The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Commented by Carsten Mainitz

Commented by Carsten Mainitz on September 10th, 2021 | 13:35 CEST

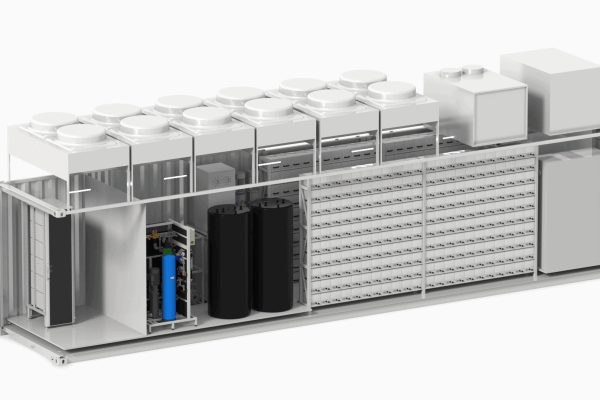

Enapter, NEL, Ballard Power - Hydrogen: This will happen!

If you follow the political discussion in Germany regarding climate and green energy, the debate is almost exclusively about solar and wind power. Electric mobility is the order of the day. But soberly considered, there will and must be a coexistence of several approaches. Hydrogen solutions have received far too little attention. But this technology is urgently needed for the energy transition. The industry is still relatively young, but there is a very good chance that a huge market will emerge in which several companies will be able to operate successfully and profitably. Are these the winners?

ReadCommented by Carsten Mainitz on September 8th, 2021 | 12:28 CEST

PuriflOH, Bayer, Philips - Innovations as yield drivers

Innovations enrich our everyday lives in many ways. The following companies have developed innovative solutions for health and climate in the broadest sense that help remedy important problems. The focus here is on water, a scarce resource, and air purification, which in times of Corona plays an increasingly important role. Which Company has the best opportunities?

ReadCommented by Carsten Mainitz on September 7th, 2021 | 10:40 CEST

Deutsche Rohstoff, Gazprom, Royal Dutch Shell - Do you really want to miss out? Single-digit P/E ratios and share price gains!

Commodities giant BHP is selling its oil and gas business after more than 60 years. However, other companies are pushing to enter and expand in this sector. How does this fit together? Ultimately, it is strategic decisions - focus, diversification or transformation? The high prices for oil and gas are providing producers with high profits. The medium-term outlook is also good. Growth and a favorable valuation are thus enticing. These are the stocks worth taking a closer look at.

ReadCommented by Carsten Mainitz on September 6th, 2021 | 10:44 CEST

Defense Metals, Nordex, Rheinmetall - These shares benefit from megatrends!

Rising corporate profits are an understandable driver for higher share prices. Therefore, positioning with stocks in sectors or with business models that benefit from long-term (mega) trends is a smart move. Renewable energies, electromobility, various areas of technology and rare earths are fields that will continue to grow significantly in the medium term. With the shares presented, you can profit from this.

ReadCommented by Carsten Mainitz on September 2nd, 2021 | 13:22 CEST

BYD, Kainantu Resources, DWS - Investing against the tide

It is well known that a successful long-term strategy in times of high inflation is to invest in tangible assets. Whether it is stocks, gold or real estate, or a mix of these is up to the taste of the individual investor. Looking at the big picture, there is certainly nothing wrong with investing in companies that benefit from the economic development and rising purchasing power of expanding economies. Geographically, Asia is one of the most dynamic regions with large sales markets. We will show you how you can profit from these developments. Who has the best opportunities?

ReadCommented by Carsten Mainitz on September 1st, 2021 | 11:55 CEST

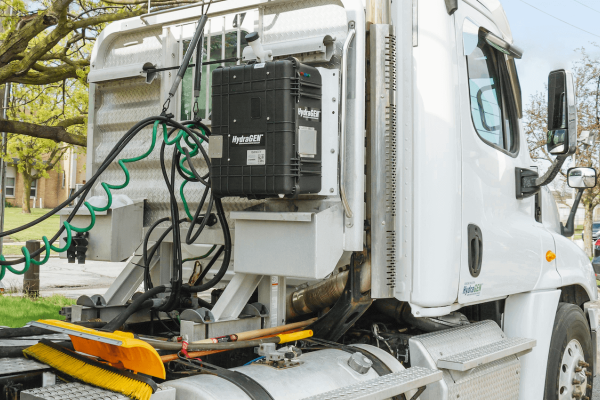

NEL, dynaCERT, Porsche - Innovative and full of opportunities, why now?

Climate change requires the decarbonization of industry, better sooner than later. What will green mobility look like in the future? Here, representatives of hydrogen technology and electromobility provide very different answers. There are also innovative bridging technologies, and the innovative power of major automakers should not be underestimated. Who will put the most horsepower on the road?

ReadCommented by Carsten Mainitz on August 31st, 2021 | 12:16 CEST

Square, Aspermont, flatexDEGIRO - FinTechs: Top or Flop?

Many FinTechs have emerged in recent years to put the fear of God into traditional banks with their dusty business models. As with many disruptive business models, the spread of the Internet and smartphones provided the basis for scalable, rapid growth. In addition, sufficient venture capital was available. Valuations in the billions, even before an IPO, were and are not uncommon. In addition, cryptocurrencies began an unprecedented triumphal march. In some places, the sword of Damocles of regulation hovers over the industry and not every Company will reach the finish line. Too many advance praises are priced into some prices. Who will be among the winners?

ReadCommented by Carsten Mainitz on August 30th, 2021 | 11:33 CEST

Central African Gold, Nordex, Varta - Performers for the second half of the year!

Climate and energy transition are more than just buzzwords. They affect us all to an ever increasing extent. The production of green energy and the currently also politically favored spread of electric mobility place considerable demands on the availability of raw materials, the sufficient production of green energy and the existence of an area-wide infrastructure. As steering mechanisms, states offer extensive support measures. A market for emission certificates creates incentives as well. It is also important to keep an eye on the development of increasingly stringent ESG standards in the investment sector. Companies that do not do their homework will sooner or later lose out. These three companies have the potential to profit from the energy transition. Who will win the race?

ReadCommented by Carsten Mainitz on August 27th, 2021 | 12:35 CEST

Orocobre, Kodiak Copper, Infineon Technologies - Good for the climate, even better for your portfolio

Heat records and droughts on the one hand and heavy rainfall and flooding on the other - climate change is no longer an abstract threat but a reality. Speculating about the causes is idle. It is more important to tackle the problem. Phasing out coal-fired power generation by 2038? Much too late, experts criticize. And politicians are also slowly realizing that it is already five to twelve. That is why they are really stepping on the gas! We need to say goodbye to the combustion engine, decarbonize industrial production, and expand renewable energy sources. But this requires certain raw materials. Here are three companies with a bright future ahead of them.

ReadCommented by Carsten Mainitz on August 26th, 2021 | 13:12 CEST

Pure Extraction, Nikola, SFC Energy - Is Elon Musk wrong with his hydrogen forecast?

On the subject of eMobility, Elon Musk, CEO of Tesla Automotive, takes a clear position: In the future, cars and transport vehicles will be electric, and the energy they need will come from batteries. Any other solution is unthinkable for him, as he recently let slip in a mocking remark when asked about hydrogen as a fuel. But even Elon Musk is not always right. Many respected scientists around the world recognize the advantages of hydrogen technology. Particularly in combination with a fuel cell, the advantages of rapid refueling and trouble-free gas transport to even the remotest corners of the earth do not seem to be underestimated. These stocks benefit from the triumph of hydrogen technology!

Read