At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories. That it depends thereby less on large names, but on the future potential and whether the market also recognizes these perspectives, was one of its first learnings at the stock exchange.

On these pages, Nico examines current events at listed companies and takes a closer look at companies that are traded under the radar of the market, in addition to well-known securities.

In order to be able to take advantage of speculative opportunities on the stock exchange, Nico not only focuses on a balanced asset allocation of defensive and opportunity-oriented securities, but also on an intact risk management. "In addition to position size and entry in several tranches, investors should also develop a sense of timing and get to know a stock better before investing," says the columnist.

Commented by Nico Popp

Commented by Nico Popp on September 16th, 2025 | 07:15 CEST

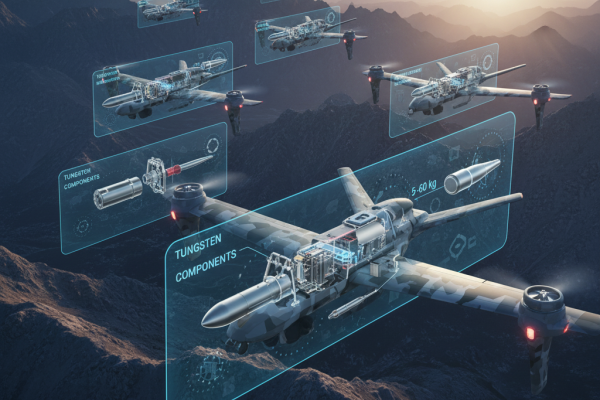

Defense industry expands – New growth drivers: Hensoldt, Almonty and Rheinmetall

An industry once largely overlooked by the public is now dominating the headlines. On Monday, it was announced that Rheinmetall will acquire the Marine Division of the Bremen-based Lürssen Group. This includes the Blohm + Voss shipyards, the Norderwerft shipyard in Hamburg, the Peene shipyard, and the Neue Jadewerft shipyard in Wilhelmshaven. This move underscores how the defense industry is venturing into new domains. Meanwhile, tensions between Russia and NATO continue to escalate. The drones that flew over Poland last week are considered by experts to be a serious provocation. In this context, we take a closer look at three high-flyers in the defense industry and highlight where investors may find the greatest opportunities.

ReadCommented by Nico Popp on September 15th, 2025 | 07:15 CEST

No more diet injections! Innovations in weight loss drugs: BioNxt Solutions, Merck & Co., Novo Nordisk

As recently reported by the United Nations Children's Fund (UNICEF), for the first time, more children worldwide are obese than underweight. While this is a great success in the fight against hunger, it also poses new risks. Severe overweight in childhood leads to obesity and associated diseases in adulthood, such as cardiovascular problems and diabetes. The treatment of overweight and diabetes in children is therefore likely to play an even more significant role in the future. GLP-1 receptor agonists have been popular for several years now in the form of modern weight loss injections. With patents expiring soon, experts anticipate substantial further growth and development in this rapidly expanding market. We explain who could benefit and what the future holds for modern diet medications.

ReadCommented by Nico Popp on September 11th, 2025 | 07:05 CEST

Shovels for the Commodity boom: Aspermont wins Rio Tinto as a customer with AI solution - Macquarie Group and family offices also on board

Gold is more expensive than ever! Critical metals such as tungsten, rare earths and lithium are making a spectacular comeback – in some cases, even the government is investing in producers. And in South America, Teck Resources and Anglo American are merging. All these events show that the commodities market is in flux like never before. Since US Vice President JD Vance's announcement at the Munich Security Conference last February, it has become clear that the old world order is over. New power blocs are emerging, and economies such as the EU and Canada must become independent. This can only be achieved with raw materials. One company that provides mining companies and raw material investors with a powerful tool in this market phase published a decisive corporate announcement a few weeks ago.

ReadCommented by Nico Popp on September 10th, 2025 | 07:25 CEST

German-Canadian raw materials alliance: Graphano Energy, Volkswagen, Magna International

February 1, 2025, came as a shock to many Canadians. On that day, US President Donald Trump imposed tariffs on Canada and repeatedly suggested the country could become a US state. In response to these trade barriers, Canada sought to reduce its dependence on the US. An obvious partner is the EU. The two economies already entered into a strategic raw materials partnership in 2021. In this article, we explore the prospects for joint supply chains for electric vehicle batteries and highlight which companies stand to benefit.

