Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Commented by André Will-Laudien

Commented by André Will-Laudien on July 28th, 2021 | 13:24 CEST

Tencent, Prosus, Troilus Gold, Baidu - The big China slump!

If you compare it with the US stock markets, the stock market in Hong Kong is already almost in free fall. While Europe and the US keep climbing to new highs, the HangSeng has lost a full 20% since February. Is the great Asian rally now over? The reason for the panic on the markets is the ever stronger intervention of the Chinese regulators. These regulators do not want to tolerate the flourishing business of large domestic corporations. More or less unfounded and drastic measures to restrict the tutoring industry have also unsettled investors. We calculate whether the current prices may be considered entry prices.

ReadCommented by André Will-Laudien on July 27th, 2021 | 11:12 CEST

BYD, EuroSports Global, NIO - The age of electric vehicles!

Mobility will be rethought in the future with greater climate protection, new markets and less dependence on fossil fuels. The age of electric vehicles has begun. The further development of electromobility and the reinvention of the car as a rolling computer with new functionalities are a central future topic of the automotive and supplier industry. The innovative power here no longer requires long development cycles; often, even a software update is enough to anchor new features. Moreover, by linking the charging infrastructure with the energy networks, electromobility can become the key to the energy transition and climate-friendly mobility. We look at three representatives of the e-industry.

ReadCommented by André Will-Laudien on July 26th, 2021 | 11:04 CEST

Varta, Deutsche Rohstoff AG, Nordex: Multipliers in the commodity sector!

Commodity companies are currently sitting in the front row. But not all of them can profit! Only if a company has invested in recent years can it now deliver. Mining operations worldwide are currently working at the limits of their capacity, and supplying customers is also causing increasing problems. That is because supply chains have been badly hit by a lack of transport capacity, skyrocketing freight rates and pandemic-related outages. It is particularly noticeable in industry: Procurement prices for raw materials and precursors are going through the roof. We take a look at the books of some of the companies involved.

ReadCommented by André Will-Laudien on July 23rd, 2021 | 11:37 CEST

CureVac, XPhyto Therapeutics, BioNTech, NanoRepro - Continuous testing or vaccination or both?

Public confusion reigns. The pandemic seems to be locked in chains over the summer, and the population is happy about initial relief with incidences below 10. But now, the first vacationers are already coming back, partly from risk or mutation areas and have to go for testing again as vaccinated persons. It is often forgotten that even those who have been fully vaccinated can be carriers of the virus and can also fall ill, so it should be clear to everyone that personal protective measures must continue to be kept high. Our life with the COVID virus will last much longer than many want to believe...

ReadCommented by André Will-Laudien on July 22nd, 2021 | 10:51 CEST

Carnival, Triumph Gold, TUI - It is starting again!

Since the beginning of July, the cruise ships are now sailing again. AIDA already has 5 ships on the water again, and Carnival plans to bring a capacity of 75% back onto the water in the fall. These are the plans as of today. However, concerns about the pandemic development are also spreading because the travel industry is still very tense about the infection situation in the fall. A rampant spread of various mutations caused by summer tourism is expected for the winter. The good price-performance of various travel providers in the second quarter has also gone into reverse gear again. We take a closer look.

ReadCommented by André Will-Laudien on July 21st, 2021 | 11:56 CEST

Allianz, Kainantu Resources, Munich Re - The 10 billion disaster!

Indescribable images of destruction are spreading across Germany. People lose their homes, possessions and sometimes even their entire existence overnight. To use only climate change as a reason would be a one-sided argument because, for hundreds of years, there have been floods, some of them of biblical proportions. The death toll appears unusually high, and there seem to have been too few serious warnings. The authorities have a greater duty to take preventive action here. Corresponding warning systems have been in place in the EU since 2020. There is insurance for property damage if it has been taken out correctly...

ReadCommented by André Will-Laudien on July 20th, 2021 | 12:38 CEST

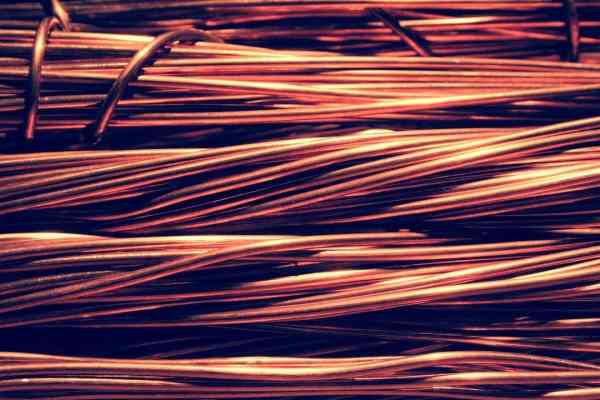

BYD, Volkswagen, Kodiak Copper: The 1000 Dollar Correction!

The copper price had reached its interim high in May 2021 at around USD 10,500. Since then, we have seen a standard consolidation of 10-15%, which is not an unusual occurrence in an uptrend. The increase since the beginning of 2020 is over 100%. Copper mines have been able to post multiple performances in the same period, and the recent correction was accordingly somewhat higher. For many market participants, however, the medium-term scenario for the industrial metal is set. Since the political closing of ranks on e-mobility, demand for copper and battery metals has shot through the roof. Mine operators worldwide are alarmed; the currently recoverable capacities cover just 85% of the demand from 2022. Who can close the gap?

ReadCommented by André Will-Laudien on July 20th, 2021 | 09:36 CEST

Alphabet, Aspermont, Palantir - Big Data in a new dimension!

Information today spreads in a matter of seconds and is immediately converted into cash by machines with corresponding trading algorithms. It usually takes a few minutes from the original company message for the relevant news services to filter and analyze the information content accordingly. That is because the analysis of a message is, per se, only possible after a professional check. Modern systems with artificial intelligence work with keywords that evaluate the respective characteristics of the news according to an internal scoring and forward them to the decision-maker at lightning speed. We take a look at some of the protagonists in the big data analytics sector.

ReadCommented by André Will-Laudien on July 19th, 2021 | 12:53 CEST

SGL Carbon, Millennial Lithium, Standard Lithium, Blackrock Silver - Millions of batteries needed!

If current trends in Germany remain valid, the share of electric vehicles in new sales will shake the 25% mark in the next 5 years. In a recent forecast, the Center of Automotive Management (CAM) predicts new car sales of around 480,000 battery-electric cars and plug-in hybrids this year, representing a good 15% share of new registrations of an estimated 3.3 million passenger cars. The assumption is that battery and plug-in hybrid vehicles will each account for around 50%. By 2025, according to the forecast, the e-vehicle share will rise to 27% of new sales, of which about 65% are expected to be pure electric vehicles. The scenario for the battery industry is thus set.

ReadCommented by André Will-Laudien on July 16th, 2021 | 13:22 CEST

Microsoft, Daimler, Mineworx Technologies - Market leaders on the rise!

The claim to market leadership can be made by the Company that can demonstrate the largest market share in comparison with the other market participants. The measure of market share is based either on market volume or market sales in units. Some typical attributions are the market leader in Germany, the European market leader or the world market leader in a relevant product sales market. Of course, market leadership is not indisputable, especially from a subjective point of view. A broader focus is needed to determine who sets the tone.

Read