DEFENSE METALS CORP.

Commented by Fabian Lorenz on January 3rd, 2024 | 07:20 CET

100% share price increase in a few days! Plug Power, BYD and Defense Metals shares

Within just a few days, the Defense Metals share price more than doubled shortly before Christmas. Even if the price level of the developer of a rare earths project in Canada could not be fully maintained, the share is entering 2024 with new momentum. Important data is due soon. If these are also positive, the current valuation of around CAD 50 million could be a real bargain. Plug Power is not a bargain despite the massive drop in the share price. The hydrogen specialist needs to grow and accelerate its path to break even. The e-commerce giant Amazon should help with this. BYD can only dream of doing big business in the US so far. The market is closed to Chinese e-car manufacturers. Is it justified?

ReadCommented by André Will-Laudien on December 27th, 2023 | 07:00 CET

The 2024 share rocket without e-funding - BYD, Defense Metals, Porsche and Volkswagen

With the supplementary budget 2023, the fate of the e-funding was sealed. On December 16, the purchase premium hammer came down in an "ad hoc announcement" from Berlin: The funding of up to EUR 4,500 for the purchase of a new e-vehicle has expired with immediate effect. This was announced by the Federal Office for Economic Affairs and Export Control (BAFA). The deadline for applying for the funding ended on December 17, 2023, meaning that e-mobility is now a thing of the past. Only the reduced tax rate under the company car scheme and the general exemption from vehicle tax remain. Consumer advocates are complaining about the unequal treatment of different mobility concepts that have prevailed for years, and the Federal Constitutional Court will likely have to deal with this issue in due course. Time for investors to rethink - where are the opportunities in the investment year 2024?

ReadCommented by Stefan Feulner on December 12th, 2023 | 06:30 CET

Hensoldt, Defense Metals, RWE - Important milestones

Following the recent year-end rally on the world's stock markets, the chances of further price gains are good. Even in the last month of an eventful stock market year, plenty of activity remains. The course is being set with regard to the strategic goals for a successful 2024 as a whole. In addition, even in mid-December, major capital measures must be finalized before the books are closed.

ReadCommented by Armin Schulz on December 6th, 2023 | 08:00 CET

Siemens Energy, Defense Metals, Rheinmetall - Rare earths as a risk factor

The scarcity of and access to rare earths has become a major global concern. China plays a decisive role in the production of rare earths, as the country mines 60% of all rare earths worldwide and processes 85% of them. After the US banned the export of AI chips, China considered banning the export of rare earth metals. These trade blockades from both sides are causing tensions in international trade relations and concerns about supply bottlenecks. Rare earths play an important role in wind power, armaments, medicine, electromobility and the electronics industry. As an investor, one should be aware of these risks.

ReadCommented by Juliane Zielonka on November 30th, 2023 | 07:00 CET

Growth Industries in Focus: Investors see potential in Defense Metals, BASF and Volkswagen shares

Investors are looking for opportunities in growing markets. Looking at industries currently requiring rare earths - such as energy, defense, electromobility, and many more - leads to the mining sector. Someone has to supply the valuable raw materials so these industries can continue growing. Defense Metals' Wicheeda project in Canada shows promising results, particularly the increase to 6.4 million tons with a TREO content of 2.86%. BASF secures EUR 124.3 million in government funding for a green hydrogen plant in Ludwigshafen, planned in collaboration with Siemens Energy. Volkswagen is facing challenges, emphasized by VW board member Thomas Schäfer, who announced tough cuts to maintain competitiveness without closing plants. Volkswagen will have to respond to change with a more agile approach, especially as China advances in electromobility.

