DESERT GOLD VENTURES

Commented by André Will-Laudien on November 2nd, 2023 | 07:30 CET

Surprise after Q3 figures: Deutsche Bank, Microsoft, Desert Gold, Siemens - Good Chart Technique and a boost from AI?

The ECB has paused its interest rate adjustments for the first time in 12 months. It is not surprising, as a declining economy is currently causing inflationary pressures to subside somewhat. Because of the numerous geopolitical conflicts, gold has surpassed the USD 2,000 mark again after a long consolidation period. And then there are the many quarterly figures. It is good for those who can keep track of them all. We look at new developments with Deutsche Bank, Microsoft's entry into the German corporate AI market, and the excellent opportunities at the explorer Desert Gold.

ReadCommented by Stefan Feulner on October 26th, 2023 | 09:20 CEST

Coinbase, Desert Gold Ventures, MicroStrategy - Gold at USD 3,700, Bitcoin Priceless

Are you familiar with the book "Rich Dad Poor Dad", which was, for a long time, on the Top 10 bestseller lists of the Wall Street Journal, USA Today and the New York Times? Its author, Robert Kiyosaki, recently revealed his forecasts for his "hard assets" via the X platform, formerly Twitter. Accordingly, he expects the price of gold to rise significantly to USD 3,700, while Bitcoin will reach a price of USD 135,000.

ReadCommented by Juliane Zielonka on October 20th, 2023 | 08:00 CEST

Desert Gold, Netflix, Allianz - The stocks investors prefer now

The gold price is currently experiencing a high phase triggered by the conflict in the Middle East. In the last four weeks, the price has risen by 6%. This development is not only piquing the interest of investors but is also boosting companies like Desert Gold Ventures, which is piloting an ambitious gold project in West Africa. Their flagship project, the Senegal Mali Shear Zone (SMSZ), is at the heart of this. With escalations in international cities rising, people prefer to stay home and watch Netflix. The stock shot up 12%. And what do you do if your car catches fire, as happened yesterday in Hamburg's Elbe Tunnel? It is good to have insurance with Allianz...

ReadCommented by Fabian Lorenz on October 12th, 2023 | 07:15 CEST

Stocks for bargain hunters: BYD, JinkoSolar and Desert Gold

What do renewable energies and gold have in common? Despite attractive future prospects, shares from both sectors have taken a beating in recent months. Often for no apparent reason. This opens up opportunities for bargain hunters with a bit of patience. For example, with shares like JinkoSolar and Desert Gold. Both companies are historically cheap. JinkoSolar has just reported a new sales record and wants to grow further. Desert Gold lures with an almost ridiculously low valuation of its gold resources and continues to drill. A rebound or takeover beckons for patient investors. And BYD? The Chinese are on track to displace Tesla as the world's No. 1 e-car manufacturer. Nevertheless, the stock is stuck, and in Europe, the EU is investigating illegal subsidies.

ReadCommented by André Will-Laudien on September 25th, 2023 | 08:35 CEST

Make a return instead of sitting on the sidelines! Nel ASA, Desert Gold or Nikola Motors - Who belongs on the buy list?

Despite the bull market, the hydrogen sector is feeling the global investment slump, not to mention precious metals. Once again, the US Federal Reserve has issued warnings on the inflation front, but this time, after 11 consecutive hikes, it has not turned the interest rate screw. The refinancing rate remains at 5.5%, but the accompanying wording has greatly unsettled the markets. Capital market rates shot up, reaching a whopping 4.55% for 30-year US Treasury bonds - the highest level in 10 years. We take a look at values that have fallen sharply. Where can adequate yields be expected?

ReadCommented by Stefan Feulner on September 20th, 2023 | 07:40 CEST

TUI, Desert Gold, Rheinmetall - Is the next upward wave coming?

Today is the day! Once again, the Federal Reserve Bank will tip the scales. Is there another interest rate hike, or, as the consensus expects, will the US central bank pause until further notice? In addition to the actual interest rate step, the markets also react to the statements of the FED members, in which direction they tend in the coming months. Many anticipate an end to the strict monetary policy and see the high interest rate level wavering due to the increased risks of a recession.

