February 1st, 2023 | 20:22 CET

Altech Advanced Materials, Mercedes-Benz Group, NIO - Electric mobility on the verge of a revolution

Electric cars are becoming increasingly popular as a sustainable mode of transportation. As technology improves, this type of vehicle is becoming more attractive to investors looking for an environmentally friendly option. However, some important issues still need to be addressed before electric cars become a natural alternative for most people. Chief issues are battery charging times, limited range, and safety. Today, we look at Altech Advanced Materials, a company that has developed a solution to the problems, and look at the current status of two automakers.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

Altech Advanced Materials AG | DE000A31C3Y4 , MERCEDES-BENZ GROUP AG | DE0007100000 , NIO INC.A S.ADR DL-_00025 | US62914V1061

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Altech Advanced Materials - CERENERGY project moves forward

Altech Advanced Materials (AAM) is starting to shake up the battery world. It is pursuing three projects in this area at once. First is its high-purity alumina business in Malaysia. There, the Company has the option to acquire 49% of the project from Altech Chemicals Australia. The alumina will be used in the battery material coating project. AAM has the technology to coat anode material, such as graphite or silicon, with a ceramic nano-coating. The advantage is that lithium particles can no longer be deposited on the battery's electrode. This makes the battery 15% more powerful, increases its service life by 30%, and improves safety.

The third business area that could displace lithium-ion batteries long-term is the environmentally friendly CERENERGY batteries, which are being developed jointly with the renowned Fraunhofer Institute. The joint venture plans to produce CERENERGY SAS 60KWh battery packs at AAM's Schwarze Pumpe manufacturing facility. The batteries are non-flammable, work in all climates and can be produced around 40% cheaper than lithium-ion batteries, as no lithium, cobalt, graphite or copper are needed. Leadec, the lead engineering firm, has already completed the design basis for the 100MWh production facility. The plant will initially be capable of producing 1,500 units of CERENERGY SAS 60KWh battery packs.

Initial discussions with interested customers have already taken place. AAM says it is trying to land offtake agreements ahead of the feasibility study. Those who want to learn more about the Company should look at the study on researchanalyst.com. Alternatively, one can watch the live Company presentation at the 6th International Investment Forum on February 15 at 5:30 PM and ask the CEO questions directly. With this outlook, it is not surprising that the stock has gained over 70% at its peak since the beginning of the year. The share is currently trading at EUR 5.40, giving it a market capitalization of around EUR 38 million.

