The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Commented by Carsten Mainitz

Commented by Carsten Mainitz on March 3rd, 2022 | 12:48 CET

K+S, Globex Mining, Barrick Gold - On the road to success

The stock markets will certainly remain nervous for some time to come given the war in Ukraine and Putin's threatening nuclear gestures. But where there is uncertainty and risks, there are also opportunities. The big picture favors commodity investments: precious metals as a crisis currency, battery metals with high demand due to the energy transition, and agricultural commodities. We take a look at shares that offer good opportunities.

ReadCommented by Carsten Mainitz on March 2nd, 2022 | 13:21 CET

MAS Gold, Nordex, Hensoldt - Profit from the crisis!

War in Europe! After the end of the Balkan conflict and the ceasefire in Northern Ireland and the Basque country, no one could have imagined that it could happen again so quickly. On the stock exchanges, armed conflicts seldom cause storms of enthusiasm. On the contrary, investors take refuge in supposedly "safe investments," such as precious metals. Therefore, it is all the more important to closely examine the news situation in order to identify which stocks can benefit from the overall negative situation.

ReadCommented by Carsten Mainitz on February 25th, 2022 | 12:07 CET

Dt. Telekom, Barsele Minerals, Munich Re - Top opportunities with discount!

In the last few days, what was supposed to be prevented by diplomacy has become the bitter truth. Russia, in the person of Russian President Putin, has made the decision for a military operation and has advanced with its troops into eastern Ukraine. A heavy blow for the stock market, sending the DAX temporarily down more than 5% below the 14,000 point mark. That political stock markets have short legs has been shown all too often in the past. As a result, investors should take a closer look at companies that have lost significant value due to the Ukraine crisis but are making significant fundamental progress.

ReadCommented by Carsten Mainitz on February 24th, 2022 | 13:45 CET

Barrick Gold, Ximen Mining, Yamana Gold - Outperform with gold stocks!

Unsettled times are good for gold investors. The precious metal has risen by 5% since the beginning of the year. At times it was quoted above the USD 1,900 per ounce mark again. The shares of Barrick and Yamana gained about 20% during this period. The NYSE Arca Gold BUGS Index, which tracks the most important international gold producing mining companies, topped this performance with a plus of 25%. Thus, the sector clearly outperformed the global stock markets recently. Rising precious metal prices are also the hour of explorers and developers.

ReadCommented by Carsten Mainitz on February 24th, 2022 | 11:30 CET

SYNLAB, XPhyto, Novavax - How long will the Corona boom last?

Corona has been turning the world upside down for two years. Although the stock markets have largely recovered from their crash in February and March 2020 and are clearly up again, some stocks are still doing much better, thanks to Corona. For example, shares of companies involved in developing and producing Corona vaccines, medicines, or testing methods have significantly outperformed the indices. But how sustainable is this boom?

ReadCommented by Carsten Mainitz on February 22nd, 2022 | 10:49 CET

Bayer, Memiontec, Dr. Hönle - Serious threat!

Water is the basis of all life. We use water for our nutrition, daily hygiene and leisure activities. Water is also a crucial economic factor as an energy source, transport medium and raw material. But access to clean drinking water is not a matter of course; even today, 1 billion people are denied it. According to various experts, this situation will soon deteriorate dramatically. By 2025, 3 billion people could be living in countries with severe water shortages. Therefore, water scarcity is an urgent issue for the future of humanity.

ReadCommented by Carsten Mainitz on February 21st, 2022 | 14:49 CET

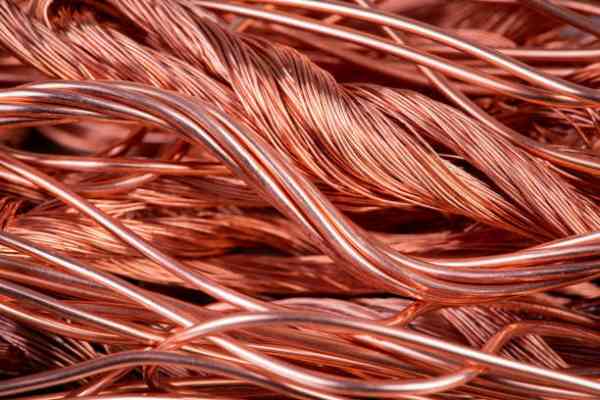

E.ON, Nevada Copper, Nordex - The only way it works

In the course of the energy transition, renewable energies such as hydroelectric and solar power, wind energy, geothermal energy and renewable raw materials are replacing fossil fuels. By 2050, renewable energy sources are to cover around 60% of national consumption. Another key challenge is to increase energy efficiency. New storage concepts and intelligent energy networks play a central role here. Not to be forgotten are the essential raw materials such as copper, from whose expected price increases commodity producers can profit.

ReadCommented by Carsten Mainitz on February 18th, 2022 | 12:47 CET

Commerzbank, wallstreet:online, Bayer - Positive signals!

The US Federal Reserve is on the verge of ending its ultra-loose monetary policy and is signaling interest rate hikes soon in order to get a grip on high inflation, which is currently far above the target value of 2%. In addition, the monetary watchdogs cite future inflation risks and the robust labor market as reasons for the rising interest rates. As a result, shares of banks and financial services providers are benefiting. The successful restructuring measures, which are now generating billions in profits for the banks, also boost share prices.

ReadCommented by Carsten Mainitz on February 17th, 2022 | 13:22 CET

Allkem, Kodiak Copper, BHP - Profiteers of high commodity prices!

The growth of electromobility will cause the prices of copper, lithium and other battery metals and critical raw materials to rise in the long term. Supply and demand are the determining influencing factors. Whether interest rates rise or not, whether stock markets wobble or not, the price trend will continue. Profiteers are (prospective) commodity producers.

ReadCommented by Carsten Mainitz on February 15th, 2022 | 13:35 CET

Almonty Industries, Mercedes-Benz Group, Varta - Highs and lows, what to do?

Without raw materials, life in many sectors of the economy comes to a standstill. The economically most important raw materials with a high supply risk are referred to as critical raw materials. The European Commission counts 30 elements in this group, including tungsten and lithium. Demand rising sharply above supply has caused prices to increase significantly for some time. Raw material producers are on the winning side. Buyers have to do their homework.

Read