January 23rd, 2025 | 08:00 CET

XXIX Metal, Apple, D-Wave - Three beneficiaries of the 500-billion-dollar AI revolution

At high speed, the US government announces the "Stargate" project - a historic USD 500 billion investment in the country's AI infrastructure. The strategic partnership between tech giants such as OpenAI, SoftBank, and Oracle will include the construction of 20 state-of-the-art data centres. Initial construction work in Texas has already begun. Tons of copper will be needed to build the infrastructure and data centres, which means golden times are dawning for copper exploration companies. On the one hand, demand for copper is increasing due to rapid technological advances, and on the other hand, analysts say that the price of copper could double this year. Microsoft and Nvidia emphasize the strategic importance of healthcare in the AI deal. This is precisely where Apple has an opportunity for the future. If they manage to make a breakthrough with the Apple Watch in the diabetes market, there is the potential for billions of dollars in profits. D-Wave, a quantum computer manufacturer, also seems to be on the fast track. The Silicon Valley company produces, among other things, energy-efficient AI computing solutions. Music to the ears of investors...

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

XXIX Metal Corp. | CA9013201012 , APPLE INC. | US0378331005 , D-WAVE QUANTUM INC | US26740W1099

Table of contents:

"[...] If we pursue our goals conscientiously, the market will adjust its valuation accordingly, I am sure. Often, all it takes is a trigger. [...]" Ryan McDermott, CEO, Phoenix Copper

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

XXIX Metal Corp.: USD 500 billion AI investment drives copper demand

The announcement of a massive AI infrastructure project in the US underscores the further upturn for the copper market. Immediately after taking office, US President Donald Trump announced a USD 500 billion investment in the construction of AI data centres.

The "Stargate" project is a strategic collaboration between OpenAI, SoftBank, and Oracle and includes the construction of 20 data centres. Initial construction work is already starting in Texas. Other partners such as Microsoft and Nvidia have made it clear that healthcare is one of their top priorities, particularly for AI applications.

The enormous data centres will consume massive amounts of electricity, which also justifies the energy emergency declared by Trump. The infrastructure for the expansion is urgently needed.

