December 13th, 2023 | 07:45 CET

Uranium, lithium or gold? The climate conference tells us which way to go! BYD, Globex Mining, VW and Mercedes!

At the international climate conference in Dubai, several Arab countries sharply criticized and ultimately rejected the global move away from fossil fuels. The move by Western countries is an "aggressive attack", said Kuwaiti Oil Minister Saad Hamad Nasser al-Barrak yesterday, Tuesday. "I am astonished by this extraordinary insistence on depriving people and many countries of their basic source of energy. This approach is racist and colonialist," al-Barrak continued. This means that there will be no decision on a global phase-out of oil and gas with the OPEC states. Therefore, the current World Climate Conference is likely to be inconclusive or conclude with unilateral declarations from the EU. However, there is much to suggest that commodities that positively impact the global climate will remain on the import list of industrialized countries. Which shares should be considered in this mixed situation?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , GLOBEX MINING ENTPRS INC. | CA3799005093 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , MERCEDES-BENZ GROUP AG | DE0007100000

Table of contents:

"[...] In 2020, the die is finally cast in the automotive industry towards electromobility. [...]" Dirk Harbecke, Executive Chairman, Rock Tech Lithium Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - Here comes the ultimate low-cost e-car

The Chinese car manufacturer BYD ("Build Your Dreams") has long since embraced the climate turnaround in its product portfolio. With the largest stand at Munich's IAA Mobility trade fair, five electrically powered import models have already been presented to a wide audience. BYD spared no expense or effort and booked the largest exhibition space.

The Company delivered strong results in the third quarter, but the share price is still consolidating at EUR 24.50. According to a rumor, the new BYD Yuan UP electric car is now to be launched on the market at absurd prices. It is said to cost less than half the price of a new VW Golf or less than a third of a Volvo XC30. The compact Yuan UP will be offered with two electric drive systems that differ only in terms of power output. There will be a very affordable 70 kW version and a significantly more powerful 130 kW option; details on the battery, range, and specific prices have yet to be released by the Company headquarters.

