DEFENSE METALS CORP.

Commented by Stefan Feulner on June 29th, 2023 | 07:30 CEST

The profiteers of the new super cycles - SAP, Defense Metals, Hut 8 Mining

Every new innovation takes time and is also not protected from delays. This can be clearly seen in the example of listed renewable energy companies. At the beginning of the new decade, these companies were praised with great anticipation, but disillusionment quickly set in due to the lack of sales and profits. On the other hand, the fact that this sector will prevail in the long term due to the energy turnaround is a foregone conclusion. The situation is similar for artificial intelligence and blockchain technology.

ReadCommented by Armin Schulz on June 21st, 2023 | 07:30 CEST

Volkswagen, Defense Metals, Rheinmetall - Dependence on China

Without rare earths, the energy transition fails. There would be neither electric cars nor wind turbines without the critical raw material, which has long been on the list of critical metals in Europe and the USA. But these applications are only the tip of the iceberg because this metal is also needed in the defense industry, smartphones, MRIs and many other high-tech devices. China processes the mined rare earths and has a near monopoly. Now that demand is increasing due to the energy transition and the BRICS countries are slowly breaking away from the US, alternatives should be sought. Today, we look at three companies that cannot do without rare earths.

ReadCommented by Juliane Zielonka on June 15th, 2023 | 07:25 CEST

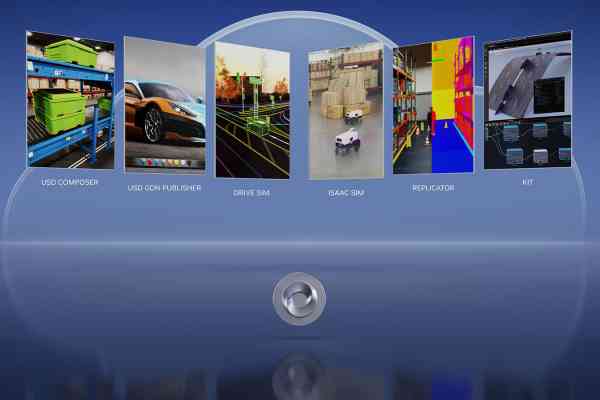

Nvidia, Defense Metals, Uniper - Valuable commodities for trillion-dollar digital market

Digital transformation is critical for industrial companies worldwide to remain competitive and gain strategic advantage. In this context, Nvidia and Hexagon have partnered to provide companies with a comprehensive set of solutions for accelerating industrial digitalization. Defense Metals, on the other hand, secured the supply of essential rare earths for the global energy transition with a successful hydrometallurgical trial and feasibility study. The Wicheeda project in British Columbia strengthens the local energy supply and offers strategic advantages in defence, security and green technology. Uniper, an international energy company, relies on biomass instead of natural gas for energy production. With the construction of a syngas plant in the Netherlands, the Company aims to replace natural gas with sustainable gas in chemical production processes.

ReadCommented by André Will-Laudien on June 1st, 2023 | 09:00 CEST

Heating chaos in Berlin! Palantir, Defense Metals, Borussia Dortmund - Do governments use artificial intelligence like ChatGPT?

Artificial intelligence (AI) is a key driver for the digital transformation of our society. Some technologies have been around for over 50 years but advances in computing power and the availability of big data and new algorithms have led to breakthroughs in AI in recent years. Even if AI is only slowly becoming present in our everyday lives, new applications are likely to bring enormous changes in the future. Decision-making processes, for example, can be strongly supported digitally since today's computers can sift through hundreds of years of knowledge within a few seconds. But does this necessarily mean that the quality of results will also increase?

ReadCommented by Nico Popp on May 23rd, 2023 | 08:15 CEST

Bringing the lead home: Borussia Dortmund, BYD, Defense Metals

For the first time since 2012, the German football champion this weekend might not be FC Bayern Munich. After a turbulent weekend, challenger Borussia Dortmund holds all the trump cards ahead of the final matchday. But will their lead be enough, or will they succumb to nervousness in the decisive phase? We look at three stocks that only need to extend their lead to the finish line. Where profits await and where, despite everything, risks lurk.

