Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Commented by André Will-Laudien

Commented by André Will-Laudien on July 1st, 2021 | 13:49 CEST

NEL, Plug Power, dynaCERT - Hydrogen, here we go again!

What momentum! In just 6 weeks, hydrogen stocks have gained up to 60% again. Of course, those who missed the first wave are happy. Maybe it will work out now with the second one. The framework parameters are suitable because both the EU and Joe Biden have agreed on more hydrogen within the climate targets. Germany's significant contribution to climate protection can create applications in these sectors that operate with low emissions using hydrogen. An important focus in developing a German hydrogen economy and strategy should therefore be the commercialization of applications.

ReadCommented by André Will-Laudien on July 1st, 2021 | 10:41 CEST

CureVac, Barrick Gold, Troilus Gold - Now it is important to keep your nerves!

The bull market is maturing a bit more every day. It is no longer young - because it has been running steadily since 2015. Admittedly, it stuttered a bit in March 2020, but the subsequent recovery was all the more violent. There are long-term fundamental trends, so-called megatrends, such as digitalization or e-mobility. At present, we can assume that the mining industry will also boom again in contrast to the crypto world. That is because the medium-term parameters here match the current economic trends. Here is a small selection of well-positioned stocks.

ReadCommented by André Will-Laudien on June 30th, 2021 | 14:03 CEST

TUI, Lufthansa, Silver Viper - The doubling opportunities for 2022!

Things are about to get really exciting once again. The travel season is in full swing, hotel occupancy rates are rising, and airlines are enjoying high occupancy rates. But how long will the catch-up effects last? The constraints are still burdensome. Travelers who have previously stayed in high-incidence or virus variant areas must carry a negative test certificate with them when they enter the country and, if a carrier is used, present the proof for the purpose of transport. That does not make travel so easygoing. The first countries are already appearing on the Robert Koch Institute's blacklist again: Portugal and Great Britain. In the autumn, when the temperatures tumble again, this can become a problem.

ReadCommented by André Will-Laudien on June 29th, 2021 | 11:47 CEST

Varta, JinkoSolar, Ballard Power, Sierra Growth - Energy technology on the test bench

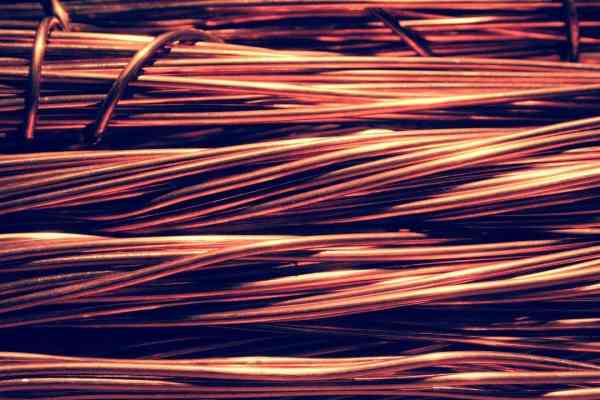

What will mobility look like in 10 years? Will we all be riding bicycles because climate regulations make it impossible to move around using electricity or fossil fuels? Or are there still revolutionary developments that go beyond the battery as a universal remedy? Germany continues to experience an energy shortage because we buy cheap nuclear power from abroad. That is how things can go when a messed-up energy policy is associated with climate protection goals. No matter how things go, the world needs copper for modern technologies, and this raw material is in short supply.

ReadCommented by André Will-Laudien on June 28th, 2021 | 13:38 CEST

Infineon, Nvidia, BMW, Defense Metals - Exploding commodity prices ahead!

The explosion in commodity prices is foreseeable. Due to the fatal misjudgment of the governments on how the COVID pandemic will develop, the economies are currently in a supply shock. The months-long lockdowns have broken off some supply chains, and the breakdown in the Suez Canal has further aggravated the situation. Ever Given's wrecked ship is still stuck in the Egyptian Bitter Lake with 20,000 containers on board. Whether in cell phones, electric vehicles, non-fossil power generation and storage, or modern server farms - industrial metals are needed everywhere. For special applications, we even need rare earths, which makes it highly political.

ReadCommented by André Will-Laudien on June 25th, 2021 | 12:32 CEST

NEL, Plug Power, Royal Helium - Things could get explosive here!

