The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Commented by Carsten Mainitz

Commented by Carsten Mainitz on June 1st, 2021 | 09:20 CEST

dynaCERT, Plug Power, Nel ASA - Hydrogen stocks pick up speed again!

Undeniably, 2020 was a fantastic year for stocks even remotely involved in hydrogen technology. It seems all too obvious that hydrogen will become an essential part of the new energy mix and play a central role in most major industrial and transportation projects. Whether as a fuel in the automotive industry (both for combustion and in fuel cell technology) or as a storage medium for smart power grids, the high-energy gas that burns only to form water is seen as the answer to many questions. Then, in early 2021, a trend reversal. Too many uncertainties about the green production and usability of hydrogen technology unsettled investors, so a correction followed. Now, however, hydrogen stocks are starting a new rally, and those who were too late last time should think about getting in now.

ReadCommented by Carsten Mainitz on May 31st, 2021 | 11:45 CEST

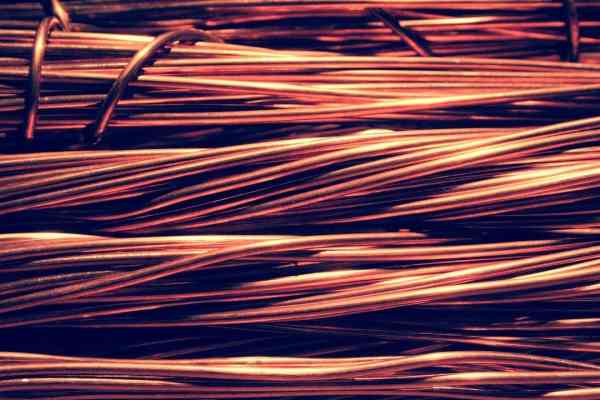

BYD, Kodiak Copper, Xiaomi - Copper: Buy or cash in?

The demand for copper will continue to grow. These are the findings of the recently published study by the International Copper Association (ICA). The ICA predicts that by 2030, more than 250,000 tons of copper per year will be used as part of the windings in electric traction motors. But copper is also in demand in many other industries. Demand exceeding supply or supply bottlenecks can make the raw material more expensive overnight at any time. For this reason, today, we take a look at a budding copper producer. Of course, large demanders such as BYD or Xiaomi must not be missing in the consideration. After all, our everyday companion, the smartphone, contains 15% copper. Let us surprise you with three exciting investment ideas.

ReadCommented by Carsten Mainitz on May 28th, 2021 | 10:14 CEST

wallstreet:online, flatexDEGIRO, Commerzbank - If you look closely...

A positive stock market environment, low-interest rates and stock trading at zero cost are the reasons that have sent the prices of stockbrokers and brokers from all-time high to all-time high in recent months. Intermittent breathers are healthy for the peakers. The latest round of capital in unlisted broker Trade Republic, with a valuation of more than EUR 4 billion, demonstrates the potential investors have for new fee models and an active investor base. The following three stocks are far from exhausted, in our opinion.

ReadCommented by Carsten Mainitz on May 27th, 2021 | 10:55 CEST

Oatly, The Very Good Food Company, Beyond Meat - Big profits with no end in sight!

It should be dawning on many of us by now that with increasing prosperity and a growing population, factory farming and meat consumption cannot continue indefinitely. But the vegetarian way of life is still too often ridiculed. However, it could be a partial solution to the challenges mentioned. From an investor's point of view, it is worth considering how much money can be made with vegetarian substitutes. Therefore, the following is a brief look at three publicly traded companies that are likely to appeal to even meat-eaters.

ReadCommented by Carsten Mainitz on May 26th, 2021 | 10:45 CEST

Almonty Industries, ThyssenKrupp, Klöckner & Co.- Indispensable raw materials!

According to the EU, tungsten is one of the most critical raw materials globally in terms of economic importance and procurement risk. The chemical element has the highest melting and boiling point and is therefore used in many critical industrial sectors. The main application of tungsten is in the form of tungsten steel - a high-alloy steel. Given the resource scarcity, it is reason enough for us to take a closer look at the interface between the steel industry and tungsten production with three promising stocks. Where is the yield driver?

ReadCommented by Carsten Mainitz on May 25th, 2021 | 11:35 CEST

Bayer, Saturn Oil + Gas, Deutsche Lufthansa - All the ingredients for a price fireworks display!

Information moves prices. Sometimes up, sometimes down, and sometimes information seems to "bounce off" - ignored or misinterpreted by market participants. It is easier said than done to correctly classify the information in relation to the long-term perspective of a company. Thus, as seen last week with Bayer and Deutsche Lufthansa, a short-term price dampener is a good opportunity to enter the market. But also, information that is complex in detail and must first be "understood", offers the chance to make a real bargain. Canadian oil and gas producer Saturn is a case in point. The Company is moving into new dimensions with an acquisition, and according to the latest analyst report, the stock has the potential to triple in value. Where will you buy?

ReadCommented by Carsten Mainitz on May 21st, 2021 | 09:14 CEST

Silkroad Nickel, NIO, Varta - Pre-programmed bottlenecks = price opportunities

Electromobility and battery technology are inextricably linked. Sales figures for e-vehicles are rising rapidly and will multiply in the next few years. This global increase in production will become challenging in many places. Not just with the competitive situation, which is becoming increasingly intense as Chinese players gain strength, but also the availability of the critical raw materials for battery production. There are signs of a huge supply deficit in nickel over the next few years. We show you how to invest with foresight and profitably.

ReadCommented by Carsten Mainitz on May 20th, 2021 | 10:10 CEST

Bitcoin Group, Deutsche Rohstoff, Aurelius - Alternative Investment Champions

Those who invest in the asset class "Alternative Assets" either move away from "Classic" investments such as stocks or bonds or invest in the liquid securities with "Alternative" strategies. Here, the universe available for selection is huge. Classic cars, private equity, cryptos or commodities - you decide. Except for the old-timers, we brought an investment idea from each category. If successful, there might be a classic car in there too...

ReadCommented by Carsten Mainitz on May 19th, 2021 | 12:27 CEST

Royal Helium, Royal Dutch Shell, Gazprom - These commodity stocks are stepping on the gas

Commodities are currently on everyone's lips again: energy transition, electromobility, medical progress. All of these require resources that, as always, have to be laboriously extracted or produced. Corona has made the situation even worse: people are currently feeling the pain of global production shortfalls. Semiconductor chips are currently in short supply, and copper prices are rising. What this means for the manufacturing industry and the end consumer, however, is reflected in the profits of the raw material producers. Time to take a closer look at them and profit from the development!

ReadCommented by Carsten Mainitz on May 18th, 2021 | 10:20 CEST

QMines, Leoni, Siemens Energy - Top picks for the energy turnaround

Surveys show that the majority of Germans believe the energy turnaround is necessary. Climate change is manifesting itself in increasingly extreme weather conditions: exceptional cold, extreme heat spells, massive flooding and ever more pronounced droughts are causing hardship for people around the world. Most experts agree that further aggravation of the problem can only be mitigated by limiting CO2 emissions. The companies that stand to benefit massively from this are those that provide the resources needed to do so. Below are three candidates with the 'through-the-roof' potential.

Read