Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Commented by André Will-Laudien

Commented by André Will-Laudien on May 17th, 2023 | 07:20 CEST

Withdrawal from Russia, Asia says thank you - shares of BYD, Canadian North Resources, and Volkswagen in focus!

The triumphant march of electrification is gathering pace. While European producers are abandoning their production facilities in Russia, a new axis of industrialization is forming between Moscow, Beijing and New Delhi. For symbolic prices, local technology leaders are selling their plants in Russia to investors and speculators. What is no longer delivered to Russia from Europe is now produced by others, such as the Chinese manufacturer BYD, which can hardly be stopped in its expansion policy. It is interesting how a competitive picture can change completely within months. We analyze this a little more closely.

ReadCommented by André Will-Laudien on May 16th, 2023 | 09:45 CEST

BioNTech, Bayer, BioNxt, Formycon - The next biotech wave is rolling in - select carefully now!

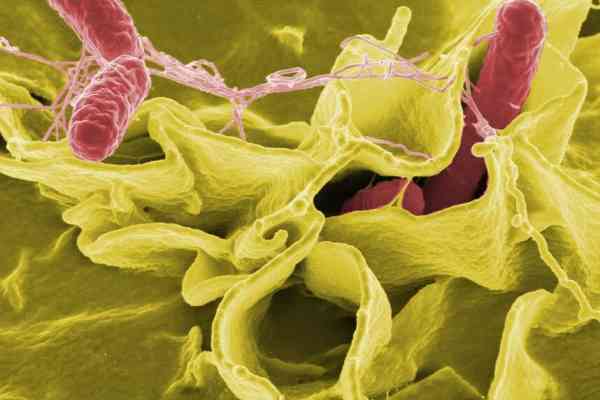

Even after Corona, the biotech sector remains an interesting investment sector because it is still important to keep an eye on the major widespread diseases. For many companies, this will probably mean a longer waiting game for investors. In addition to the promising research approaches and milestone plans, the cash reserves of these companies are also important. While having ample funding can lead to quick progress in the laboratory, it is crucial to have the necessary liquidity. In refinancing, however, things have become a little frostier since the rise in interest rates. Which companies should be put under the microscope?

ReadCommented by André Will-Laudien on May 16th, 2023 | 09:20 CEST

Heat pump, wind power and solar energy, is this the electricity mix of the future? E.ON, Myriad Uranium and ThyssenKrupp in focus

Germany is rapidly moving away from fossil fuels and has removed nuclear power from its energy mix. This makes us the forerunner of a new-thinking society that wants to switch energy production entirely to renewable sources. But there are a few problems because, by abandoning nuclear power, we are forced to extend the lifetimes of coal and natural gas-fired power plants. From a CO2 point of view, this is madness, and there is another point: the supposedly more environmentally friendly versions of energy production, such as wind or solar power, are not nearly as environmentally friendly as advertised by politicians because of current production practices. We will analyze these aspects objectively and in more detail.

ReadCommented by André Will-Laudien on May 15th, 2023 | 07:50 CEST

Correction in Greentech shares Varta and Nordex - Manuka Resources becomes a gamechanger

The goals of the climate protectionists are being delayed. With the Building Energy Act unlikely to arrive until 2025, the construction of the Tesla Gigafactory in Brandenburg will also be further delayed. Tesla has determined that the 300 hectares of factory space officially approved in 2022 is not quite enough. However, the latest planning for 400 hectares is meeting with resistance, especially from environmental groups. The municipalities are accused of planning chaos and failure to comply with environmental regulations. The climate-neutral future requires tremendous efforts because time is pressing. The stock market also seems to have run too far on many issues and urgently needs a break from its permanent upward trend. Pay attention to the following stocks.

ReadCommented by André Will-Laudien on May 11th, 2023 | 12:30 CEST

Financial crisis - which financial crisis? Spring bull market ahead: Mercedes-Benz, Blackrock Silver, Nel ASA, Plug Power - Still getting in now?

