The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Commented by Carsten Mainitz

Commented by Carsten Mainitz on December 16th, 2021 | 12:43 CET

Memiontec, E.ON, RWE - Fighting the crisis with basic services!

A ghost is haunting the world - the ghost of inflation. With 6.8% for November, the USA reports the highest rate since June 1982. 5.2% inflation in Germany was also the highest in 30 years. Central banks are under pressure to act, and tension is rising on the stock markets. Experts expect inflationary pressure to ease again somewhat in 2022. However, no one knows whether new variants of the Coronavirus will again trigger disruptions in supply chains. In such cases, in addition to tangible assets and commodities, shares in companies that provide basic supplies are recommended. Here are interesting candidates that could provide a safe haven for investment.

ReadCommented by Carsten Mainitz on December 15th, 2021 | 13:24 CET

United Internet, BrainChip, Software AG - Promising further growth!

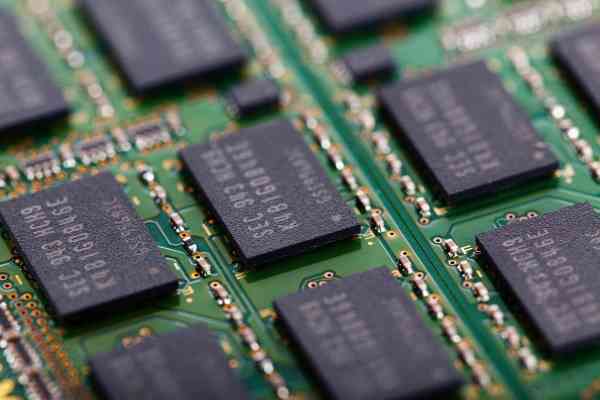

Growth strategy and the use of innovative technologies are often decisive for the continued existence of a company. Not only in large corporations, as seen in the example of SAP with the expansion of the cloud business, but the conventional business areas are also hardly sufficient anymore. A generation change is also taking place in the production of semiconductors. The market for chips for artificial intelligence is currently experiencing a real hype, which is likely to accelerate in the coming years. Smaller companies, in particular, have a head start in terms of know-how.

ReadCommented by Carsten Mainitz on December 14th, 2021 | 10:28 CET

Meta Materials, SAP, Palantir - Well prepared for the future!

New technologies are entering the mainstream ever faster. Cloud computing, machine learning using artificial intelligence and autonomous driving are coming out of the research departments and are influencing the economy and society to a great extent. In materials management, too, research is being conducted into new materials that have the prerequisites for turning the tide. Metamaterials are artificial materials that have specific optical, magnetic or electrical properties that do not exist in nature. A rosy future lies ahead for the market leader.

ReadCommented by Carsten Mainitz on December 10th, 2021 | 11:26 CET

BASF, Kodiak Copper, Salzgitter - Inflation stays longer

For the first time in almost 30 years, the German inflation rate rose above the 5% mark in November. According to an initial estimate by the Federal Statistical Office, goods and services cost 5.2% more than a year earlier. Energy and raw material prices, which have risen sharply, account for a major share of this increase. Given the increased demand for special materials to achieve the energy turnaround, the trend is likely to be confirmed in the coming years.

ReadCommented by Carsten Mainitz on December 9th, 2021 | 04:57 CET

Barrick Gold, Barsele Minerals, Merck KGaA - Much movement in the market

Currently, there is little movement in the gold market. The gold price peaked at around USD 2,070 an ounce in the summer of last year, and it is now consolidating around USD 1,800. Investors prefer to invest in higher-yielding assets such as equities or cryptocurrencies despite the economic environment with high inflation and historically low-interest rates. Behind the scenes, however, a lot is going on in the gold market. Most recently, for example, Tembo Gold announced its entry by Barrick Gold, with further acquisitions to follow.

ReadCommented by Carsten Mainitz on December 8th, 2021 | 12:53 CET

Pfizer, Defence Therapeutics, Novavax - Who will benefit from Omicron?

The world is trembling before the new Corona variant Omicron. Stock exchanges are going down, panic reigns in the crypto markets and politicians are outbidding each other with calls for tighter lockdown regulations. However, some experienced epidemiologists already see the emergence of Omicron as an indication of an imminent change from pandemic to endemic, in which we will live with the Coronavirus as if it were the flu. However, everyone agrees on one thing: we will still need vaccination. Who is this good news for?

ReadCommented by Carsten Mainitz on December 3rd, 2021 | 13:41 CET

Desert Gold, Barrick, First Majestic - Countercyclical opportunities!

The drop of the gold price below USD 1,800 opens up first-class countercyclical investment opportunities for long-term investors. The high inflation worldwide and the low-interest rate policy speak for precious metals as inflation protection and crisis currency. High-quality gold shares have historically outperformed the underlying over longer periods. Who will be ahead in 2022?

ReadCommented by Carsten Mainitz on December 2nd, 2021 | 12:52 CET

Nevada Copper, Varta, Aumann - Catching up!

Electromobility is inextricably linked with raw materials such as copper and lithium. The demand for e-cars and batteries is increasing enormously. This megatrend is also pulling up the relevant raw material prices. How can investors profit from this development, and which of the three stocks has the best opportunities in the coming year?

ReadCommented by Carsten Mainitz on December 1st, 2021 | 13:53 CET

Square Inc., CoinAnalyst, Coinbase - The crypto wave is unstoppable!

Corona and cryptocurrencies seem to have one thing in common: The next wave is coming as surely as the amen in church. All kinds of positive decisions around the best-known cryptocurrency were recently reported. Countries such as El Salvador, where Bitcoin is now recognized as an official means of payment, Argentina and the EU had decided numerous facilitations for Bitcoin investors. And also, the extension of the term of FED chief Jerome Powell provided a positive mood. Now, however, the news of the new Corona variant, Omicron, ended the renewed price rally for the time being. Time to prepare for the next run and look at a few promising companies that should benefit massively.

ReadCommented by Carsten Mainitz on December 1st, 2021 | 10:44 CET

Defense Metals, Aixtron, TUI - Winners or losers?

Supply chain problems have hit many industries hard in the wake of the Corona pandemic. Essential parts and components were missing, and as a result, production lines at automotive manufacturers, among others, came to a standstill. In addition, raw materials and components such as chips have become much more expensive. Now, in the wake of the new wave of the pandemic, there are signs that the situation will worsen. Who are the winners, and who are the losers?

Read