ReadCommented by Nico Popp on September 10th, 2025 | 07:10 CEST

Hydrogen – New paths through the funding jungle: ITM Power, NEL, First Hydrogen

Europe has ambitious goals for the hydrogen economy, but its implementation is often hampered by complex regulations and bureaucratic funding processes. "We have ambitious goals in Europe, but implementation is stalling because we are getting lost in the details of the rules. Instead of triggering investment, we are creating complexity," criticizes Jorgo Chatzimarkakis from the Hydrogen Europe association in an interview with Telepolis. Many projects are still on hold due to unclear approvals or subsidy details. While large energy corporations can navigate the bureaucratic jungle, agile specialists are looking for niche opportunities. We shed light on the business models of NEL, ITM Power, and First Hydrogen.

ReadCommented by Nico Popp on September 9th, 2025 | 07:15 CEST

MENA region offers growth opportunities: What can MiMedia learn from Anghami and Thomson Reuters?

Regional opportunities on the stock market still exist: The Arabic-speaking countries of the Middle East and North Africa (MENA region) are among the most dynamic growth markets for digital services. A rapidly growing, young population with increasing smartphone penetration is driving demand for cloud services, streaming offerings, and digital information. MarkNtel Advisors forecasts annual growth rates of 18% for cloud solutions in the MENA region through 2028. White-label cloud provider MiMedia has just rolled out its app in Arabic and anticipates significant growth. Role models could be the streaming platform Anghami and the data service provider Thomson Reuters, which have already discovered the region for themselves.

ReadCommented by Nico Popp on September 9th, 2025 | 07:00 CEST

Trump Lifts Tariffs on Tungsten: Implications for Almonty, historical parallels with Nucor and Cameco

There is hardly a trading day without a tariff headline: Over the weekend, US President Donald Trump announced the exemption of several key imports — including gold, uranium, and tungsten — from import tariffs. The measure highlights just how strategically important these two raw materials, in particular, have become for the country. No tariffs should hinder trade in tungsten and other critical materials. This is good news for tungsten producer Almonty Industries, which has only recently relocated its headquarters to the US and has already secured offtake agreements with US industry players. The Company is now preparing to bring its massive Sangdong mine in South Korea into production - a project that could account for more than 40% of the global tungsten supply outside China. It now appears likely that a large portion of this production can be exported to the US tariff-free. We take a closer look at what the US government's measures mean in concrete terms and what opportunities similar market interventions have created for investors in the past, with the examples of Nucor and Cameco.

ReadCommented by Nico Popp on September 8th, 2025 | 07:15 CEST

High-profile projects as a zinc turbo: Glencore, Mercedes-Benz, Pasinex Resources

Zinc is a highly sought-after industrial metal — but its price can fluctuate significantly at times. There is about a 25% difference between this spring's yearly low and the average annual price of USD 3,400 forecasted by analysts at Wood Mackenzie. Why is that? Just a few months ago, the market was concerned about an industrial downturn. Today, it is clear that inventories are low and demand from China is anything but weakening. Still, the zinc market remains challenging. We explain which companies are good investments in this environment and which are not!

ReadCommented by Nico Popp on September 8th, 2025 | 07:00 CEST

Trillion-dollar market for tokenized securities: Stock market newcomer Finexity, Deutsche Börse, Coinbase

Blockchain offers transparency and efficiency—it is no surprise that digital assets are considered the next evolutionary stage of capital markets. Studies predict a market volume in the double-digit trillions by 2030. Boston Consulting, for example, is talking about a market volume of USD 16 trillion by 2030. The race for market share includes the major stock exchange operators as well as savings banks and fintechs. Finexity, a pioneer in digital assets, has now gone public - a company that has significantly shaped developments in recent years and is well-positioned for the future. We shed light on the prospects for Finexity and explain how far along competitors like Deutsche Börse and Coinbase already are.

ReadCommented by Nico Popp on September 5th, 2025 | 07:10 CEST

"Olive-Green Economic Miracle" – Who stands to benefit? Volatus Aerospace, Hensoldt, AeroVironment

Germany's Federal Minister of Economic Affairs, Katherina Reiche, sees great potential for the German economy in military rearmament. An article in Handelsblatt even refers to it as an "olive-green economic miracle." But who will benefit most from the billions in spending over the coming years? In addition to traditional defense companies, smaller niche providers and startups are also raring to go. We explain which stocks will truly benefit from this "olive-green economic miracle."

Read