The stock markets are jumping from one high to the next. If it even comes, the long-anticipated recession has already been mentally filed away. That is because the GFK consumer climate index has been rising for 8 months, and the ifo index is once again close to the 100 mark at 96.5, which is considered an expansion signal among economists. Uncertainty in the financial sector could not be greater due to overnight takeovers. But after 8 consecutive US interest rate hikes, some market participants now believe the hawkish period is over. Since the ECB has been reluctant to get into the inflation fight, only 5 rate hikes have been registered here. Gold, silver, and even lithium are sensing the arrival of spring once again. We will now focus on three interesting stocks.

ReadCommented by André Will-Laudien on May 9th, 2023 | 09:10 CEST

Turnaround stocks with a 300% chance do not come along every day - BASF, Defiance Silver and TUI

Whenever the stock market reaches new highs, investors look for lagging stocks. This is not so easy because a weak price performance has its reasons. But often, things are simply overlooked. We present three stocks with a good story to tell but have been left behind. BASF, Defiance Silver and TUI were conspicuously undercut. And amid all the turbulence in the financial system, silver is stealthily making its way upwards and easily overcoming the USD 25 mark. Watch out at the edge of the platform!

ReadCommented by André Will-Laudien on May 8th, 2023 | 07:40 CEST

Impending financial crisis 3.0 boosts gold: Desert Gold Ventures, Deutsche Bank, Allianz - This is where the music plays!

And another double interest rate hike. First the FED, now the ECB followed suit last week, as expected. Monetary policy is trying a dangerous balancing act, as the US banking sector is tottering, and at the same time, inflation rates remain high. Now lavish wage settlements are added to the mix, and the second-round effects are on. The aggressive interest rate hikes and the collapsing real estate market have been among the factors causing stress in the banking sector. Profiteers are few and far between at the moment, but precious metals are back on the buy list. What about the prominence of the German financial industry?

ReadCommented by André Will-Laudien on May 5th, 2023 | 09:50 CEST

The future calls for battery metals! BYD, Grid Metals, VW - The international pecking order in e-mobility is reshuffling!

Since Western governments have finally started to get serious about climate protection, the media have focused on the areas of energy, mobility and health. It is clear to all participants that the changes in the world climate will lead to undesirable developments. Glaciers are melting, the earth's temperature is rising, and the oceans are already too warm for many species. Huge investments are being made in renewable power generation and modern mobility solutions, and it requires access to metals. Some companies are making a name for themselves, and shareholders can profit from this.

ReadCommented by André Will-Laudien on May 3rd, 2023 | 07:15 CEST

The copper war! Nordex, Orestone Mining, Nel ASA, ThyssenKrupp - Shortage of copper weighs on Greentech expansion

The World Copper Conference 2023 took place in Chile in mid-April. According to the experts, the global energy turnaround requires huge investments in new industrial metal mines, especially copper. The red metal has become very rare, and the large deposits are working at their capacity limits. One figure made the conference participants turn pale. According to estimates by the International Copper Association (ICA), at least USD 105 billion must be invested to provide enough mining capacity for the upcoming demand. Converted into quantities, this means 6.5 million tonnes more than the production from 2022. Anyone hearing these figures doubts the successful solution to climate change. Some stocks are to be considered in this context.

ReadCommented by André Will-Laudien on May 2nd, 2023 | 08:50 CEST

Nuclear off, secure energy now! Altech Advanced Materials, Varta and BYD - Up 700 % and no end in sight?

The nuclear reactors are now off! As though there was enough energy far and wide, the Berlin government ensemble decided to phase out nuclear energy. The reaction of the electricity suppliers followed immediately. On Monday, April 17, E.ON raised its electricity prices by 43%. Meanwhile, the coalition government cannot be deterred from suggesting to citizens that electricity prices will decrease in the long term. It will now be difficult for private households to behave in a climate-friendly way and still be able to consume. There are plenty of solutions for battery storage, but what is affordable and reliable? We take a look at an industry with a future.

Read