January 30th, 2025 | 07:10 CET

D-Wave, Power Nickel, Amazon - Copper as a key raw material for the technological revolution

The increasing demand for copper for new technologies such as quantum computers, power grids, and solar system expansion is putting pressure on the global raw materials market. D-Wave, a pioneer in quantum computing, requires copper for its highly complex systems. With fresh capital of USD 150 million, the Palo Alto-based company is continuing its growth strategy. In the immediate vicinity, the Canadian raw materials company Power Nickel is tapping into promising copper and precious metal deposits with its NISK project. The ongoing boom in raw materials is ideal for Power Nickel. The current drilling is delivering promising results from a nickel-copper-cobalt-PGE deposit and a high-grade copper-precious metal zone. Amazon, in turn, is pushing ahead with its zero-emissions strategy with its 58-MW solar projects in Japan. Here, too, copper plays a key role in the construction of the solar plants. The economic sustainability of individual countries depends heavily on their available raw material resources and suppliers. Three companies exemplify how copper is becoming the strategic metal of the digital transformation.

time to read: 6 minutes

|

Author:

Juliane Zielonka

ISIN:

D-WAVE QUANTUM INC | US26740W1099 , Power Nickel Inc. | CA7393011092 , AMAZON.COM INC. DL-_01 | US0231351067

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Quantum computing pioneer D-Wave secures USD 150 million for further growth

The tech company D-Wave Quantum from Palo Alto, USA, has successfully completed a capital increase of USD 150 million. The share placement, which began on January 15 and ended on January 21, was carried out at an average price of USD 6.10 per share. The price obtained was around 3.7% above the volume-weighted average price of the previous four trading days - a clear signal of strong investor interest.

With the planned expansion of D-Wave, the Company's copper requirements will continue to rise in order to be able to buy its systems. The Company's shares have seen a significant price increase in recent months, from below USD 2 in November 2024 to USD 10 at times. Now, analysts at Needham have raised their price target for D-Wave significantly from USD 2.25 to USD 8.50. Their reasoning is based on the increasing acceptance of quantum computing, which could become a key factor in the tech and AI scene, particularly in the coming years.

CEO Alan Baratz is confident that the new funds will enable the Company to achieve its operational goals. His focus is on the Company's profitability. D-Wave's cash reserves currently amount to around USD 320 million. The capital increase will be used primarily for working capital and capital expenditures to advance both technological development and business growth further.

Power Nickel: NISK Project Uncovers World Class Copper Grades: 12.7% Copper and 20 g/t Palladium in New Drilling

The return of Donald Trump and his bold "Drill, Baby, Drill" approach is giving the resource sector a boost. Particularly exciting for investors is the NISK project in Québec, Canada, which positions Power Nickel as a strategic supplier for the digital future. The incumbent President of the United States places great importance on short supply routes and advocates greater independence from raw material supplies from competing countries such as China. The USD 500 billion injection for the large-scale AI project "Stargate" demonstrates the future viability of the United States and the increased demand for raw materials that Power Nickel can provide.** The geographic proximity to the US makes the NISK project particularly interesting – especially given Trump's possible energy policy and the growing demand for critical metals for the tech industry.

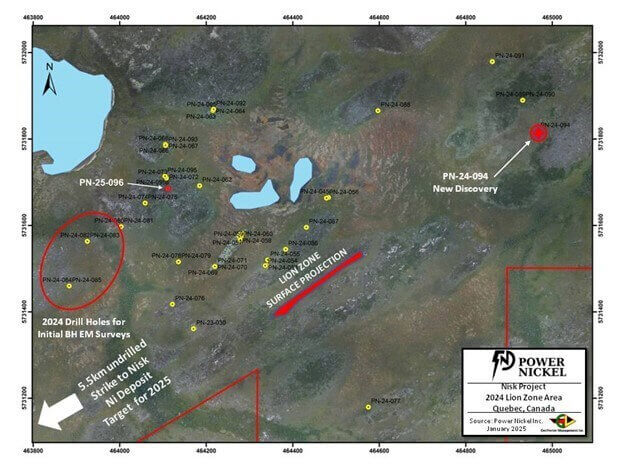

The NISK project hosts both a nickel-copper-cobalt-PGE deposit and a high-grade copper-precious metal zone called Lion – along the same geological structure. These metals are essential for the technology industry: with its high conductivity, copper forms the basis of many data centers. The quantum computer pioneer D-Wave uses copper for its systems. Amazon's quantum technology "Braket" also benefits from the highly sought-after copper. Power Nickel has recently made a new discovery: 700 meters east of the Lion Zone, a new mineralized zone has been found, and initial drilling indicates massive sulfides with strong nickel indications.

