addition to their role in domestic energy supply, SMRs are considered an important export product for allied countries looking to reduce their dependence on fossil fuels. At the same time, they offer the possibility of being flexibly combined with renewable energy sources, such as supplementing solar and wind farms to ensure base load capability. E-mobility also depends on a secure power supply. Which companies are attracting the most investor interest?

ReadCommented by Fabian Lorenz on August 12th, 2025 | 07:20 CEST

First 1,000%, now dividends! Siemens Energy, Nordex, and First Hydrogen shares

The race for dominance in artificial intelligence is increasingly turning into a competition for energy. While Helion Energy has begun construction of the first fusion reactor designed to power Microsoft's data centers in the US, Siemens Energy, among others, is earning handsomely in Germany with infrastructure for AI giants. The stock has gained over 1000% in recent years, and the Bundestag has now cleared the way for profits to be distributed to shareholders once again. First Hydrogen is on its way to becoming a specialist in green hydrogen, produced using small modular reactors (SMRs). The Canadian government is pushing development, and the Company is collaborating with a university. Following a recent setback, the stock may present a new entry opportunity. Those who invested in Nordex at the start of the year seized their chance. The stock has emerged as one of the quiet high-flyers of 2025, with profitability on the rise.

ReadCommented by Nico Popp on August 7th, 2025 | 07:25 CEST

Hydrogen turnaround? Bad news from Africa: First Hydrogen, thyssenkrupp nucera, BASF

According to a report in Der Spiegel, producing green hydrogen in Africa for export to Europe could be more expensive than previously thought. This is indicated by research conducted by scientists from the Technical University of Munich, Oxford, and ETH Zurich. According to the study, only 2% of around 10,000 sites examined across 31 African countries could produce at competitive costs by 2030. The reason lies in financing. Depending on the country in Africa, financing costs range between 8% and 27%, which is too high to remain competitive. Instead of the planned price guarantees of EUR 3 per kg of hydrogen, the EU would have to guarantee EUR 5 to ensure a reliable flow of hydrogen from Africa to Europe. What does this mean now for the European hydrogen economy?

Read