The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Commented by Carsten Mainitz

Commented by Carsten Mainitz on June 3rd, 2021 | 09:53 CEST

Barrick Gold, Scottie Resources, Yamana Gold - Joe Biden, Elon Musk, Janet Yellen and the five-month high in gold

Whether we like it or not, there are people whose statements fundamentally move the global stock markets. When Joe Biden announces economic stimulus programs worth billions, Elon Musk suddenly discovers his heart for the environment after months of hype and thus sends Bitcoin on a downward slide, or the current US Treasury Secretary and former head of the Federal Reserve Janet Yellen suddenly thinks out loud about rising interest rates, investors around the world listen closely. Fortunately, there is one asset class that is relatively unimpressed: Gold. Below are three investment ideas for the precious metal's new bull market!

ReadCommented by Carsten Mainitz on June 2nd, 2021 | 11:34 CEST

Infineon, Defense Metals, Aixtron - It is getting tight!

Supply bottlenecks in various industries, e.g. wood, metals, semiconductors or chips (see Infineon and Aixtron in this article), are causing prices to skyrocket. Whether only a short-term phenomenon, it remains to be seen. One area that is heading for ever-increasing demand with manageable supply is "rare earths." Particularly for producers or prospective producers or exploration companies, such as Defense Metals, this should pay off in the medium term.

ReadCommented by Carsten Mainitz on June 1st, 2021 | 09:20 CEST

dynaCERT, Plug Power, Nel ASA - Hydrogen stocks pick up speed again!

Undeniably, 2020 was a fantastic year for stocks even remotely involved in hydrogen technology. It seems all too obvious that hydrogen will become an essential part of the new energy mix and play a central role in most major industrial and transportation projects. Whether as a fuel in the automotive industry (both for combustion and in fuel cell technology) or as a storage medium for smart power grids, the high-energy gas that burns only to form water is seen as the answer to many questions. Then, in early 2021, a trend reversal. Too many uncertainties about the green production and usability of hydrogen technology unsettled investors, so a correction followed. Now, however, hydrogen stocks are starting a new rally, and those who were too late last time should think about getting in now.

ReadCommented by Carsten Mainitz on May 31st, 2021 | 11:45 CEST

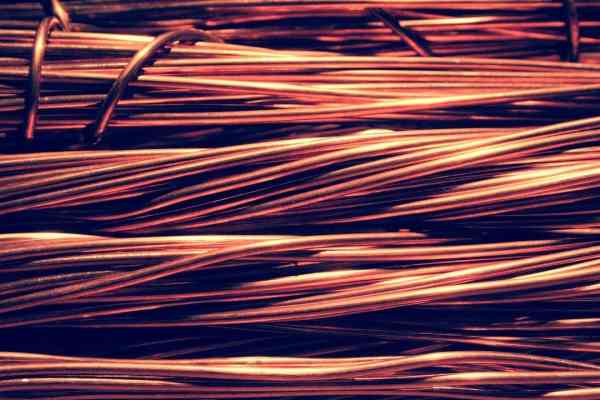

BYD, Kodiak Copper, Xiaomi - Copper: Buy or cash in?

The demand for copper will continue to grow. These are the findings of the recently published study by the International Copper Association (ICA). The ICA predicts that by 2030, more than 250,000 tons of copper per year will be used as part of the windings in electric traction motors. But copper is also in demand in many other industries. Demand exceeding supply or supply bottlenecks can make the raw material more expensive overnight at any time. For this reason, today, we take a look at a budding copper producer. Of course, large demanders such as BYD or Xiaomi must not be missing in the consideration. After all, our everyday companion, the smartphone, contains 15% copper. Let us surprise you with three exciting investment ideas.

ReadCommented by Carsten Mainitz on May 28th, 2021 | 10:14 CEST

wallstreet:online, flatexDEGIRO, Commerzbank - If you look closely...

A positive stock market environment, low-interest rates and stock trading at zero cost are the reasons that have sent the prices of stockbrokers and brokers from all-time high to all-time high in recent months. Intermittent breathers are healthy for the peakers. The latest round of capital in unlisted broker Trade Republic, with a valuation of more than EUR 4 billion, demonstrates the potential investors have for new fee models and an active investor base. The following three stocks are far from exhausted, in our opinion.

ReadCommented by Carsten Mainitz on May 27th, 2021 | 10:55 CEST

Oatly, The Very Good Food Company, Beyond Meat - Big profits with no end in sight!

It should be dawning on many of us by now that with increasing prosperity and a growing population, factory farming and meat consumption cannot continue indefinitely. But the vegetarian way of life is still too often ridiculed. However, it could be a partial solution to the challenges mentioned. From an investor's point of view, it is worth considering how much money can be made with vegetarian substitutes. Therefore, the following is a brief look at three publicly traded companies that are likely to appeal to even meat-eaters.

ReadCommented by Carsten Mainitz on May 26th, 2021 | 10:45 CEST

Almonty Industries, ThyssenKrupp, Klöckner & Co.- Indispensable raw materials!

According to the EU, tungsten is one of the most critical raw materials globally in terms of economic importance and procurement risk. The chemical element has the highest melting and boiling point and is therefore used in many critical industrial sectors. The main application of tungsten is in the form of tungsten steel - a high-alloy steel. Given the resource scarcity, it is reason enough for us to take a closer look at the interface between the steel industry and tungsten production with three promising stocks. Where is the yield driver?

ReadCommented by Carsten Mainitz on May 25th, 2021 | 11:35 CEST

Bayer, Saturn Oil + Gas, Deutsche Lufthansa - All the ingredients for a price fireworks display!

Information moves prices. Sometimes up, sometimes down, and sometimes information seems to "bounce off" - ignored or misinterpreted by market participants. It is easier said than done to correctly classify the information in relation to the long-term perspective of a company. Thus, as seen last week with Bayer and Deutsche Lufthansa, a short-term price dampener is a good opportunity to enter the market. But also, information that is complex in detail and must first be "understood", offers the chance to make a real bargain. Canadian oil and gas producer Saturn is a case in point. The Company is moving into new dimensions with an acquisition, and according to the latest analyst report, the stock has the potential to triple in value. Where will you buy?

ReadCommented by Carsten Mainitz on May 21st, 2021 | 09:14 CEST

Silkroad Nickel, NIO, Varta - Pre-programmed bottlenecks = price opportunities

Electromobility and battery technology are inextricably linked. Sales figures for e-vehicles are rising rapidly and will multiply in the next few years. This global increase in production will become challenging in many places. Not just with the competitive situation, which is becoming increasingly intense as Chinese players gain strength, but also the availability of the critical raw materials for battery production. There are signs of a huge supply deficit in nickel over the next few years. We show you how to invest with foresight and profitably.

ReadCommented by Carsten Mainitz on May 20th, 2021 | 10:10 CEST

Bitcoin Group, Deutsche Rohstoff, Aurelius - Alternative Investment Champions

Those who invest in the asset class "Alternative Assets" either move away from "Classic" investments such as stocks or bonds or invest in the liquid securities with "Alternative" strategies. Here, the universe available for selection is huge. Classic cars, private equity, cryptos or commodities - you decide. Except for the old-timers, we brought an investment idea from each category. If successful, there might be a classic car in there too...

Read