The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Commented by Carsten Mainitz

Commented by Carsten Mainitz on June 17th, 2021 | 13:58 CEST

NewPeak Metals, Barrick Gold, Aurelius - A league of their own, performance without end!

Most experts agree gold will soon reach a new high. Who wants to invest not only physically in the precious metal can participate in "gold companies." As a rule, good quality companies perform better than the "underlying." The safest option is to invest in producers, but the potential return is much higher with exploration companies due to the higher risk. Which will you choose?

ReadCommented by Carsten Mainitz on June 16th, 2021 | 14:26 CEST

Blackrock Silver, JinkoSolar, K+S - Betting on the trend

Silver is not only in demand as a "crisis currency," but also from industry. The precious metal is characterized by several advantageous physical properties that make it extremely valuable for industrial use. For example, silver plays a major role in solar and battery production. As a result, the price of silver has already risen significantly in recent months. But what if the trend continues for longer?

ReadCommented by Carsten Mainitz on June 15th, 2021 | 11:29 CEST

Aixtron, Aspermont, LPKF - Starting signal for further price gains

The general conditions on the capital markets remain positive in the short-term perspective. An excess of liquidity, government aid and support programs, and progress in combating the pandemic means that critical factors such as the massive rise in inflation are fading into the background. When things are going well, they go well. So why not bet on stocks in the uptrend that have recently delivered excellent news and with which investors can undoubtedly outperform the market? We present three promising stocks. Who is winning the race?

ReadCommented by Carsten Mainitz on June 14th, 2021 | 11:04 CEST

Adler Modemärkte, Barsele Minerals, CureVac - Watch out: The ABC of price rockets!

News is the fuel for prices. The only question is in which direction the prices will go and how long the fuel will last. With the prospect of a loan from the federal government, the shares of the insolvent textile retailer Adler Modemärkte have made substantial gains since mid-May. In the last week, there was also news at Barsele Minerals and CureVac, which should move the prices in the next few days!

ReadCommented by Carsten Mainitz on June 11th, 2021 | 11:59 CEST

Plug Power, Enapter, Siemens Energy - Hydrogen boom, the next round!

The accounting crisis at the hydrogen industry leader, Plug Power, unsettled investors and forced the entire sector to correct. With the presentation of the corrected annual financial statements in mid-May, this already seems to be water under the bridge. Many stocks quickly began to rally again, as if nothing had happened. But how long can this continue? Are we already seeing the first signs of overheating? It is now essential to focus on companies that produce a steady and sustainable positive news flow.

ReadCommented by Carsten Mainitz on June 10th, 2021 | 09:58 CEST

Silver Viper Minerals, Nordex, JinkoSolar - These shares are taking off!

Like gold, silver is a precious metal. Both are characterized by the fact that they do not rust. They have always been used for the production of jewelry and in medicine. However, since silver is much more abundant than gold, its price is many times lower. Currently, the ratio is about 1:70, so it was affordable even for less well-heeled investors, which earned it the nickname of the "poor man's gold." However, silver is also characterized by various physical properties that make it extremely valuable for industrial use today. Due to its excellent conductivity and catalytic properties, it is used in solar and battery production. As a result, the price has literally exploded over the past twelve months. Below are three promising stocks that are directly or indirectly related to the price of silver.

ReadCommented by Carsten Mainitz on June 9th, 2021 | 10:41 CEST

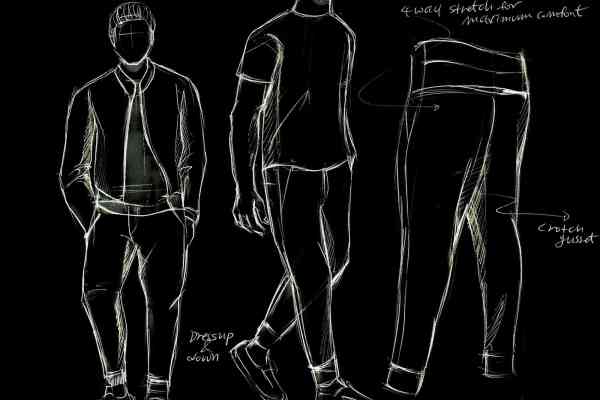

SAP, RYU Apparel, Zalando - Do not miss it!