ReadCommented by Nico Popp on September 12th, 2023 | 08:25 CEST

Wirecard 2.0 for AI industry? Deutsche Bank, Commerzbank, Desert Gold

It is currently little more than a sequence of events and backgrounds. Nevertheless, the video, published at the end of last week, has great explosive power. Is there a rigged game going on around one of the largest companies in the world? Are greedy hedge fund managers lining their pockets with dubious schemes? And above all, are these events sending us into a disaster compared to which the collapse of Wirecard is a non-event? We assess the situation, provide insights and point out alternatives.

ReadCommented by Juliane Zielonka on September 5th, 2023 | 08:10 CEST

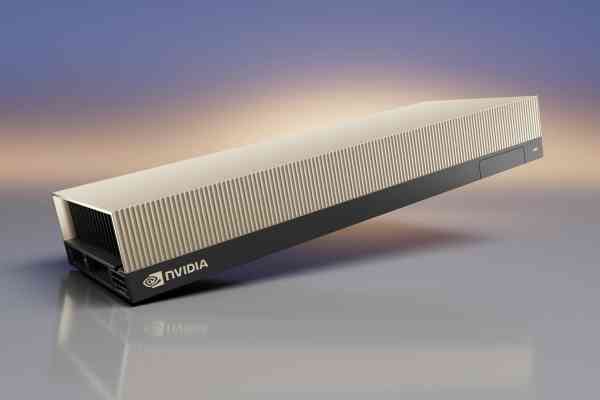

Gold rush mood at NVIDIA and Desert Gold - Concrete gold share Vonovia crumbling

Stock market darling NVIDIA is behaving bullish again after a moderate decline. Over 50% of NVIDIA's buying comes from S&P500 heavyweights like Microsoft, Google and Amazon. All these companies invest heavily in GPUs to develop AI models. The rising importance of Artificial Intelligence (AI) and the increased use of GPUs in this industry contribute to the increased demand for gold and other commodities used in the manufacture of GPUs. Desert Gold, an exploration and development company in Mali, is benefiting from this trend. Its main project, the SMSZ project, covers 440 sq km and has proven and indicated gold resources of 8.47 million tons with a grade of 1.14 g/t gold. The venerable concrete gold real estate market is currently experiencing severe dislocation. 31% of project development volume in Germany is experiencing delays in residential construction. We look at what investors should do now to protect their portfolios.

ReadCommented by André Will-Laudien on August 31st, 2023 | 09:25 CEST

BRICS Realigns: Gold, Silver and Bitcoin in Turnaround! Is this the starting signal for TUI, Desert Gold and Adyen?

The acronym BRIC was coined in 2001 by Jim O'Neill, the Chief Economist of the major bank Goldman Sachs. The now frequently used acronym represents the initial letters of the countries Brazil, Russia, India, and China. At the time, it referred to the four fastest-growing emerging economies outside the Western industrial community G7; later, South Africa was added as the "S". At the August meeting of the BRICS countries in South Africa, a further 40 countries registered their interest in joining, 6 of which were admitted directly by January 2024. Thus, a strong community of states is emerging, covering a full 30% of the world's GDP and 46% of the global population. They all share a common goal: to reduce dependence on the US and the US dollar - thereby lessening Western influence. There are even long-term considerations of a shared currency. A wake-up call for Gold, Silver, and Bitcoin.

ReadCommented by Stefan Feulner on August 16th, 2023 | 05:30 CEST

Covestro, Desert Gold Ventures, Barrick Gold - Waiting for the next push

Although crash prophets have been raising their fingers for months and conjuring up a crash in the largest stock indices, such as the Dow Jones, Nasdaq and DAX, these continue to rush from high to high. On the other hand, precious metals such as gold and silver, which are suitable for crises and as inflation protection, are correcting. At the same time, the general conditions continue to improve, which should lead to sustainably rising prices in the long term.

Read