November 13th, 2024 | 07:30 CET

Gold correction - Now is the time to take advantage of the lows! Takeover rumors at Evotec, Desert Gold, Bayer and SMCI

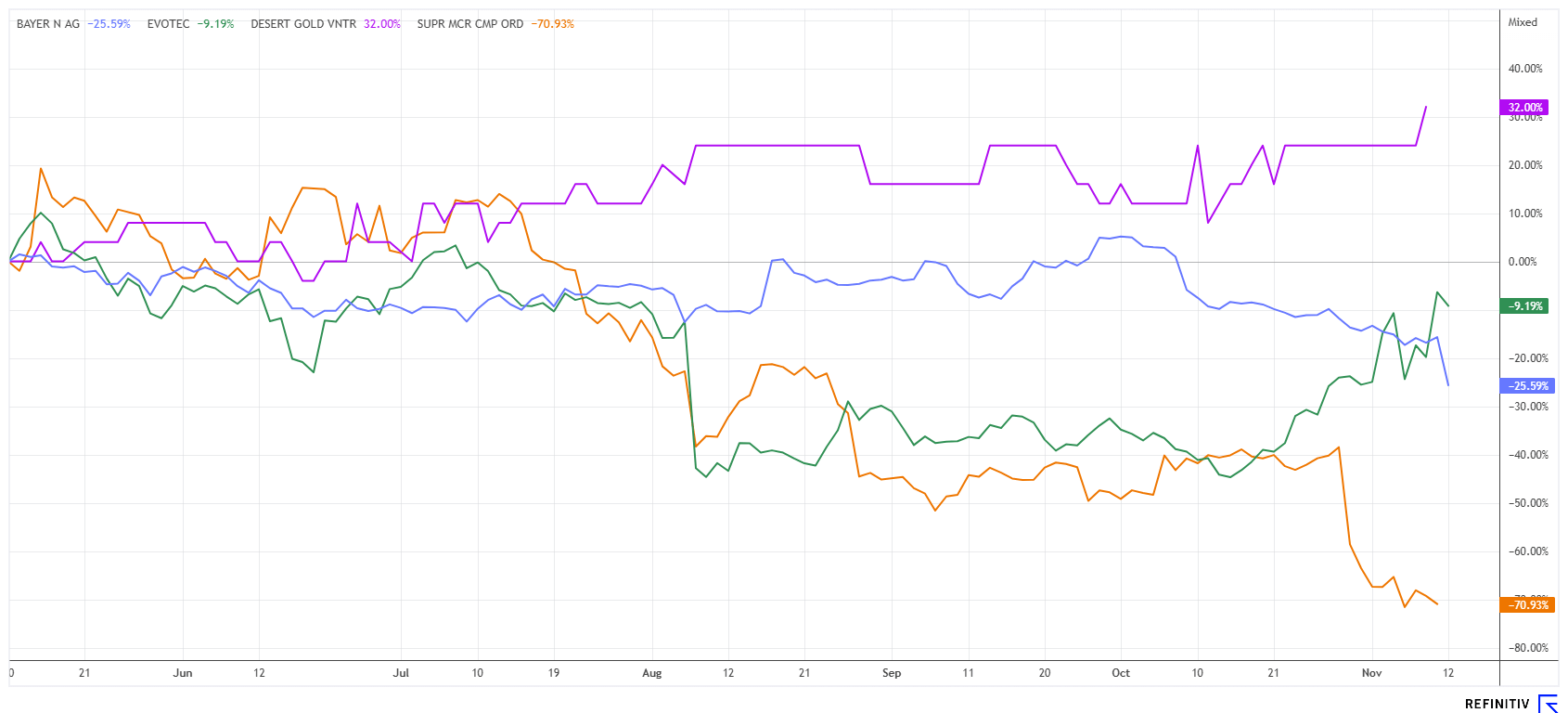

The re-election of Donald Trump as US President had varying effects on the capital markets. The US dollar gained against all currencies, while the hot topic Bitcoin reached new all-time highs of over USD 90,000. The enormous influx of funds into the US stock markets initially slowed down other exchanges. At the same time, the previously sought-after precious metals corrected sharply, putting pressure on mining stocks again. The first shockwaves have now been absorbed, and attention is turning to the real political issues that the White House will now push forward. Defense, industry, and security are in the spotlight, while biotech and green tech remain sidelined. There are some interesting special movements that we will examine here.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , DESERT GOLD VENTURES | CA25039N4084 , BAYER AG NA O.N. | DE000BAY0017 , SUPER MICRO COMPUT.DL-_01 | US86800U1043

Table of contents:

"[...] The processes in Namibia are predictable and the country itself is very safe. [...]" Heye Daun, President and CEO, Osino Resources Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Desert Gold – The stock continues to rise

Despite the correction in precious metals, the Canadian gold explorer Desert Gold has continued its upward trend, which has now been sustained for six months. What is interesting here is that a large number of shares have been traded in recent weeks. Traders suspect a larger mining company could be building up a position in the background. Desert Gold has been focusing on the Senegal-Mali Shear Zone (SMSZ) for several years. 1.1 million ounces of gold have already been identified here near surface. A feasibility study is currently being prepared.