The energy turnaround in Europe is tied to several factors. On the one hand, it is about reducing emissions, especially of harmful climate gases. On the other hand, companies want to leave a green footprint because it is good for the public reputation and opens other doors of refinancing on the investor level. Concerning ESG criteria, we certainly want to attribute ethical, ecological reasons to most companies. Nevertheless, the road to greater climate neutrality is still rocky and cost-intensive for most. Another prerequisite is that substitute materials and environmentally friendly precursors are equally subject to scarcity since supply chains have been broken. Therefore, the pivotal point for climate-oriented business is the factual competence of the "how," then the necessary means, and finally, the material availability.

ReadCommented by André Will-Laudien on June 24th, 2021 | 15:51 CEST

windeln.de, Steinhoff, Mineworx Technologies - Can you believe it?

The capital markets are going in circles! A new round every day. Usually weak in the morning and up again in the evening as Wall Street rises. A never-ending game at absolute top levels. The slogan of the investment banks is "buy on any dips" because they naturally want to continue their business with the lucrative new issues. The pressure to refinance becomes stronger in an inflationary environment for companies because they first have to lay out preliminary products that have become expensive. Investors are therefore demanding more risk premium today than they were a few months ago. Once large stocks have taken off, investors are also turning their attention to smaller stocks. Penny stocks, in particular, are being moved back and forth with the help of social media slogans.

ReadCommented by André Will-Laudien on June 24th, 2021 | 15:38 CEST

Coca-Cola, Beyond Meat, The Very Good Food Company - Green Food, Blue Planet!

To eat vegan or live consciously, let's say, is a decision that more and more people are making for themselves. According to estimates, there are between 700,000 and 1.3 million vegans living in Germany alone. In addition, there is a steadily growing number of so-called flexitarians who do not yet feel that they belong to be veganism; however, their food plan contains a heavily reduced amount of animal products. Even insects are included in the discussion of veganism so that vegans also do not (should not) consume honey from bees. Political and social change is progressing, and people's daily habits are changing accordingly. We look at the approaches of modern food producers.

ReadCommented by André Will-Laudien on June 23rd, 2021 | 14:03 CEST

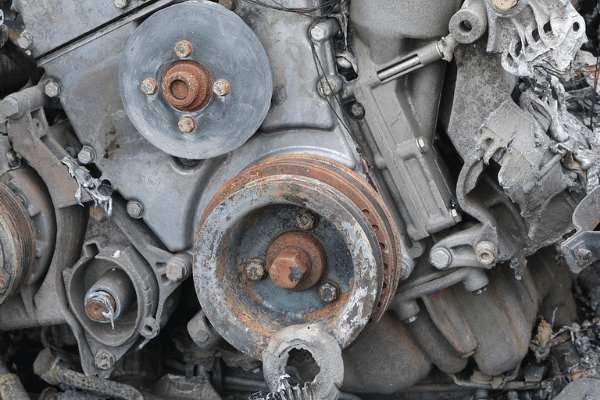

BHP, Glencore, NewPeak Metals - Scarce, scarce and sold out!

Whoever tries to order an e-bike from the Internet these days sometimes gets the delivery notice: "Due to missing components delivery delayed indefinitely!" Reason: The container ship "Ever Given" in the Suez Canal, shipwrecked, is still fully loaded at the Egyptian quay walls and is waiting to continue its journey. However, the insurance issues have not yet been resolved because the accident caused considerable damage to the canal structure. The riparian states admittedly do not want to pay for the restoration. It may therefore take some time before the insurance sum is paid. Moreover, on the ship are also bicycle components of the manufacturer Shimano, so European bicycle manufacturers cannot deliver!

ReadCommented by André Will-Laudien on June 23rd, 2021 | 13:14 CEST

FuelCell, NEL, Enapter - Hydrogen on the rise again!

It was quiet around the hydrogen stocks for a few months. Although we see high stock market turnover, the prices tended to move sideways. Yesterday there was good quarterly news from Plug Power, sales are increasing, but the loss continued to grow because of their high investment costs. The whole industry was caught in the downward trend, but in the last 4 weeks, there was a small revival of the stocks. The independent research organization SINTEF from Norway forecasts a massive market for hydrogen with a demand of over 100 million tons by 2050. We take a brief look at the protagonists' cards.

Read