The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Commented by Carsten Mainitz

Commented by Carsten Mainitz on January 18th, 2022 | 13:07 CET

Ayurcann, Novavax, Covestro - The stragglers are coming!

Humanity continues to find itself in the clutches of the Corona pandemic, the infection figures are rising, and the demand from politicians for mandatory vaccination is becoming louder and louder. While BioNTech and Pfizer vaccines and Moderna have dominated to date, new vaccine manufacturers are entering the market in the next wave. The situation is similar in the cannabis industry. After a boom about 3 years ago, the market leaders have since lost up to 80% of their value. Legalization and the rise of Cannabis 3.0. will pave the way for new companies.

ReadCommented by Carsten Mainitz on January 17th, 2022 | 10:05 CET

Aspermont, SAP, Steinhoff - Unbridled growth

With focused growth and high investments in the cloud division, European software giant SAP wants to attack the US tech groups Oracle and Salesforce. The Walldorf-based Company has recognized the signs of the times; technological progress concerning a rapidly growing engineered and digital world is picking up speed. The Australian Company Aspermont, a formerly long-established publishing house, has already gone through the digital transformation. The next step is now to become a fintech group. The path has already been paved.

ReadCommented by Carsten Mainitz on January 14th, 2022 | 12:31 CET

Barrick Gold, Alerio Gold, First Majestic - Experts agree: 2022 will be the year of mining stocks

2021 was a consistently strange year. Corona surprised with more new variants, Olaf Scholz became German Chancellor and the prices for gold and silver, despite ever-rising inflation, developed downwards towards the end year. While in the past many investors have relied on cryptocurrencies as a hedge against inflation, perhaps the recent price capers of the leading cryptocurrency, Bitcoin, could make investors rethink.

ReadCommented by Carsten Mainitz on January 13th, 2022 | 14:13 CET

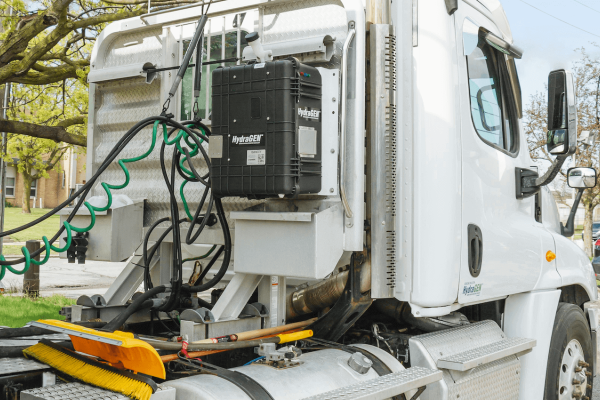

dynaCERT, Plug Power, Nikola - Will hydrogen be the comeback of 2022?

Electromobility is an important building block for reducing CO2 emissions. However, batteries are not efficient enough due to their limited range and long charging times, especially in heavy-duty traffic. The most promising technology is hydrogen. However, after a veritable hype last year, many values experienced an abrupt crash after it became clear that the necessary infrastructure was not yet ready. But in 2022, the course could slowly be set, and hydrogen stocks could make the comeback of the year. We took a closer look at three promising candidates.

ReadCommented by Carsten Mainitz on January 12th, 2022 | 13:21 CET

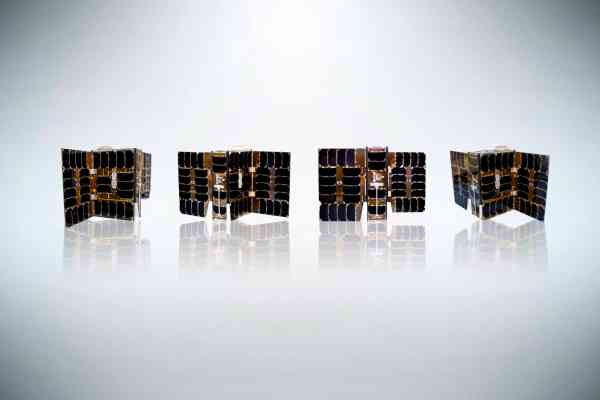

Deutsche Lufthansa, Kleos Space, BYD - The picture is brightening up

Exploding infection figures, contact restrictions, and no prospect of improvement are some of the impressions one could get from the current news situation. In contrast, individual scientists are cautiously optimistic that the new variant could be the beginning of the end of the pandemic and the change to an endemic. In an endemic situation, people continue to become infected with the virus; however, by that time, most people's immune systems have already been exposed to the virus or are protected by vaccination, so there is no longer a burden on the health care system. A more normal life would thus be possible again, with significantly fewer restrictions.

ReadCommented by Carsten Mainitz on January 11th, 2022 | 13:13 CET

Deutsche Bank, CoinSmart, PayPal - New opportunities after the correction!

After bitcoin reached a new all-time high of around USD 69,000 in November, price targets of over USD 100,000 were already being passed around. But the reality looks different. In the wake of a sharp correction, the digital reserve currency is trading below USD 41,000. The altcoins have also been dragged down with it. Even if cryptocurrencies are not yet at the end of the current correction cycle, the ecosystem's development and infrastructure are still in their early stages. Thus, there are attractive countercyclical entry opportunities in this segment for selected securities, which should pay off in the long term.

ReadCommented by Carsten Mainitz on January 10th, 2022 | 13:14 CET

Nel ASA, CoinAnalyst, GameStop - Prepared for the future!

Technology stocks suffered from a painful correction in recent weeks. The announcement on the occasion of the publication of the FED minutes that interest rates would be raised faster than expected intensified the consolidation. As a result, stocks with disruptive business models fell, as did hydrogen stocks, which are promising in the long term due to the energy transition. The bulk of cryptocurrencies also lost by double digits. However, these sectors are more than promising in the long term and offer attractive entry opportunities at current levels.

ReadCommented by Carsten Mainitz on January 7th, 2022 | 11:36 CET

Deutsche Bank, Troilus Gold, Allianz - Interest rate hike and the consequences

The loose monetary policy could end sooner than thought, at least in the US. The Federal Reserve's Monetary Policy Committee members noted that the inflation trend had been higher and stronger than forecast. This reads from the minutes of the Fed's mid-December meeting. As a result, faster rate hikes were warranted, it said. In the wake of expectations of a more restrictive monetary policy, financial stocks, in particular, are benefiting. The chances of further price gains are good.

ReadCommented by Carsten Mainitz on January 6th, 2022 | 12:37 CET

Gazprom, Desert Gold, TeamViewer - Nothing ventured, nothing gained

Opportunity and risk are two sides of the same coin when it comes to investing. When the market misses opportunities over a long period of time or prices in risks excessively, investment opportunities arise. Timing and investment horizon are equally part of the decision-making process. The three stocks mentioned are in an exciting phase - reason enough for a closer look.

ReadCommented by Carsten Mainitz on January 5th, 2022 | 11:23 CET

Noram Lithium, Varta, Allkem - Profit from the growing hunger for lithium!

Along with cobalt and manganese, lithium is one of the raw materials of the mobility revolution. The silvery white-grey light metal is needed to produce rechargeable batteries with a very high energy density, such as those used in electric cars. Demand is growing enormously, but there is insufficient production capacity. As a result of this constellation, the price of battery-grade lithium carbonate has risen fivefold in the last year and a half. And it does not look like the situation will ease. Mining group Rio Tinto warns that in the future, only 15% of the supply deficit of battery-grade lithium carbonate can be extracted from existing projects. Lithium producers and explorers will benefit from these conditions. Which lithium stock will make the running this year?

Read