The current resource should be significantly expandable through new discoveries, and the report could also document the viability of mining the oxide and transition mineral resources in the Barani East and Gourbassi West gold deposits. This would make low-cost heap leaching production possible from 2025. For investors, a potential trigger here is that Desert Gold's properties are located near production sites of major players like Barrick, B2 Gold, Allied Gold, and Endeavour Mining. However, the active mines need new mineral discoveries to continue to grow. It would be surprising if Desert Gold's properties weren't already on the wish lists of these larger companies.

The preferred exercise period for the warrants, valid until 2027 at CAD 0.08, expired last week. This should mean that several hundred thousand Canadian dollars have been paid into the Desert account again. Approximately 224 million shares have been issued, bringing the market capitalization to CAD 19 million. The current strength of the Desert Gold share in the junior market is certainly no coincidence!

Super Micro Computer – Disaster at Nvidia Cooperation Partner

Nvidia cooperation partner Super Micro Computer (SMCI) is currently not getting out of the headlines. The former AI high-flyer stock has now corrected over 70% in the last 6 months. First, there was a negative research report from a hedge fund, and later, management reported delays in submitting regulatory filings to the SEC. Now, it has been announced that the auditor has resigned. The year's high of EUR 112 per share now seems a distant prospect at just EUR 21, and investors are wondering if these declines signal a buying opportunity or a pressing need to sell. After all, the auditor is none other than Ernst & Young. Stock market players remember Wirecard! CEO Liang emphasizes that everything is in order, but the experiences of the past are too deeply rooted. Currently, there is a rumor that the collaboration with Nvidia is at risk. We believe that the investor community is overreacting here, but almost anything is possible in a market driven by hysteria. SMCI is currently only for die-hard speculators; wait for a technical bottoming out. Those who prefer fundamental security should heed the words of the new auditor.

Evotec and Bayer – Now it is getting serious

Takeover rumors are increasing at Evotec, a topic we have already addressed in recent weeks. On Monday morning, the financial investor Triton announced that it had directly and indirectly acquired a good 9% of the voting rights. Around noon, the Bloomberg news agency reported, citing people familiar with the matter, that Triton was considering a takeover of Evotec. However, this is being denied by the Hamburg-based company.

Now, the focus is increasingly on the fundamentals. In the last quarterly report, management stuck to the annual targets that were lowered in the summer. However, in order to meet market expectations for 2024, Evotec will have to step on the gas again in the final quarter. Analysts are divided. While Deutsche Bank is sticking to its "Sell" vote despite takeover speculation, Jefferies would first like to hold talks with CEO Christian Wojczewski to evaluate the latest progress in Evotec's strategic realignment. 7 out of 10 analysts on the Refinitiv Eikon platform still expect a 12-month target of EUR 11.80, which is still 35% above the current price of EUR 8.70.

The already low share price of the German agrochemical and pharmaceutical company Bayer has plummeted to its lowest level in 20 years following weak business figures and a further reduction in forecasts. At times yesterday, the price reached the EUR 21 mark. In the agricultural sector, Bayer reports that developments have been worse than expected in its Q3 report, with plans to cut over 5,000 jobs by the end of 2025. The crop protection business has faced challenges beyond the Glyphosate lawsuits, experiencing a significant drop in prices. The outlook for the coming year remains subdued, and the legal disputes will continue to drain funds. Since the summer of 2018, Bayer's market capitalization has plummeted from almost EUR 92 billion to just EUR 21 billion. In 2015, even before the costly Monsanto takeover, the Leverkusen-based company was temporarily the most valuable company in Germany, with a market value of over EUR 120 billion. In Q3, operating revenues fell by 3.6% to EUR 9.97 billion, with only the over-the-counter medicines division managing to increase sales slightly. EBITDA plummeted to EUR 939 million, and the bottom line showed a loss of EUR 4.2 billion. The repeated losses are mainly due to write-downs in the agriculture division. With rising debt levels, Bayer shareholders should be cautious, as the restructuring will continue through 2026.

The stock market currently seems more captivated by the Bitcoin frenzy. Since Donald Trump's re-election to the presidency, the capital markets have been on fire. Although gold corrected from USD 2,780 to 2,580, this did not affect the highly favorable Desert Gold stock. The two biotech stocks, Evotec and Bayer, could not be more different. On the one hand, there are the anticipated takeover rumors surrounding Evotec, but at Bayer, further disappointment is looming after the disappointing quarterly figures. Caution is advised!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.