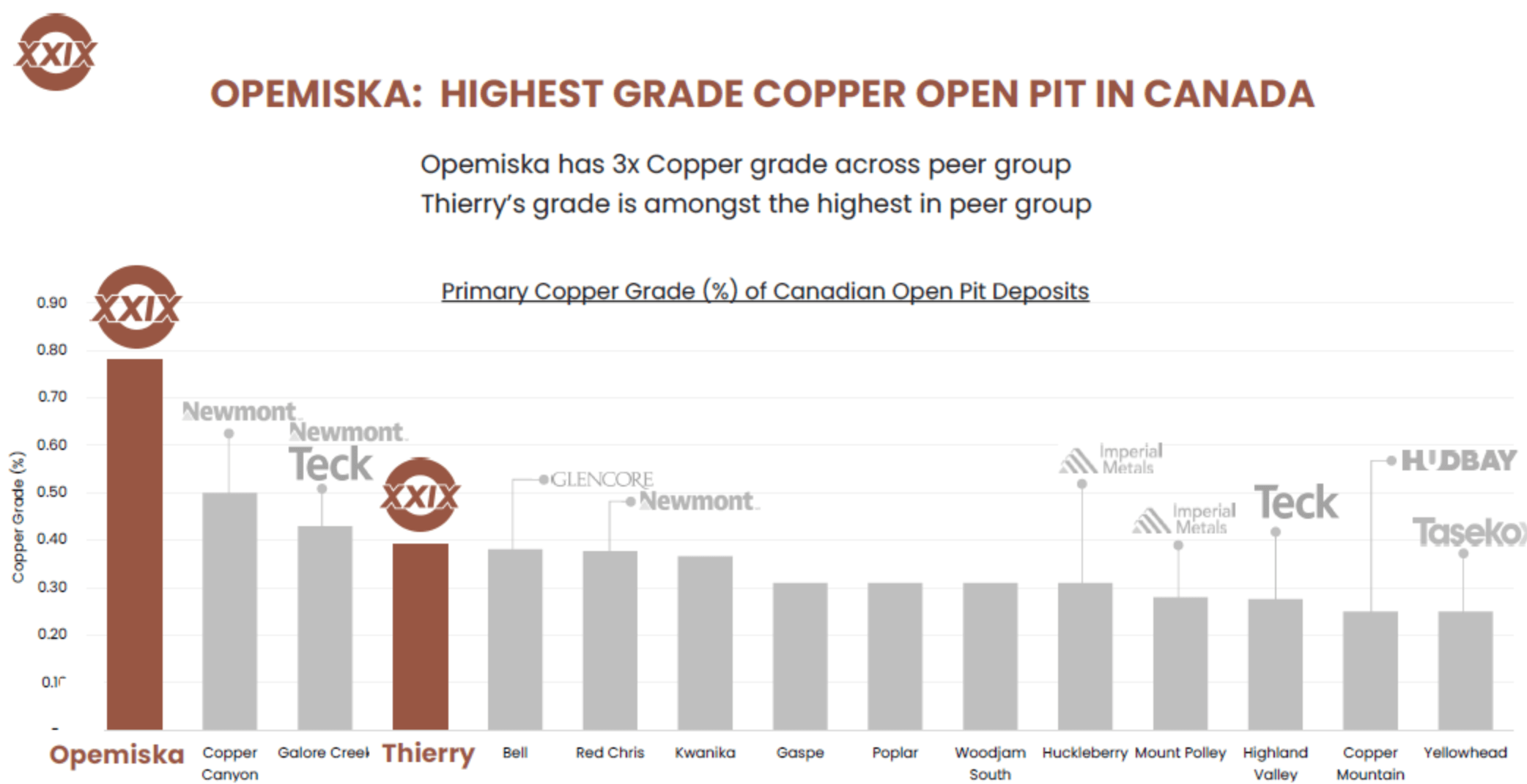

Current developments are bringing copper exploration companies such as XXIX Metal Corp. into focus, as such modern data centres require significant amounts of copper for power supply, cooling systems, and data lines. XXIX Metal Corp. is an emerging Canadian company specialising in the development of copper projects. With its Opemiska and Thierry projects, XXIX Metal offers an excellent opportunity to invest in the future of copper. Demand for copper is increasing worldwide, and experts already see a supply gap of 9.9 million tons by 2023. The scarcity of the resource is likely to lead to a price increase of around USD 15,000 per ton by the end of this year. This is nearly a doubling of the current price of 9,503.03 USD/t.**

XXIX Metal owns two significant copper projects:

-

The Opemiska Project, Canada's highest-grade copper resource, spanning 13,000 hectares in the Chapais-Chibougamau region of Quebec. Direct access to rail and road networks and developed infrastructure near the Horne smelter. A January 2024 resource estimate shows a 16% increase in contained copper equivalent metal and a 10% increase in ore grade, with 87.3 million tons at 0.93% CuEq in measured and indicated mineral resources, with additional resources outside of the open pit.

-

The Thierry Project includes two historic ore bodies, one of which was mined underground for six years, producing 5.8 million tons of copper and nickel. Infrastructure is already in place, with all-season road access. An airport is just 5 km away, power is only 8 km away, and nearby rail facilities allow for transportation.

With these projects, XXIX Metal is well positioned and is one of the largest copper developers in Eastern Canada (see graphic). With the expected copper prices, this stock can become a strategically valuable asset in the portfolio.

Apple: New flagship store in Miami and surprising watch anniversary

On January 24, 2025, the technology company Apple opened its tenth store in Miami. The Company is setting new standards in retail with this store, which was built according to strict sustainability criteria and will be powered by 100% renewable energy.

The store opening also coincides with the tenth anniversary of the Apple Watch. The fitness gadget on millions of wrists of loyal Apple users has revealed entirely new insights to the Vice President of Fitness. For example, active athletes use the watch more in their everyday lives, while less athletic users feel more motivated to get active through the software and interactions.

Apple is planning more innovations in the health sector this year. The future Apple Watch models will be equipped with blood pressure measurement. Behind the scenes, health tech engineers are working on a non-invasive blood sugar measurement. If they succeed in this endeavour, it would be a breakthrough in the diabetes testing device market, where all devices currently still require a skin prick. The global market for type 2 diabetes is estimated to reach USD 40.09 billion in 2025, with an annual growth rate of 7.47%, reaching up to USD 76.39 billion, according to forecasts

Apple's FY 25 First Quarter Results will be released on January 30, 2025. Investors can access the webcast here.

D-Wave Quantum shares rise 13.7% in pre-market trading

Thanks to the Stargate project, which is providing massive funding for artificial intelligence in the US, demand for computing power for AI is rapidly increasing, leading to higher energy requirements. For the inventors at D-Wave, this could be an enormous opportunity, because their quantum computers significantly reduce the energy consumption of AI computing farms. Trump's proclaimed energy emergency could improve the infrastructure for these data centers by promoting fossil fuels and accelerating energy projects, which in turn could increase the innovative strength and efficiency of companies like D-Wave and their customers.

D-Wave could score points with two solutions:

-

Through its Leap Quantum Cloud Service, the Palo Alto-based company offers access to its quantum computers, enabling developers and researchers around the world, including in Germany and Europe, to access quantum computing resources. This technology is used in various fields such as logistics, financial planning, and even drug research. This is also in line with the strategic direction of Apple, Microsoft, and Nvidia to focus more on healthcare.

-

Additionally, D-Wave has announced a roadmap for the expansion of its Leap Quantum Cloud Service, which focuses on the integration of quantum computing into AI and machine learning environments. This includes optimising processes, improving model accuracy, and testing new business applications that combine AI and business optimization.

These are exciting times for investors in a high-tech future. Pre-market, D-Wave's share jumped by 13.7%.

XXIX Metal Corp. has a bright future ahead of it. The growing demand for copper from the USD 500 billion AI infrastructure project in the US is causing prices to rise dramatically. With its Canadian projects, Opemiska and Thierry, the Company is well-positioned to benefit from the expected price increases. The existing infrastructure and high quality of the projects' soil resources provide a solid base. Apple is opening its tenth store in Miami on January 24, 2025, which sets new standards in retail: The store will be powered by 100% renewable energy and was built under strict sustainability criteria. Apple plans to introduce further innovations in the health sector this year, including blood pressure measurement and non-invasive blood sugar measurement, which could position the Company in the billion-dollar market of type 2 diabetes therapies and applications. D-Wave can also expect profits from the demand for computing power for AI. With their energy-efficient solutions, they are ideally positioned for the further tech boom. The stock jumped 13.7% in pre-market trading.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.