March 28th, 2025 | 07:20 CET

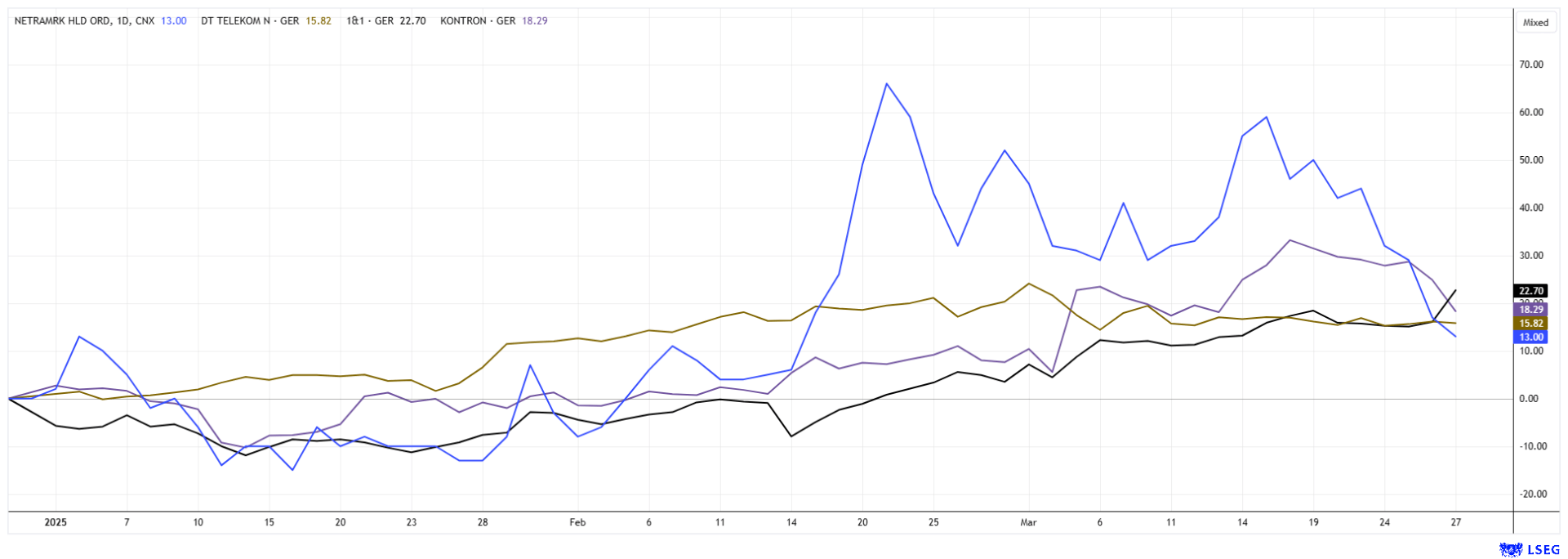

Doubling possible: Using artificial intelligence! Deutsche Telekom, NetraMark Holdings, Kontron, and 1&1

Combining artificial intelligence (AI) and 5G opens up new possibilities in various areas. The strengths of 5G, such as high speed, low latency, and large network capacity, perfectly complement the capabilities of AI. The goal is to recognize complex patterns, automate processes, and make decisions in real time. AI has long since found its place in medicine and pharmaceutical development. High-tech and telecom companies are working on many promising topics here. For some stocks, this is the starting signal for a higher valuation. We highlight some of the opportunities.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

DEUTSCHE TELEKOM ADR 1 | US2515661054 , NETRAMARK HOLDINGS INC | CA64119M1059 , Kontron AG | AT0000A0E9W5 , DT.TELEKOM AG NA | DE0005557508

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Kontron – Annual figures depress the share price

Artificial intelligence is accelerating innovations in transportation, industry, medicine, and security, paving the way for a networked, automated future. 5G also enables decentralized data processing (edge computing). Kontron AG describes itself as one of the leading providers of IT services and solutions in Central and Eastern Europe. The Company is focused on the prospering Internet of Things (IoT) market. The business is divided into three segments: IT Services, IOT Solutions Europe and America. These segments provide secure and connected solutions through a combined portfolio of hardware, middleware, and services in the areas of the Internet of Things and Industry 4.0.