In addition to the unstoppable digitalization, copper is particularly needed for the expansion and modernization of infrastructures. By 2050, copper demand for power grids, in particular, will increase fivefold. The metal plays a central role in the modernization of outdated network infrastructure. From the current 25 million tons, an increase to 53 million tons is expected by 2050.

The latest drilling results from Power Nickel are impressive: hole PN-24-070 returned 32 meters of 3.62% copper with high precious metal grades. Even more impressively, hole PN-24-053 assayed 12.7% copper and over 20 g/t palladium. As digitalization advances and quantum computing moves from vision to reality, NISK may be in the right place at the right time.

Amazon secures 66 MW of solar power in Japan through double deal

Amazon is strengthening its commitment to renewable energy in Japan with two new solar projects. Together, they will add up to 66 MW of capacity, securing long-term power supply contracts for the Seattle-based company in the Land of the Rising Sun. The metal copper also plays a crucial role in the construction of solar plants.

The Spanish company X-Elio has signed a 20-year power purchase agreement with Amazon for its 14 MW solar plant in Funaki. The plant, which has been under construction since 2024, is scheduled to go online in mid-2025 and produce around 18,686 MWh of electricity per year – enough to supply over 5,000 Japanese households.* Luis Perezagua, X-Elio Country Manager in Japan, emphasizes: "Our portfolio already includes 379 MW in operation, 14 MW under construction and a further 384 MW in the planning stage – including battery storage*."

In the same breath, Amazon has secured the entire power output of a 44 MWp solar park from the Portuguese energy company EDP in the Fukushima Prefecture. The plant, with 63,000 modules, is expected to be completed by Q3/2025 and will generate 48 GWh of electricity per year. This corresponds to a CO₂ saving of 20,500 tons. This is the second power purchase agreement (PPA) between EDP and Amazon in the Asia-Pacific region, following a similar deal in 2021.

Japan plays a central role in Amazon's Climate Pledge strategy, with which the Company aims to become carbon neutral by 2040. Japan has committed to generating around 36-38% of its electricity from renewable sources by 2030 – a target that will be driven by such partnerships. The long-term PPAs provide Amazon with predictable energy prices while also acting as a buffer against volatile electricity markets.

In addition to the solar projects, Amazon is preparing to publish its quarterly figures for Q4 2024. The results will be presented in a live webcast on February 6, 2025. Investors can register here: https://events.q4inc.com/attendee/404153115

D-Wave secures further cash reserves through the USD 150 million financing. The share price of USD 6.10 at the time of placement – 3.7% above the market level – speaks for itself. Analysts at Needham have raised the target price to USD 8.50 and are encouraging CEO Alan Baratz to expand his operating business. Power Nickel presents the latest drilling results from the NISK project. Hole PN-24-053 returned a high grade of 12.70% copper and 20.87 g/t palladium over 5 meters. Hole PN-24-070 also returned an encouraging 32 meters at 3.62% copper. The combination of nickel-copper-cobalt and precious metals along the same geological structure indicates enormous potential for further raw material deposits. With three additional drill rigs starting in February, the depth extension of the Lion zone will be explored along with the 5.5 km long, previously unexplored corridor between NISK and Lion. Amazon secures a double deal on green electricity in Japan. Around 58 MW of solar energy will come from two projects. The first is the 14 MW X-Elio plant, which will supply over 5,000 Japanese households with electricity from mid-2025. The slightly larger 44 MWp EDP solar park will save 20,500 tons of CO₂ annually. The long-term power purchase agreements enable Amazon to secure predictable energy costs on its path to climate neutrality, which is planned for 2040.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.