Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Commented by André Will-Laudien

Commented by André Will-Laudien on September 28th, 2021 | 14:06 CEST

BYD, Fisker, Kodiak Copper, Varta: Nothing works without Copper!

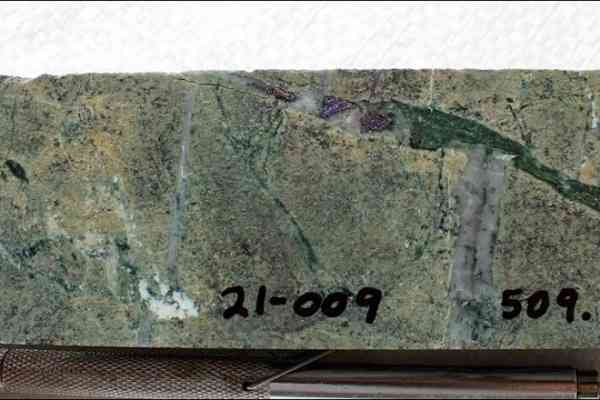

Electromobility is becoming increasingly crucial for the energy transition in transportation. And with it the research, development and production of drives, batteries and components. In addition to electricity storage, however, vehicle cabling and the assembly of e-components are also coming to the fore. Today, an electric vehicle requires three to four times the amount of copper as it did 20 years ago, plus the demand in industrial manufacturing processes. The earth's deposits are exhaustible, and copper, in particular, is pretty much on the edge. A spot price of just under USD 10,000 per kilo clearly shows how the markets are processing this situation. Rising prices!

ReadCommented by André Will-Laudien on September 28th, 2021 | 12:56 CEST

Standard Lithium, Defense Metals, Orocobre, Millennial Lithium: Separating the wheat from the chaff!

Lithium has become one of the most important metals in electromobility. Where all this lithium will come from is critical, as the logic behind electromobility is to generate more sustainable technologies. For more climate protection, mining companies must also fit into a sustainable concept. Lithium extraction should therefore follow high environmental standards and take place in an appropriate economic and social context. But beware: the overall market has recently stopped following every battle cry. Separating the wheat from the chaff is becoming a portfolio challenge!

ReadCommented by André Will-Laudien on September 27th, 2021 | 12:52 CEST

Central African Gold, TUI, Lufthansa - Attention, these were the lows!

The upward movement at the stock exchanges is very advanced because, in the last years, the higher valuation of the shares (and real estate) was funded by cheap money from the central banks. Now, however, inflation shows up in the statistics, for Europe officially a plus of 3,8%. This inflation rate, by its measuring method, corresponds little to reality. It is generally known, the actual price markup in the relevant goods might already lie beyond the 5% mark. One thinks here only of the exploding gasoline prices, the bread roll at the baker or the restaurant attendance after the reopening. Precious metals could be a tried and tested means of achieving real purchasing power protection. Let us do the math.

ReadCommented by André Will-Laudien on September 24th, 2021 | 13:34 CEST

Tencent, Memiontec, Gazprom - Buy when the cannons are firing!

The last few trading days have been dominated by the scandal surrounding China Evergrande. To take pressure off the markets, the management and China's central bank have reacted accordingly and presented measures. The highly indebted real estate company has probably reached an agreement with domestic creditors regarding the outstanding interest payments. No mention was made of offshore liabilities. The People's Bank of China has reportedly injected 90 to 110 billion yuan, the equivalent of just under 14 billion euros, into the banking system in an attempt to calm investors' nerves. Nightingale, "we" hear you galumph!

ReadCommented by André Will-Laudien on September 23rd, 2021 | 13:21 CEST

BIGG Digital Assets, Bitcoin Group, Coinbase - Invest in the future with crypto!

The crypto world is developing rapidly and with volatility. In the last few weeks, Bitcoin released another wave upwards, and the benchmark coin was worth a whole USD 50,000 again. However, it did not reach its old high of USD 60,000 in the first swing. Then followed the abrupt crash below USD 40,000 within 24 hours. Time and again, disruptive fire comes from China; the regulators have their eye on the miners and tend to want to ban crypto trading. The reasoning: The trades are opaque, enable criminal payments and lead to unwanted shifts in people's wealth. We take a look at companies that are doing well with the crypto world so far.

