The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Commented by Carsten Mainitz

Commented by Carsten Mainitz on January 27th, 2022 | 11:41 CET

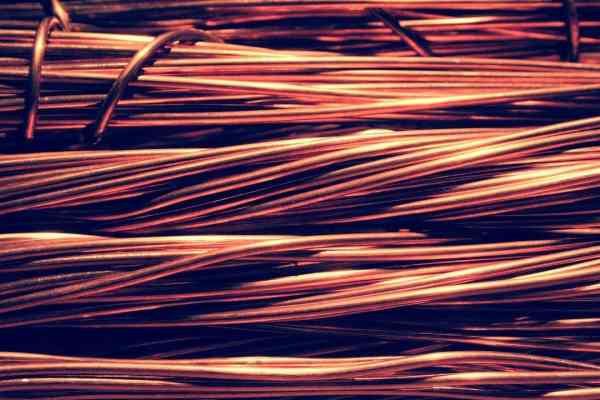

Aurubis, Nevada Copper, Daimler - Copper: Fueling the mobility and climate shift

No metal represents the step into our electrical century more than copper. The reddish shimmering metal with excellent conductivity is in demand wherever electricity is concerned. Experts estimate that about three to four times as much copper needs to be installed in e-cars than in a conventional combustion engine for mid-range cars, which currently comes to about 25kg of copper. Due to the high demand, copper consumption could increase more than tenfold in the next ten years.

ReadCommented by Carsten Mainitz on January 26th, 2022 | 13:34 CET

Valneva, Perimeter Medical Imaging AI, MorphoSys - This is where it gets exciting!

The Corona pandemic still has the world firmly in its grip. The number of new infections is skyrocketing. Nevertheless, the chances are good that the pandemic can be brought under control by means of numerous vaccines. But Corona is not the only scourge. Numerous research efforts are focused on diagnosing, treating and curing cancer. Here, innovative AI-based technologies are increasingly being used to help save lives and significantly reduce costs for the healthcare system.

ReadCommented by Carsten Mainitz on January 25th, 2022 | 11:14 CET

Allkem, Triumph Gold, K+S - Take advantage of price setbacks!

What moves prices? When reduced to the core, it is supply and demand. So simple and yet so complicated. The forecast or anticipation of the two factors and the pricing of the future is what moves the stock market. Many developments and general conditions speak for rising commodity prices. While the prices of industrial and battery metals have been rising significantly for many quarters, the increases in precious metal prices, on the other hand, have been moderate. Where are the opportunities to take advantage of price declines?

ReadCommented by Carsten Mainitz on January 24th, 2022 | 12:20 CET

Barrick Gold, Prospect Ridge Resources, Glencore - The starting signal has been given!

With the publication of quarterly results last week and the achievement of full-year targets, the share of the second-largest gold producer Barrick Gold was able to gain. As a result, this also boosted the entire sector. In addition, the price of gold, which has maintained the USD 1,800 mark at a level of USD 1,830, provides support. The prospects for investments in gold shares remain good.

ReadCommented by Carsten Mainitz on January 21st, 2022 | 11:02 CET

Samsung SDI, Altech Advanced Materials, Manz - Power stocks!

How is the energy turnaround to be achieved exclusively with renewable energy generation? The sun does not shine at night, and the wind does not blow every day. The answer is energy storage. Batteries and accumulators will play an increasingly important role in the future. Whether for electric vehicles of all kinds (pedelecs, automobiles, buses) or as intermediate storage for renewable energies (at home on a small scale or in wind and solar parks on a large scale). Without new and increasingly efficient storage technologies, the world will not achieve climate neutrality. These three "power stocks" should benefit massively from this development.

ReadCommented by Carsten Mainitz on January 21st, 2022 | 10:45 CET

Yamana Gold, MAS Gold, Newmont - Entry opportunities!

In recent months, gold stocks consolidated. The shares of the second-largest producer, Barrick Gold, were recently boosted by good quarterly data. From a historical perspective, the current price level of the precious metal can be considered high. The general conditions for rising prices are also good in the medium term. Now the sentiment for precious metal stocks could turn more positive again. These companies will certainly benefit from the next gold price rally.

ReadCommented by Carsten Mainitz on January 21st, 2022 | 09:25 CET

Shell, Saturn Oil + Gas, Plug Power - Energy stocks in focus

Oil prices remain in bullish mode, reaching a new seven-year high. The latest increase was due to an explosion of a critical oil pipeline between Iraq and Turkey, through which up to 450,000 barrels of crude oil are transported daily. In general, the supply situation remains tight. OPEC expects a further increase in global oil demand. The primary beneficiaries of this supply shortage are oil producers; they were already able to post record results last year.

ReadCommented by Carsten Mainitz on January 20th, 2022 | 12:14 CET

Evotec, Defence Therapeutics, Formycon - Who will benefit from Omicron?

The Coronavirus has shown that without biotechnology and ongoing research, we are relatively defenseless against the whims of nature. What would have happened if novel technology had not been available to produce potent vaccines in a very short time? Would our intensive care units have been as crowded as they were in Italy at the beginning of the pandemic? Would hospital triage be the norm today? No one can say for sure, but history has shown how epidemics - such as the Spanish flu - have claimed many lives in the past.

ReadCommented by Carsten Mainitz on January 18th, 2022 | 13:07 CET

Ayurcann, Novavax, Covestro - The stragglers are coming!

Humanity continues to find itself in the clutches of the Corona pandemic, the infection figures are rising, and the demand from politicians for mandatory vaccination is becoming louder and louder. While BioNTech and Pfizer vaccines and Moderna have dominated to date, new vaccine manufacturers are entering the market in the next wave. The situation is similar in the cannabis industry. After a boom about 3 years ago, the market leaders have since lost up to 80% of their value. Legalization and the rise of Cannabis 3.0. will pave the way for new companies.

ReadCommented by Carsten Mainitz on January 17th, 2022 | 10:05 CET

Aspermont, SAP, Steinhoff - Unbridled growth

With focused growth and high investments in the cloud division, European software giant SAP wants to attack the US tech groups Oracle and Salesforce. The Walldorf-based Company has recognized the signs of the times; technological progress concerning a rapidly growing engineered and digital world is picking up speed. The Australian Company Aspermont, a formerly long-established publishing house, has already gone through the digital transformation. The next step is now to become a fintech group. The path has already been paved.

Read