Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Commented by André Will-Laudien

Commented by André Will-Laudien on September 16th, 2021 | 11:58 CEST

Siemens Healthineers, PuriflOH, Fresenius, Novavax - Focusing on health!

The pandemic outbreak in 2020 ushered in a new era. People's health is once again moving to the center of attention. Politicians worldwide see themselves obligated to make public life safe, but whether this will be 100% successful remains questionable. Ultimately, it will depend on the commitment of private companies to what extent the existing health issues can be solved and by what means. On the capital markets, the healthcare sector has been sailing on the highest wave for months because the dangers for billions of people need to be reduced, and framework conditions for public life need to be created. Who benefits the most?

ReadCommented by André Will-Laudien on September 15th, 2021 | 14:23 CEST

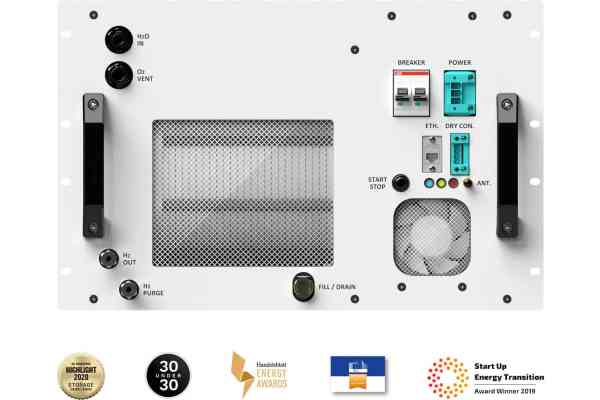

Nel ASA, Enapter, Plug Power, FuelCell Energy - It is time to go all out!

Hydrogen is not only a climate-friendly means of propulsion for automobiles and heavy-duty transport. Large industries such as chemicals and steel can use hydrogen technology to reduce their consumption of natural gas. There are costs involved when converting to hydrogen, most of which are only feasible with political support. The German government's national hydrogen strategy fits in well here. But medium-sized industries, especially energy-intensive sectors, could also become much more environmentally friendly with hydrogen-based technologies. Which stocks are well-positioned here?

ReadCommented by André Will-Laudien on September 15th, 2021 | 12:51 CEST

Bayer, Water Ways Technologies, Kali & Salz - Clean water for 7.9 billion!

Clean water, good nutrition and hygiene are basic human needs and indispensable for healthy development. For this reason, as part of the Sustainable Development Goals, the world's countries have set themselves the goal of giving everyone access to clean drinking water and adequate sanitation by 2030. These are two issues that need to be addressed, particularly in areas of the world that are difficult to access or inhospitable. Africa and Asia are at the forefront of the need here; they hope for few standards taken for granted in the developed world. We look at some interesting shares from this area.

ReadCommented by André Will-Laudien on September 14th, 2021 | 10:38 CEST

BYD, EuroSports Global, NIO - The shooting stars of electric mobility

According to a study conducted by McKinsey & Company in early 2020, 51% of Germans surveyed seriously considered an electric car the last time they purchased one. Still, only 3% of them decided to buy one. 36% cited uncertainties about battery reliability and lifespan, as well as area-wide charging options, as reasons for not buying. By the end of 2020, 589,752 electrically powered passenger cars had been registered in Germany, according to the Federal Motor Transport Authority: 309,083 pure electric cars, 279,861 plug-in hybrid cars and 808 cars with fuel cells. Therefore, the targeted one million was missed by a wide margin, but 2021 has been a very dynamic year so far. The number of non-combustion cars has risen by more than 140% so far. We present three interesting e-players.

ReadCommented by André Will-Laudien on September 13th, 2021 | 12:07 CEST

Gazprom, Barsele Minerals, Agnico-Eagle, Nordex - The energies of the future!

Election Sunday in Germany is approaching. No matter who will win the race at the end of September, the goals in climate policy have been put on the agenda by every party. In the future, it will not be possible to ignore this issue because young voters, in particular, are rightly concerned about the living conditions for the next generations. The decisive factor will be the course set in energy policy.

ReadCommented by André Will-Laudien on September 10th, 2021 | 12:43 CEST

NanoRepro, XPhyto Therapeutics, BioNTech, Valneva - The next biotech wave is rolling!

So far, vaccine manufacturers can maintain their high valuation because the next wave of new infections is rolling in. In Germany, tests will be subject to fees starting in October, making public life more expensive for those who want to participate. In surveys, most German citizens have expressed support for fee-based testing; probably, the populations here should be separated into "vaccinated" and "unvaccinated" to indicate general opinion accurately. Four interesting values benefit from the current situation.

ReadCommented by André Will-Laudien on September 9th, 2021 | 12:49 CEST

Royal Dutch Shell, Saturn Oil + Gas, Steinhoff: From 17 to 51 - Triples sought!

Investing in shares consists of striving for a return on the capital invested. In recent months, there have been many stocks that have increased tenfold in price. However, only few investors had persevered. If one lowers one's targets somewhat and still maintains a reasonable profit expectation, even a threefold increase could bring great joy. We take a look at three stocks that stand at just under 17 today and calmly consider whether a 51 could be possible. Impossible, you say - Possible, we say!

ReadCommented by André Will-Laudien on September 8th, 2021 | 12:59 CEST

TeamViewer, TalkPool AG, Deutsche Telekom - This is the way to the top!

When the dot-com boom took off at the turn of the millennium, many immature and unpromising business models came onto the market. Every idea was made ready for the stock market - then the techno-crash followed, and many companies disappeared from the radar. The COVID-19 pandemic triggered a worldwide digitalization push - many new achievements now determine the working world of every individual and change society as a whole. The focus is now on: Distant Working, Internet of Things and Communication. We take a look at the cards of three protagonists.

ReadCommented by André Will-Laudien on September 8th, 2021 | 11:33 CEST

BYD, Teck Resources, GSP Resource, Varta - Commodity rally three point zero!

There is a growing concern in the German economy that rapidly rising raw material prices will jeopardize the upswing in the future. Thus, the head of the Munich-based economic research institute Ifo, Clemens Fuest, warns: "If commodity prices continue to rise significantly across the board in the coming years, this could become a problem." He is referring to the upswing because supply chains are already severely disrupted by the pandemic. The temporary failure of the Suez Canal has even led to a delay of several months in the delivery of high-tech products.

ReadCommented by André Will-Laudien on September 7th, 2021 | 13:24 CEST

Nvidia, AMD, BrainChip, Infineon - Scarcity: These chip stocks are exploding!

The global chip markets remain tight, and a recent PwC study predicts that the global semiconductor market will continue to experience solid growth years. The authors forecast that chip sales will rise to USD 575 billion as early as 2022. Starting from the USD 481 billion in the previous record year 2018, this would correspond to a compound annual growth rate (CAGR) of 4.6% - not even the pandemic slowed this increase noticeably. In Europe, the automotive industry will become the primary sales market for chip manufacturers. A new growth driver is semiconductors to support artificial intelligence (AI) in autonomous mobility. We present a few industry representatives.

Read