ReadCommented by André Will-Laudien on September 22nd, 2021 | 14:05 CEST

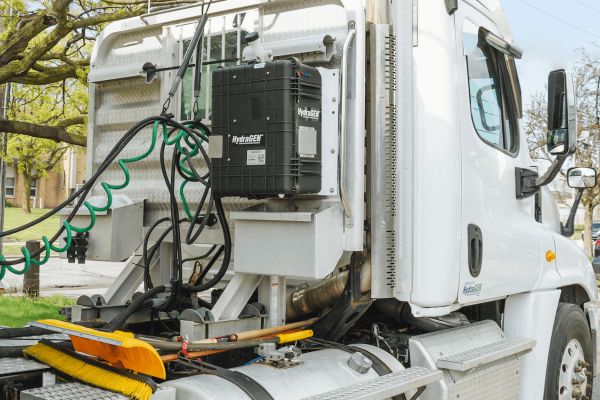

NEL, dynaCERT, Plug Power, FuelCell Energy - Hydrogen, the flagpole is broken!

Today, what a hype, one would say. Those who held their nerve in January and let reality prevail are not the ones who are surprised at the outcome today. Hydrogen was the stuff of dreams for a few weeks, but the barrel foamed over properly. After rises of up to 2500%, almost all H2 stocks went into the cellar. And how dynamic it was! In just 6 months, hydrogen stocks have lost up to 85% again. One wonders: can there be a second wave? The framework parameters are suitable, as both the EU and Joe Biden have agreed on more hydrogen within the climate targets. The only important thing is the exact design of the subsidies because it will probably not be possible without government orders!

ReadCommented by André Will-Laudien on September 21st, 2021 | 14:23 CEST

Barrick Gold, Tembo Gold, Varta - Where is the crisis gold rally?

A lot is going on in the markets. Asia is stumbling; here, the real estate markets had recently euphorically soared, now there are serious concerns. China has been struggling with high vacancy rates in its industrial cities since the pandemic broke out. People have fled the city for fear of infection and returned to the countryside. The resulting de-leveraging puts downward pressure on prices and, ultimately, with interest rates rising slightly, causing significant skewing in a highly leveraged shadow banking world. The imbalance of China Evergrande shows these excesses in pure form. Yesterday, there were wild price falls. The problem: Evergrande has to make high-interest payments, which are due this week. Some investors think back to Lehman Brothers and press the sell button first. What will the Fed say tomorrow in the USA on this subject?

ReadCommented by André Will-Laudien on September 21st, 2021 | 13:57 CEST

Porsche, Diamcor Mining, Aston Martin - Can it be a little more?

With the stock market upswing between 2015 and 2021, a gigantic shift in wealth took place. 85% of the world's wealth is in the hands of the wealthiest 10%. According to official surveys, just under 57% of people worldwide own assets of less than USD 10,000 - the wealthiest 1% of the earth's population, on the other hand, holds 45% of the assets. In Germany, more than 2 million people live with assets of more than EUR 1 million - in 2010, this figure was still just over 600,000. A nice increase, but luxury is still not only to be found among the wealthy because the desire for extravagance is a widespread character trait and less a question of money.

ReadCommented by André Will-Laudien on September 20th, 2021 | 13:21 CEST

Palantir, AdTiger, Deutsche Bank - The digital revolution is on!

Digitization - for years, this term has been omnipresent in political debates and the subject of what feels like every third talk show. The individual protagonists never tire of emphasizing the countless benefits of digitization. The overriding goal is to further improve the quality of life for everyone and to make education accessible to all. Optimally implemented, this would unleash new economic and ecological potential. The German government is spending more than EUR 5 billion on this in 2021, and digitization has already been a fixed item in companies' spending budgets for years. We take a look at different business models.

ReadCommented by André Will-Laudien on September 17th, 2021 | 11:23 CEST

NEL, Royal Helium, Linde, BASF - This is where it gets highly explosive!

How will the energy transition play out in Europe? With hydrogen is one way. It is costly to produce if you look at the issue sustainably. The raw material itself is seen as an alternative building block of a green future and, according to experts, could become one of the most important energy sources in the coming decades. The water element is available in abundance, but what is lacking is a truly environmentally friendly way to convert it back into hydrogen and oxygen. Even under the best conditions, green hydrogen costs about 10 times as much to produce as Russian natural gas, which also burns fairly cleanly overall. What is next for this sector?

Read