ReadCommented by André Will-Laudien on November 15th, 2023 | 06:30 CET

Greentech sector buybacks - The stage is set for a 100% rally! Nordex, Defense Metals, SMA Solar and Siemens Energy

With the new EU Climate Law, Europe has once again raised its long-term target for reducing greenhouse gases by 2050. Instead of a reduction of 80% to 95%, the aim is now net zero emissions, i.e. "climate-neutral". This is to be followed by negative emissions in subsequent years. The idea sounds promising: emission reducers can offset emission sources! However, climate change generally requires the use of modern Greentech technologies that "produce" these savings. Those looking to reduce or replace fossil fuel consumption typically need large apparatus and innovations, such as various alternative energy sources converted into electricity. Europe, in particular, faces the challenge that most of the necessary metals are classified as critical, making it financially unrealistic to roll out innovative projects on a broad scale. Which shares stand out in this environment?

ReadCommented by Stefan Feulner on November 6th, 2023 | 07:30 CET

These shares are right on trend - BYD, Defense Metals, Rheinmetall

After the correction of recent weeks, the DAX was able to send a positive signal for a year-end rally by exceeding the 15,000-point mark. Despite the escalating events in Gaza, the world's stock markets appear to be heading north. They are receiving a tailwind from monetary policy. This could mean the end of interest rate hikes for the time being. The badly battered companies in the technology sector, in particular, are likely to benefit from this.

ReadCommented by Fabian Lorenz on November 2nd, 2023 | 08:10 CET

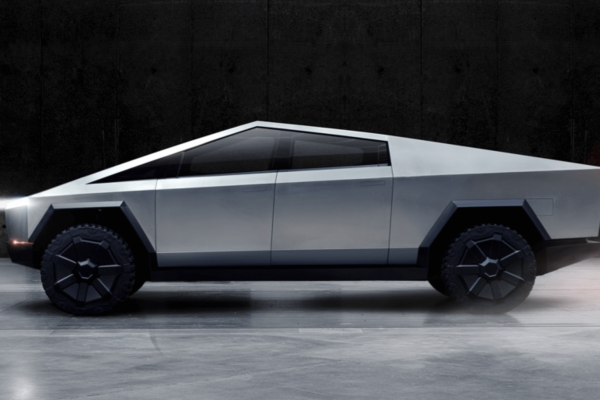

14 million e-cars in 2023 alone: BYD, Standard Lithium and Defense Metals profit

In the current year, one in every five vehicles sold is expected to have an electric drive, according to the International Energy Agency (IEA). This would amount to 14 million vehicles and correspond to a growth of around 35% compared to the more than 10 million sold in 2022. Opportunities for investors lie dormant along the entire value chain of electromobility. BYD aims to capture a significant portion of these sales figures and replace Tesla as the number one player in the electric vehicle sector. While Warren Buffett is selling again, analysts are advising to buy. Standard Lithium and Defense Metals are benefiting from the rising demand for batteries. Both companies have exciting projects with compelling economic calculations and alleviate concerns about China potentially using lithium and other resources as a "weapon." So, is it time to buy?

ReadCommented by Juliane Zielonka on October 19th, 2023 | 07:20 CEST

Defense Metals, Rheinmetall, FREYR Battery - Who offers the greatest growth potential?

Demand for rare earths is rising relentlessly, especially in sectors such as electromobility, renewable energies and agribusiness. Defense Metals, a Canadian explorer company, plays a key role in these industries. Through their Wicheeda rare earths project, they have the potential to become a leading producer of raw materials, which is particularly valuable given geopolitical tensions and the need for secure raw material suppliers. Rheinmetall wins an important electromobility order worth millions. Their specially designed heat pump for electric tractors is revolutionizing temperature control in modern commercial vehicles. FREYR Battery has successfully produced Norway's first lithium iron phosphate battery cell. They are also strengthening regional supply chains to establish a permanent presence in North America in the long term. Discover where the greatest growth potential lies now.

ReadCommented by Nico Popp on October 5th, 2023 | 08:35 CEST

Future investments that will soon ignite: Volkswagen, JinkoSolar, Defense Metals

Do you wish you had a crystal ball? What a question! Those who know the future could make great profit from it. But even without magical powers, one can succeed in consistently aligning your portfolio with the future. We explain how this works and what investors need to watch out for. In addition, we present three companies with great future potential and highlight when investments could be worthwhile and when investors would be better to wait and see.

Read