For 2024, Kontron reports a 37% increase in revenues to EUR 1.685 billion, with EBITDA also rising by 52% to EUR 191.8 million. Profit improves from EUR 77.7 million to EUR 90.7 million. This corresponds to EUR 1.47 after 1.23 per share; the dividend will be raised by EUR 0.10 to 0.60. In 2025, Kontron expects revenues of EUR 1.9 to 2.0 billion, with EBITDA of at least EUR 220 million. There is also a negative side to report. In particular, analysts have highlighted the weakness in the solar inverter business as a burden. After a 40% increase in the share price in the last six months, shareholders are using the good figures to realize profits. Analysts at Jefferies and Pareto see price targets of EUR 27 and EUR 28, respectively. With a P/E ratio of 14 in 2025, the Kontron share is not too expensive at EUR 22.90.

NetraMark Holdings – Making the best use of artificial intelligence

Among many other applications, big data and artificial intelligence (AI) applications are also revolutionizing the clinical phases of drug approval by accelerating processes, reducing costs, and significantly increasing the success rate. AI can analyze large amounts of data from electronic health records, genomic data, and patient registries to identify suitable clinical trial participants faster and more accurately. This significantly reduces recruitment time and improves accuracy.

The Canadian technology company NetraMark Holdings Inc. (AIAI) develops innovative solutions for the pharmaceutical industry by using Generative Artificial Intelligence (Gen AI). The pharmaceutical industry is increasingly using artificial intelligence to make clinical trials more efficient and accurate. The results so far indicate a quantum leap, as the NetraAI 2.0 platform addresses one of the most pressing challenges in clinical research: Finding the interface between efficacy and feasibility. Recent studies show that the market for artificial intelligence in clinical research is currently experiencing dynamic growth. In 2021, this sector generated a turnover of approximately USD 1.3 billion, and this figure is expected to reach USD 5.6 billion by 2029. This corresponds to a compound annual growth rate (CAGR) of 19.9% per annum.

CEO George Achilleos knows that a high percentage of all clinical trials, especially in Phases 2 and 3, fail. However, by this point, the biotech and pharmaceutical industries have already invested a significant amount of money. NetraMark is working hard to revolutionize the results of these studies through improved design and evaluation methods. Investors applaud the success of the Canadians, as AIAI shares have already increased tenfold since September 2024. The share price is currently consolidating between CAD 1.10 and 1.20. Between December and March, some options and warrants were exercised. This filled the coffers by over CAD 3 million and increased the share count to 79.76 million. The market capitalization of just over CAD 100 million is still quite modest for the high-tech approach. The rally is likely to start again soon.

Here is the link to the interview on the platform THE MARKETS ONLINE with CEO George Achilleos and Lyndsay Malchuk.

Deutsche Telekom and 1&1 – Conversion to 5G is in progress

Deutsche Telekom and 1&1 are working hard to convert their networks to the new 5G standard. The combination of AI and 5G will usher in a new digital era in the mobile business. It will accelerate many innovations in transportation, industry, medicine, and security – and pave the way for a connected, automated future. Autonomous driving relies on a great deal of environmental data, and fast pattern recognition is essential for avoiding accidents.

Deutsche Telekom is comprehensively integrating artificial intelligence into its business processes to increase efficiency and develop new services. AI optimizes the operation and maintenance of telecommunications networks by analyzing data and proactively responding to possible disruptions. Virtual assistants and chatbots support customer inquiries around the clock, improve service quality, and relieve employees. In the area of cyber security, AI-based systems detect and fend off threats in real-time, increasing network security. By 2027, Deutsche Telekom hopes to generate additional revenues of around EUR 1.5 billion and realize cost savings of EUR 700 million with AI. The DTE share is a star in the DAX 40 index, with a 50% increase in the last 12 months. Stay on board!

The latest developments at United Internet and its subsidiary 1&1 highlight the challenges in the highly competitive mobile market. 1&1 faces the difficult task of migrating its mobile customers to a new 5G network. This migration is part of a comprehensive plan to build its own mobile network that will ensure long-term independence from partners such as Vodafone. Analysts at Goldman Sachs recently expressed concerns about the unexpectedly poor outlook for 2025. 1&1 plans to achieve a stable contract base in 2025 and to maintain service revenues at the EUR 3.3 billion level. However, a slight decline in EBITDA to around EUR 570 million is expected. The 1&1 share has recovered well from its lows of EUR 11 to over EUR 15. A 2025 P/E ratio of 9 is not too high for the internet service provider!

Advances in AI-powered analysis could lead to personalized drug trials in the future, enabling therapeutic approaches tailored to specific patient groups. At the same time, AI has the potential to make the entire approval process more efficient and transparent. NetraMark Holdings is on the verge of establishing itself as one of the first leading AI innovators in the clinical approval phases – an extremely exciting development!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.