The native Rhineland-Palatinate has been a passionate market participant for more than 25 years. After studying business administration in Mannheim, he worked as a journalist, in equity sales and many years in equity research.

Most recently, he headed a Hamburg-based investment research company as a member of the board for 8 years.

He is particularly interested in international small and micro caps and empirical capital market research (behavioral finance).

Commented by Carsten Mainitz

Commented by Carsten Mainitz on November 9th, 2021 | 11:14 CET

Covestro, First Hydrogen, Volkswagen - Win with hydrogen!

The UN Climate Change Conference COP26 is in Glasgow until November 12 and is crucial for political climate protection measures in the coming years. The targets have already been put down on paper in black and white. Net Zero Emissions are to be achieved by the middle of the century. Fuel cell and hydrogen drives are essential prerequisites for achieving this Net Zero vision. Various companies have interesting opportunities to enter the market in the context of strategic alliances.

ReadCommented by Carsten Mainitz on November 8th, 2021 | 13:05 CET

Triumph Gold, Barrick Gold, Rheinmetall - Precious metal stocks jump!

Despite persistently high inflation, the US Federal Reserve is still far from thinking about interest rate hikes. At least in the stimulus bond purchases, however, the central bankers will step on the brakes a little and, as of November, reduce the volume of currently USD 120 billion monthly by USD 10 billion each. The program will then end completely in the fall of 2022. In the wake of this decision, prices for precious metals rose. Gold rose above the important resistance of USD 1,800.

ReadCommented by Carsten Mainitz on November 5th, 2021 | 13:27 CET

Lucid Group, Graphano Energy, Orocobre - The new eMobility and its children

It is expected that no more passenger cars with internal combustion engines will be allowed to be registered in the EU from 2035. The associated non-EU country Norway is exerting even more pressure: in the land of fjords and trolls, new vehicles with gasoline or diesel engines will be banned as early as 2025. The same applies to Great Britain: the end of the combustion engine is to be brought forward to 2035, perhaps even to 2030 and applies for light trucks up to 26 tons. With hydrogen technology still in its infancy, the world is currently focusing primarily on rechargeable batteries. Here, the capacity screw is increasingly being turned to extend ranges and shorten charging times.

ReadCommented by Carsten Mainitz on November 4th, 2021 | 11:36 CET

Barsele Minerals, Mutares, Aurelius - Investments create value!

Clever investment strategies can save some ailing companies or turn others into true high-flyers. Investment companies have professionalized these processes and create substantial added value for their investors with sophisticated strategies and portfolios. For this reason, we take a closer look at the topic of acquisitions.

ReadCommented by Carsten Mainitz on November 3rd, 2021 | 12:34 CET

Royal Helium, dynaCERT, Gazprom - What is next?

The oil and gas sector has long been a popular investment area. However, when it comes to gas, hydrogen company share certificates have been more in the spotlight in recent months. A more exciting and also little-noticed field is the noble gas helium. We take a broad look at the investment stories in the gas sector.

ReadCommented by Carsten Mainitz on November 3rd, 2021 | 12:12 CET

Osino Resources, Barrick, Newmont - Now comes the countermovement!

Inflation has been rising significantly for months. In October, consumer prices in the euro area rose by 4.1% YOY, the highest level in over 13 years. In Germany, the inflation rate even climbed to 4.5%! The last time this happened was in October 1993. Central banks dismiss this as a temporary phenomenon. The head of Deutsche Bank, Christian Sewing, made this clear a few days ago with his statements in the Frankfurter Allgemeine Sonntagszeitung. The manager vigorously contradicts the wishful thinking of a temporary phenomenon and calls on the central banks to act. Given these general conditions and prospects, investors can protect their money in the best possible way by investing in tangible assets such as shares, real estate, commodities, or precious metals.

ReadCommented by Carsten Mainitz on November 1st, 2021 | 13:56 CET

wallstreet:online, Deutsche Bank, GFT Technologies - It should continue to improve here!

Low-interest rates, high inflation and economic growth, form the framework conditions that continue to speak for a positive stock market environment and rising share prices. The three following companies benefit from this in different ways and should also perform well in the coming year. Who is your favorite?

ReadCommented by Carsten Mainitz on October 29th, 2021 | 13:39 CEST

Kleos Space, Lufthansa, TeamViewer - Exciting developments!

The capital market thrives on diversity. The stock market trades in the future and is never a one-way street. The pendulum - as painful as it sometimes is - swings in both directions. Corporate growth is just as much fuel for share prices as euphoria and panic. The following companies have seen a lot of action in the recent past. Who will perform best by the end of the year?

ReadCommented by Carsten Mainitz on October 28th, 2021 | 11:26 CEST

MAS Gold, Barrick Gold, Yamana Gold - Go for gold!

If you look at the big picture, several aspects favor a medium-term increase in the price of gold. It is a combination of a low-interest rate environment, rising inflation and crisis currency in volatile stock market times. In addition, the global economic recovery is increasing the demand for gold. As the past has shown, the gold price can perform strongly even when nominal yields rise if inflation rates climb faster than interest rates. We believe this scenario is very realistic. Thus, these stocks should benefit.

ReadCommented by Carsten Mainitz on October 27th, 2021 | 14:53 CEST

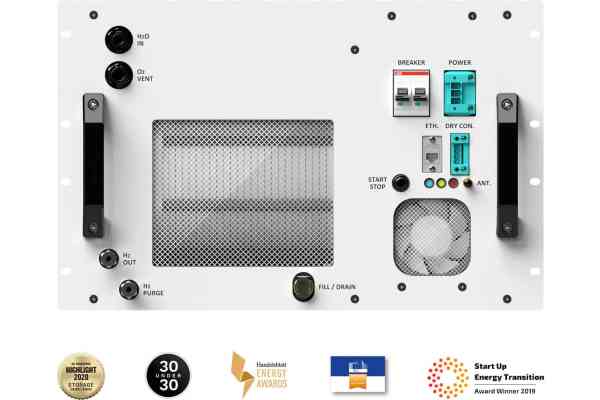

Enapter, Plug Power, Ballard Power - This is the future!

In 1875, Jules Verne wrote in his book "The Mysterious Island": "Water is the coal of the future. Tomorrow's energy is water that has been broken down by electric current. The elements of water thus decomposed, hydrogen and oxygen, will secure the earth's energy supply for the unforeseeable time." The visionary was right. For a successful energy transition, we need hydrogen solutions. Mass production is increasingly within reach for many companies, but most companies are still in the red. Who will be ahead in the future?

Read