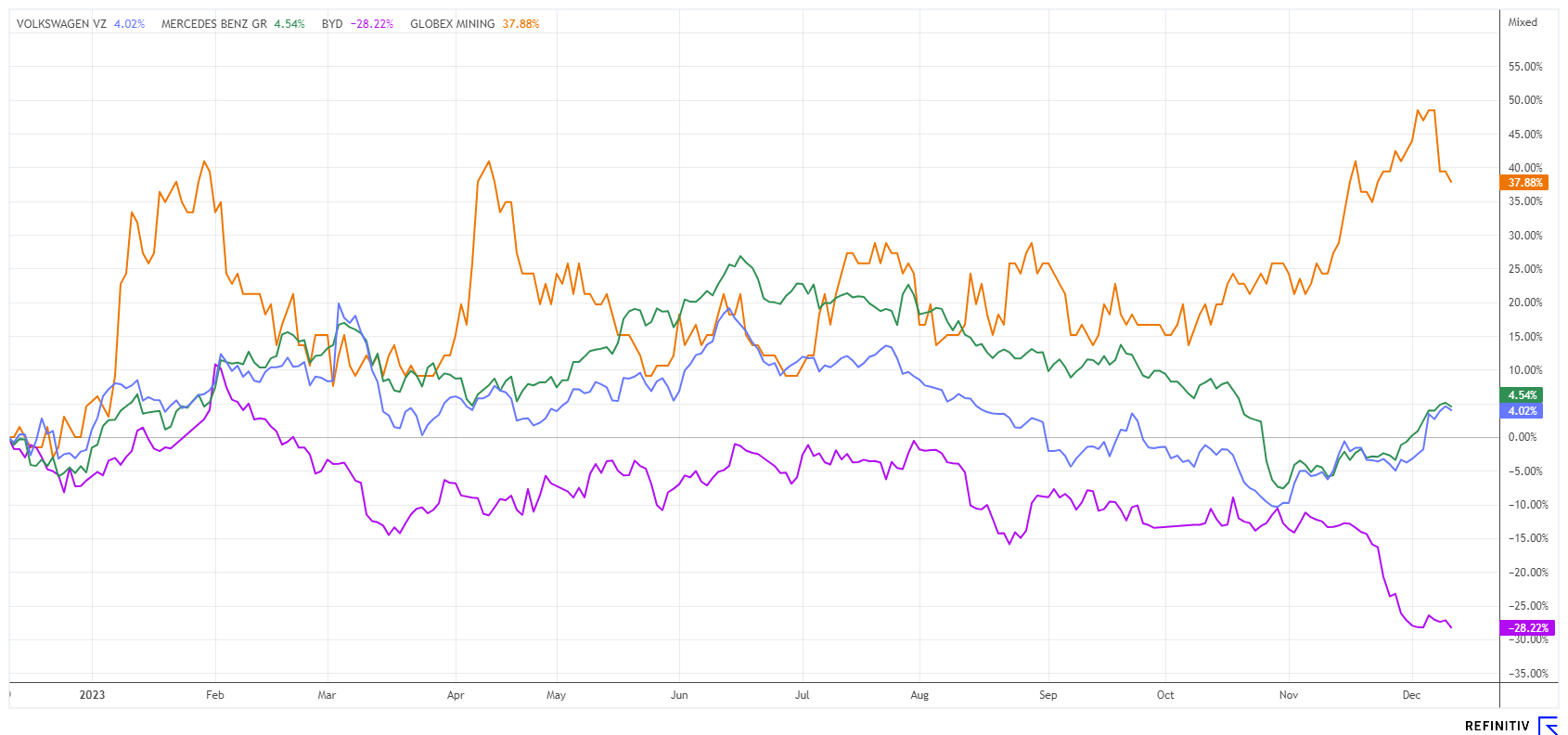

In China, the price for the similar Yuan Pro model starts at around EUR 12,400. The new UP is likely to undercut this again. For comparison, the price for a VW Golf model series 8 in the basic version is already EUR 29,275, and with reasonable features, it can be expected to cost EUR 35,000. **However, the sharp drop in the entry price of BYD shares, which are attractive in the long term, is also worth noting. It already reached EUR 42 last summer in 2022. The stock is currently trading at a 2025 P/E ratio of 14.5 - the Chinese growth wonder has rarely been more affordable!

Globex Mining - Perfectly positioned for the 2024 commodity rally

Canada is a rich resource country that supplies the North American continent with all the necessary raw materials for industrial applications. The broad-based explorer Globex Mining, which can reflect on more than 40 years of mining experience, including its predecessor companies, comes from Quebec. Company founder and CEO Jack Stoch has long been a legend in the industry with his discoveries. He has been searching for interesting precious and industrial metal properties for decades. His approach is both opportunistic and rational, and he usually leaves the processing of his discoveries to partner companies, which he gives a share in future success via option rights.

Globex Mining's business model is based on the out-licensing of mining rights and the collection of smelting fees in the event of a mine opening. Successful explorers can, of course, buy back these rights at a predetermined price, which then brings Globex a handsome sum back into its account. Thanks to over 230 properties and corresponding shareholdings, the immediately realizable assets have risen to over CAD 20 million in recent quarters. This is a fact that thousands of other explorers are looking at with a teary eye, as rising capital costs are currently making it difficult to finance smaller projects in particular.

Recently, there was an update on the initial drilling results conducted by Brunswick Exploration Inc. on the Globex Lac Escale lithium license property in the Eeyou Istchee-James Bay region in Quebec. Brunswick has drilled 36 holes for a total of 5,090 metres. 33 of the 36 holes intersected mineralized pegmatites over a strike length of 1.5 km. Intersections include bonanza grades and significant widths, such as 2.57% Li2O over 25.8 meters in hole MR-23-02, including 3.08% Li2O over 14.2 meters at a vertical depth of 28 meters in the North Zone. That sounds very promising.

GMX shares have gained a full 20% to CAD 0.98 since the beginning of November and are now consolidating again somewhat. Taking the Canadian dollar into account, German investors achieved a return of 27.6% over the last 12 months. Globex Mining is thus one of the most successful explorer stocks of 2023. The rally in the liquid share is likely to continue unabated in the coming commodity boom in 2024.

VW and Mercedes - Germany is no longer the favored location

German automotive icons Volkswagen and Mercedes-Benz have taken note of the significant deterioration of the German location and are voting with their feet. Forced by the worst location factors of recent decades, the industrial giants are now making a U-turn in their investment policy. Volkswagen, for example, has already moved the new gigafactory for EU production to Valencia. A total of EUR 10 billion will be invested there by 2026, creating over 3,000 jobs.

And the next foreign investment will start in Canada in 2024. The newly planned giga-cell factory site is in St. Thomas, Ontario, and construction will begin soon. The Giga cell factory in Canada is Wolfsburg's first overseas investment in cell production and will supply electric cars from Group brands in North America with the new unit cells. This new technology is aimed at cost-efficient mass production. With a planned annual production capacity of up to 90 GWh in the final expansion stage, the factory will be the largest investment to date by battery subsidiary PowerCo in North America. The site is powered by CO₂-free energy and meets high ESG standards.

Mercedes is also stepping up its commitment in North America. The Stuttgart-based premium manufacturer is planning to expand production in the US due to the generous subsidies from the US government. Specifically, the SUV plant in the state of Alabama is to be expanded, and from 2026 the Company even wants to produce the electric version of the best-selling GLC SUV in the US. Last year, the Group shipped 66,000 vehicles to the United States; with local production, the Company is significantly more competitive and benefits from the Joe Biden Administration's Inflation Reduction Act (IRA). In a direct comparison of the two stocks, VW shines with a 2024 P/E ratio of 3.9 and a payout of 7.7% compared to a P/E ratio of 5.3 and an equally respectable dividend of 7.9% from Stuttgart. A great deal of negative news has pushed automotive shares to multi-year lows, but at EUR 114 and EUR 62, respectively, a good level for entry should now be found.

The automotive industry is a highly capital-intensive business sector. Long-term model consequences require a stable economic environment in order to be able to make investment decisions over the next 10 to 15 years. Germany has lost its historical political reliability and is focusing on other goals. As a result, important investment capital is moving abroad. For shareholders, this decision at least offers the hope of rising profits and lower tax burdens. BYD shares continue to consolidate, while VW and Mercedes are attempting a turnaround. Globex Mining, as a Canadian company, is already in an excellent position and continues to strive upward.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.