The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Commented by Carsten Mainitz

Commented by Carsten Mainitz on October 14th, 2021 | 13:30 CEST

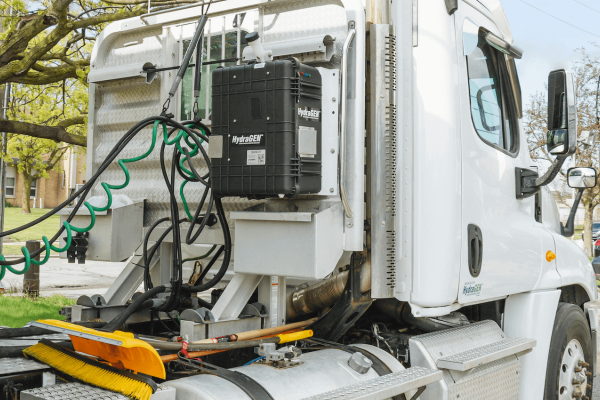

SMA Solar, dynaCERT, TotalEnergies - Good for the climate, good for your portfolio!

The signs of the times are climate protection: In America, Joe Biden is trying to push his Green New Deal through the legislature, China is phasing out the construction of coal-fired power plants, and in Germany, the Greens will most likely be part of the next government. Industry is also rethinking its position. Recently, an alliance of 69 leading German companies called for an "implementation offensive for climate neutrality" within the first 100 days of a new government. Signatories included heavyweights such as SAP, E.ON and Bayer. The following three stocks should get a tailwind from the new climate awareness.

ReadCommented by Carsten Mainitz on October 14th, 2021 | 08:20 CEST

Square, BIGG Digital Assets, Advanced Micro Devices - Profiteers of the FinTech and crypto boom

FinTech and crypto are defining investment themes of today. Even though there are now efforts by politicians to curb or regulate cryptocurrencies, they will remain part of our everyday lives in the long run. For cryptos to be usable by the broad population, it is essential to make them easy and safe to trade and use as a means of payment. That requires certified trading platforms and reliable payment service providers. These are not the only ones who will benefit from the development; hardware manufacturers are also in great demand.

ReadCommented by Carsten Mainitz on October 12th, 2021 | 12:32 CEST

Defence Therapeutics, BioNTech, Valneva - When will things pick up again?

Biotechnology companies can experience a significant, sometimes even exponential, increase in value virtually overnight with a new, successful active ingredient. BioNTech is a prime example of this. But not every research effort leads to success, and CureVac shareholders can tell you a thing or two about that. Canada's Defence Therapeutics and Valneva have innovative research pipelines. Where should investors consider investing now?

ReadCommented by Carsten Mainitz on October 11th, 2021 | 13:11 CEST

Aspermont, flatexDEGIRO, TeamViewer - Buy recommendations from analysts

Growth and expectations play a crucial role in share price development. But often, it is the discrepancy between expectations and forecasts on the one hand and the facts on the other that move prices. If expectations are missed, and this happens more often or to a serious extent, it can lead to prolonged share price weakness. On the other hand, overly high expectations of the investment community or a failure to recognize growth prospects can lead to good investment opportunities. Analysts recommend buying the following stocks.

ReadCommented by Carsten Mainitz on October 8th, 2021 | 13:04 CEST

Central African Gold, Varta, Standard Lithium - Get in or get out?

Electromobility is on the rise. Growth is gaining momentum, spurred on by massive political support. Increasing quantities of various raw materials and critical metals are needed for renewable energy plants, storage facilities and grids. Copper, zinc, nickel, cobalt and lithium are gaining enormous importance. China often dominates the global supply. The following companies are connected to the megatrend of electromobility in very different ways. What unites them is the opportunity for growth. Who is ahead of the game?

ReadCommented by Carsten Mainitz on October 7th, 2021 | 11:15 CEST

JinkoSolar, Meta Materials, Encavis - Here comes the sun!

Climate is the dominant topic of our time. Not only has the population understood this and given the Greens a record result in the last federal election, but many companies from traditional sectors such as the automotive industry or heavy industry have now accepted that only green, sustainable technology promises lasting growth. Climate-neutral energy sources are the central element. Associated with this are energy storage challenges and increasing efficiency, which is currently still far from completely replacing fossil fuels. These three stocks will benefit from the upheavals.

ReadCommented by Carsten Mainitz on October 1st, 2021 | 12:45 CEST

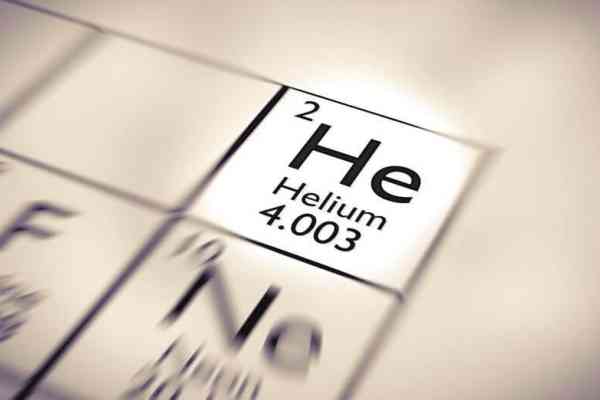

Royal Helium, Gazprom, NEL - Now it is worth taking another look!

Helium is a sought-after noble gas essential for numerous applications due to its outstanding chemical and physical properties. It is used, for example, as a non-conductive, non-reactive coolant in medical laboratory equipment or in space rockets. It is also in demand in the electronics and nuclear industries. On Earth, helium occurs only in very low concentrations in the atmosphere due to its high volatility, although it is the second most abundant element in the universe after hydrogen. Helium is often a byproduct of oil and gas production. How can investors profit?

ReadCommented by Carsten Mainitz on September 30th, 2021 | 13:29 CEST

EuroSports Global, Daimler, JinkoSolar - Eyes open!

Germany has voted. The new federal government is likely to attach great importance to the topics of renewable energies and electromobility. The mentioned areas have also gained weight internationally. With these three shares, investors can profit from the two megatrends. Who is the favorite?

ReadCommented by Carsten Mainitz on September 29th, 2021 | 12:04 CEST

AZTEC MINERALS - Fantastic drill results

In the medium term, nothing should stand in the way of rising precious metal prices. Gold and silver demand as jewelry, from the industry, and as crisis currency or inflation protection, form the basis for a perspectively higher price level. After an excellent performance last year, the prices of gold and silver are currently consolidating. For investors with an anticyclical approach, this opens up good investment opportunities. Exploration companies with high-quality projects, such as Aztec Minerals, historically benefit disproportionately from rising precious metal prices.

ReadCommented by Carsten Mainitz on September 28th, 2021 | 11:19 CEST

Cardiol Therapeutics, BioNTech, Valneva - Volatility offers good opportunities!

The share prices of the Corona vaccine manufacturers are not growing sky-high after all. Most recently, developments at France's Valneva caused uncertainty. The French Company wanted to bring a Corona vaccine to market by the end of 2021 and had already received an order from the British government for 100 million units. This contract has now been canceled. Where does the industry go from here?

Read