The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Commented by Carsten Mainitz

Commented by Carsten Mainitz on October 27th, 2021 | 14:38 CEST

Sierra Grande, Sibanye Stillwater, First Majestic - New developments!

High inflation argues in favor of investing in tangible assets such as equities, real estate and commodities. The traffic light is green for price increases in precious metals and energy metals in the medium term. Ultimately, investors must decide whether producers or exploration companies are of interest. Or perhaps a little of each?

ReadCommented by Carsten Mainitz on October 25th, 2021 | 13:25 CEST

Desert Gold, Barrick Gold, K+S - Now or never?

With inflation of over 4% in Germany and the continued massive money printing of the central banks, every investor should think about protecting oneself against the loss of purchasing power. To dismiss this as a temporary phenomenon would be a mistake. In times of high inflation, a good strategy is to invest in tangible assets such as stocks, real estate, and commodities.

ReadCommented by Carsten Mainitz on October 22nd, 2021 | 12:18 CEST

Clean Logistics, Plug Power, BYD - Huge upheavals in the transport industry fuel share prices

"Decarbonization" - this term could make it to "word of the year." That is because it describes what urgently needs to be implemented in all sectors to preserve the Earth's habitat: the switch from fossil, carbon-based energy sources to sustainably and climate-neutrally produced energy sources. The transport industry plays a significant role in global warming. In Germany alone, road freight transport is expected to increase by a further 19% by 2030. Innovative ideas and solutions that can be implemented quickly are therefore urgently needed. In doing so, manufacturers are relying on a variety of technologies.

ReadCommented by Carsten Mainitz on October 21st, 2021 | 10:11 CEST

Gazprom, Saturn Oil + Gas, TotalEnergies - Rising prices continue to create a party atmosphere

Europe is currently experiencing an energy crisis. Drivers are noticing it clearly at the gas pumps and users of gas heating systems in their bills. The reasons are manifold: the recovery of the economy after Corona, the curbing of coal-fired power generation for climate protection reasons, the growing hunger for energy of emerging economies and, last but not least, weather effects. In Germany, there is an additional reason: the phase-out of nuclear energy is currently causing a strong expansion of gas-fired power generation to secure the baseload. The beneficiaries of this development are the oil and gas producers - and thus their investors.

ReadCommented by Carsten Mainitz on October 20th, 2021 | 12:10 CEST

Formycon, Memiontec, Synlab - Act before it is too late!

When an unpredictable event occurs, humanity sees how powerless it is in the face of it. We saw this in the spring of last year with the outbreak of the Corona pandemic. Only since the approval of various vaccines has a normalization taken place. However, further, foreseeable problems are coming our way. According to expert forecasts, water demand will exceed supply by 40% as early as 2030. Some companies sense an opportunity to profit from the water shortage through novel technologies.

ReadCommented by Carsten Mainitz on October 19th, 2021 | 12:46 CEST

Nvidia, Almonty Industries, BP - Scarcity drives prices!

The shift from fossil fuels to renewable energy sources is increasing the need for industrial metals. Copper's excellent thermal conductivity, along with its corrosion resistance, ease of processing, strength, durability and formability, offer unbeatable advantages in solar thermal applications. Tungsten's properties also play an increasingly important role in power, lighting, medical and aerospace applications. Companies producing the critical metal have significant upside opportunities in this regard.

ReadCommented by Carsten Mainitz on October 18th, 2021 | 13:05 CEST

Defense Metals, Nordex, Varta - These are the reasons for the rising prices!

Rare earths are indispensable for the production of laptops, cell phones, electric motors and wind turbines. However, their extraction is complicated, which is why the supply is also relatively low. The EU has classified many of these metals as critical with regard to their availability given their great importance for many industries, also because of China's dominance as the largest supplier. Efforts to build rare earth mines outside China are proceeding at full speed.

ReadCommented by Carsten Mainitz on October 15th, 2021 | 11:25 CEST

First Majestic, Silver Viper, Barrick Gold - Best prospects for precious metals

For the first time since December 1993, the inflation rate in Germany reached a value of over 4%. In the USA, too, the rate rose to 5.4%, although economists had actually expected it to fall. Nevertheless, the central banks are currently making no attempt to counter inflation by raising key interest rates. No one wants to jeopardize the tender little plant of the economy after the disastrous Corona year. Surprisingly at first glance, prices for precious metals as a "crisis currency" are not rising to the extent that would be expected. But there are clear signs that demand will increase strongly.

ReadCommented by Carsten Mainitz on October 14th, 2021 | 13:30 CEST

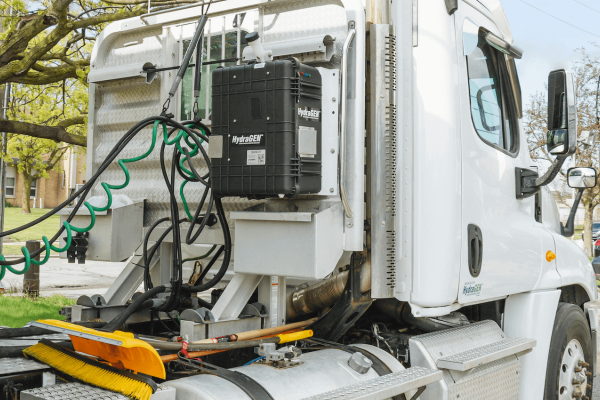

SMA Solar, dynaCERT, TotalEnergies - Good for the climate, good for your portfolio!

The signs of the times are climate protection: In America, Joe Biden is trying to push his Green New Deal through the legislature, China is phasing out the construction of coal-fired power plants, and in Germany, the Greens will most likely be part of the next government. Industry is also rethinking its position. Recently, an alliance of 69 leading German companies called for an "implementation offensive for climate neutrality" within the first 100 days of a new government. Signatories included heavyweights such as SAP, E.ON and Bayer. The following three stocks should get a tailwind from the new climate awareness.

ReadCommented by Carsten Mainitz on October 14th, 2021 | 08:20 CEST

Square, BIGG Digital Assets, Advanced Micro Devices - Profiteers of the FinTech and crypto boom

FinTech and crypto are defining investment themes of today. Even though there are now efforts by politicians to curb or regulate cryptocurrencies, they will remain part of our everyday lives in the long run. For cryptos to be usable by the broad population, it is essential to make them easy and safe to trade and use as a means of payment. That requires certified trading platforms and reliable payment service providers. These are not the only ones who will benefit from the development; hardware manufacturers are also in great demand.

Read