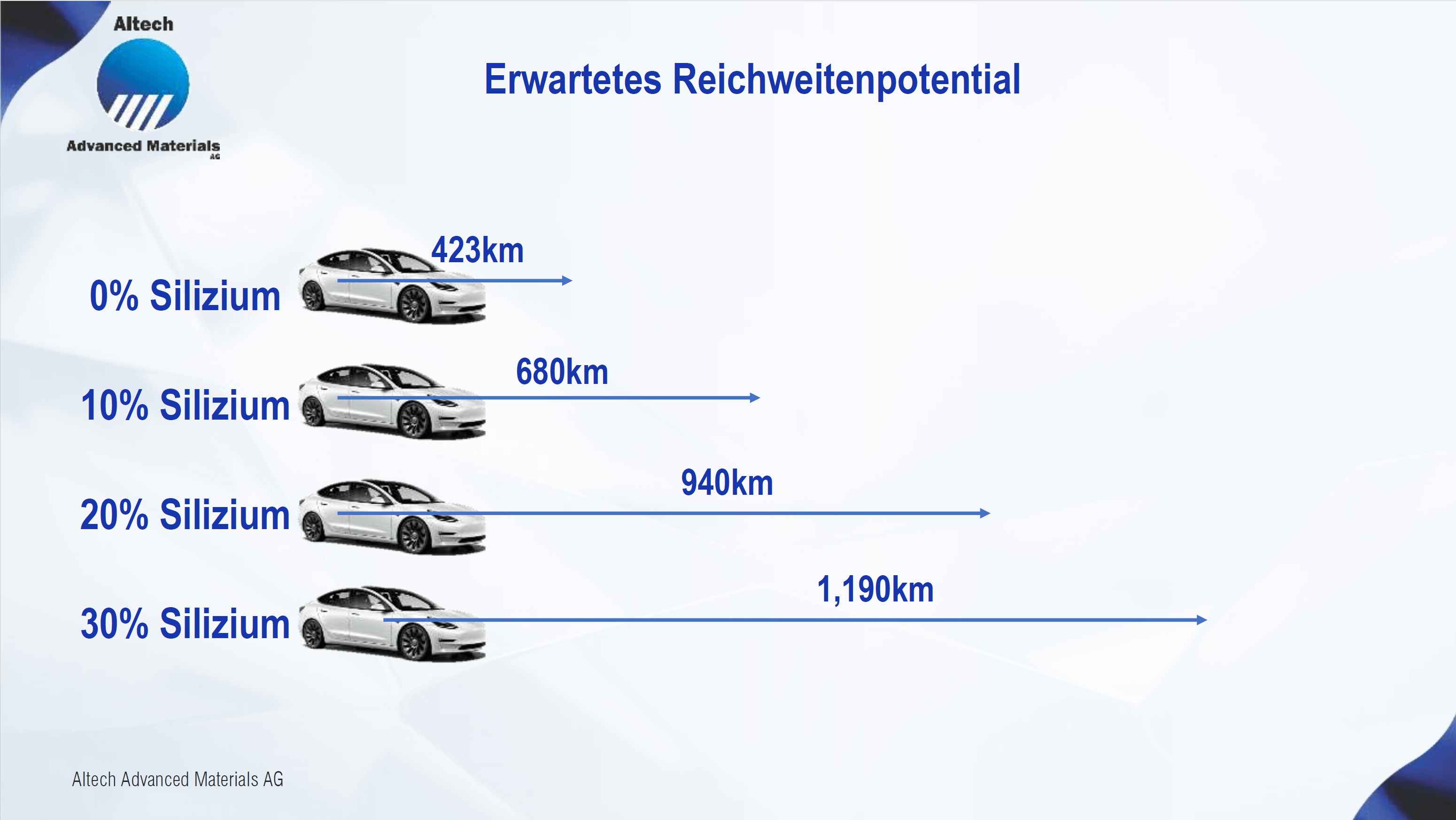

Mercedes-Benz - Decent sales figures in a challenging environment

The Mercedes-Benz Group is now also relying on silicon as an anode material. The Mercedes EQXX is a new electric vehicle equipped with innovative technologies. It uses advanced silicon technology to optimize its performance, which explains why the EQXX could travel over 1,000 km on one charge. In the process, the concept car required just 8.3 kWh per 100 km. It also has a solar roof that provides an additional range of up to 25 km over long distances. The battery is lighter and can even fit in a small car.

The concept car will probably not go into series production, but parts of the technologies installed could find their place in well-known vehicles. Autonomous driving, for example, is also apparently within reach. Mercedes-Benz was the first manufacturer worldwide to receive SAE Level 3 certification for highly automated driving in the US state of Nevada. From 2024, the so-called Drive Pilot will be available as an optional extra for the S-Class and the EQS. Sales figures in the e-mobility segment are rising, as seen from the 2022 delivery figures. While 1% fewer vehicles were sold overall, electric vehicles increased by 19%. There were also 14% increases in the premium segment.

These figures also explain the 6 buy recommendations that came out in January. The price targets were between EUR 79 and EUR 90. According to a Berenberg study, the automotive industry expects demand to weaken this year. In the premium segment, a decline in demand is rather unlikely. Against this background, Mercedes-Benz has good cards with its S-Class and EQS. At the beginning of the year, the share started at around EUR 62 and shot up to EUR 69. Currently, one share costs EUR 67.75.

NIO - Records in November and December

While sales figures for Mercedes-Benz fell slightly, NIO gained 34%. The Company is a Chinese electric vehicle (EV) manufacturer and had a strong year in fiscal 2022 with 122,486 deliveries. Deliveries in November and December set a new record, reaching nearly 30,000 units. The China Passenger Car Association expects sales to grow by about 2 million vehicles to 8.5 million this year, which is a 31% increase.

A battle for market share has broken out in China. If NIO celebrated new records in December, Tesla's sales would have plummeted. This could be related to NIO's Model ET5, which directly attacks the Tesla Model 3. NIO is also trying to optimize its batteries and signed a strategic partnership agreement with battery giant CATL on January 17. The goal is to build a battery delivery system. In the end, both parties want to benefit from this and increase the competitiveness of the Chinese e-mobility industry.

The stock has yet to recover much since Covid eased its measures. This may also have to do with a price cut by Tesla in China. On January 24, the stock was looking to continue its upward trend but failed to reach the previous high and thus has been running sideways between USD 9.50 and USD 14.36. Currently, the stock stands at USD 12.02. Production is now at 15,000 vehicles per month. Thus, sales can continue to grow in the coming year.

Research in the field of rechargeable batteries is running at full speed. Whoever establishes a product as a standard will earn a golden nose. Altech Advanced Materials has several hot irons in the fire. If the breakthrough succeeds, the stock will have to be revalued. Mercedes-Benz is well positioned in the premium segment and is also catching up in the electric vehicle sector. As soon as the supply chain problems are resolved, there is upside potential. NIO had no supply problems last year, and 34% more vehicles were sold. We should keep an eye on the sales figures for the ET5 model.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.