ReadCommented by Stefan Feulner on May 9th, 2023 | 09:25 CEST

The trend continues - BYD, Defense Metals, Hensoldt

In order to achieve the climate targets, both politics and business are taking a high risk. Fossil fuels are to be replaced by alternative energy sources as quickly as possible. In turn, the consumption of metallic raw materials is increasing in order to build renewable, energy-efficient systems. In addition to copper, cobalt and nickel, the demand for rare earth metals, which have to be imported almost entirely from China, is increasing dramatically. Since the start of the Ukraine war, there has also been growing demand from the defence industry. The producers of critical metals ex-China are likely to profit from this.

ReadCommented by Armin Schulz on May 2nd, 2023 | 08:55 CEST

ThyssenKrupp, Defense Metals, Rheinmetall - US subsidizes rare earths

Rare earths have long been on the list of critical metals in the US and Europe. As tensions build between the US and China over Taiwan, it is important to remember how critical rare earths are. Currently, China has a virtual monopoly, especially in terms of refining. In addition to high-tech products such as smartphones, the critical raw material is needed for steel alloys, in the military and above all, for the energy transition, including electric vehicles. The US now wants to promote the mining of rare earths in its own country and rewards this with a tax credit of up to USD 30 per kg. We, therefore, look at 3 companies that rely on rare earths.

ReadCommented by Fabian Lorenz on April 27th, 2023 | 09:15 CEST

Plug Power stops sell-off? BYD is grabbing lithium, and Defense Metals is doing well

In Germany, the last nuclear power plants have been taken off the grid, and in North America, one battery factory after another is being built. Hydrogen is also booming. The Fraunhofer Institute, however, sees few opportunities in the passenger car sector. Experts list the lack of a filling station network and the relatively high prices for hydrogen as disadvantages compared to battery technology. Plug Power, among others, is working on improving the refuelling situation. The operating business of the Americans is in deep red. Can the Q1 figures stop the sell-off of the share? BYD shares, on the other hand, made significant gains yesterday. The Chinese are fully committed to e-cars and have entered into a lithium partnership in Chile for the necessary batteries. It is interesting to note that only a few days ago, the government of the South American country announced that it would nationalize lithium production. Is China thus grabbing the huge lithium deposits in Chile? The battle for raw materials is coming to a head. Defense Metals should profit from this. The rare earth project is located in legally secure Canada and is considered extremely promising.

ReadCommented by André Will-Laudien on April 18th, 2023 | 08:50 CEST

With the shutdown of nuclear power plants comes the end of nuclear power! Siemens Energy, Defense Metals, Rheinmetall, E.ON - Greentech stocks on the rise

Now it is done. The German government is implementing the decision from 2011 with a slight delay due to the crisis and is taking the last three remaining nuclear power plants off the grid. Those who expected a blackout were proven wrong, at least over the weekend. Federal Economics Minister Habeck predicts a complete CO2 renewal for Germany and believes that Germany as an industrial location does not need nuclear power to be profitable. He also believes that electricity prices will fall again in the long run. The primary utility E.ON, however, did not hesitate to combine the nuclear phase-out with a hefty increase in electricity prices by about 45%. After all, what is currently easier to sell to end consumers than an imposed price squeeze that they no longer want to carry on their own books? Politically highly questionable, but a good opportunity for Greentech shares.

ReadCommented by Stefan Feulner on April 4th, 2023 | 16:51 CEST

Winners of the supercycles - Rheinmetall, Defense Metals, BYD

Rare earths are indispensable for the production of high-tech products in the defence industry and electromobility due to their unique physical and chemical properties. China controls around 80% of the global output and thus has a key role in the global supply chain. Dependence on China poses a security risk, as the country could restrict access to rare earths or use them for political purposes. Therefore, diversifying supply chains and exploring alternative sources of rare earths is of great importance to ensure long-term security of supply.

Read