The Internet has turned our lives upside down and is now indispensable. According to a forecast by Statista, around EUR 2.37 trillion will be generated in the B2C e-commerce market with physical goods in 2023. According to this forecast, the fashion sector will account for the largest share of sales, at EUR 816.55 billion. The increasing importance of e-commerce is also reflected in the sales performance of global players such as Amazon. Be surprised by three exciting stocks.

ReadCommented by Carsten Mainitz on June 8th, 2021 | 11:25 CEST

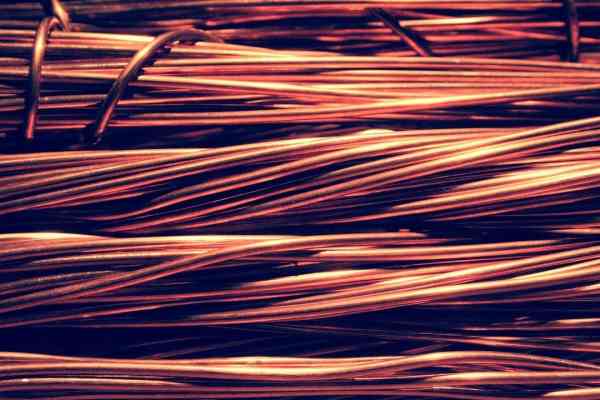

BYD, GSP Resource, Varta - Where do we go from here?

Electromobility is experiencing strong growth rates. The International Copper Association forecasts a considerable increase in demand for copper over the next 10 years, driven mainly by e-vehicles but also by industry and technology. Copper, lithium & Co are making the triumphant advance of electrification possible in the first place. We present you with exciting shares of the megatrend.

ReadCommented by Carsten Mainitz on June 7th, 2021 | 10:45 CEST

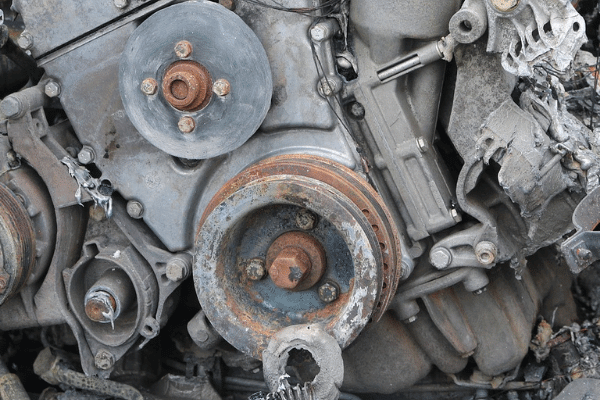

Mineworx Technologies, BASF, Nestlé - Circular economy investment idea

Everything is finite, every material and every raw material. Here is where the idea of a circular economy comes in. The aim is to develop a regenerative system in which resource use and waste production, emissions, and energy waste are minimized by slowing down, reducing, and closing energy and material cycles. The following three companies are all involved in the circular economy in different ways. Shareholders can also benefit from this.

ReadCommented by Carsten Mainitz on June 4th, 2021 | 09:27 CEST

Troilus Gold, First Majestic Silver, Sibanye Stillwater - This will move the prices!

The reasons to invest in precious metals are manifold: as protection against inflation, as a crisis currency, or to profit from increasing industrial demand. In addition to investing in gold or silver bars, certificates or funds, active investors are likely to focus on direct investment in stocks that offer good opportunities. The universe is huge, and there is the right opportunity for every risk appetite. Exploration companies searching for raw materials, development companies busy building the mine and ramping up production, or producers, whose success shareholders can ultimately participate in through dividend payouts. Below are three promising stocks that have recently published excellent news.

Read