October 13th, 2025 | 07:15 CEST

Trump tariffs 3.0 for China and the Bitcoin crash: Major movements at Strategy, Metaplanet, Coinbase, Nakiki, and D-Wave

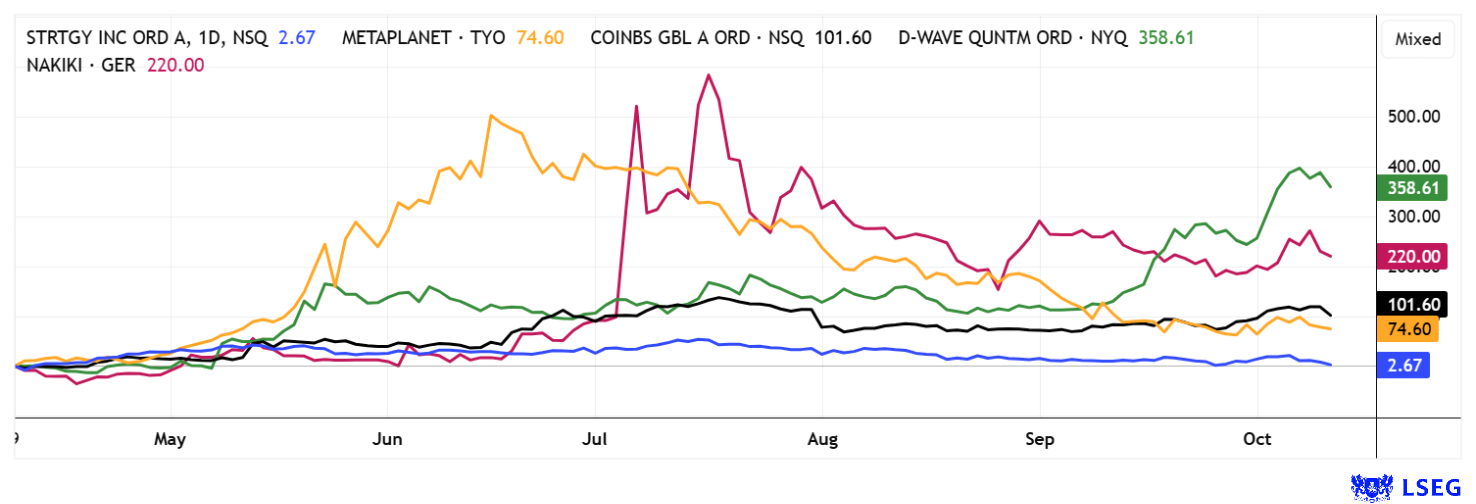

With Donald Trump's announcement of a new 100% tariff measure against China on Friday afternoon, previously strong performers in the crypto sector came under significant pressure. The protagonists, Strategy, Coinbase, and Metaplanet, were hit with daily losses of between 3 and 10%. D-Wave, which had gained over 50% in the last 6 weeks, is also starting to feel the squeeze. Nakiki shares, on the other hand, reacted with price gains. The German Bitcoin stock can be pleased that its coin purchase program doesn't start until November - this could offer attractive buying opportunities, with the timing looking ideal. However, it remains to be seen whether this move will trigger a broader correction accompanied by rising volatility. Meanwhile, precious metals have recently been moving in only one direction: up! Could the rally now make an abrupt return?

time to read: 3 minutes

|

Author:

André Will-Laudien

ISIN:

MICROSTRATEG.A NEW DL-001 | US5949724083 , METAPLANET INC | JP3481200008 , Coinbase | US19260Q1076 , NAKIKI SE | DE000WNDL300 , D-WAVE QUANTUM INC | US26740W1099

Table of contents:

"[...] Most of all we were on a mission to MAKE CRYPTOCURRENCY ACCESSIBLE [...]" Justin Hartzman, CEO, CoinSmart Financial Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Strategy, Metaplanet, and Coinbase – This could be a hefty correction

Michael Saylor believes that Bitcoin is a solution to inflation and a digital asset that runs independently of government decisions and market volatility. On Friday, however, things looked a little different when Bitcoin slumped by 15% and some altcoins even fell by up to 50% at times. Volatility in this sector remains extreme, even though Bitcoin's 3-year returns have recently outperformed every other asset class. Bitcoin holding company Strategy has temporarily paused its Bitcoin purchases, with no new Bitcoins acquired between September 28 and October 5. The Company is currently running a program to raise fresh capital through the sale of USD 4.2 billion in preferred shares. Strategy's stock fell as much as 11% on Friday but recovered significantly by the end of trading.

Crypto exchange Coinbase corrected by USD 45, or 13%, from its previous interim high of USD 402 on Friday. Even after this sell-off, the 2025 P/E ratio remains just under 46. Analysts on the LSEG platform forecast earnings growth of 30-50% over the next 5 years. Even if these projections materialize, a market capitalization of nearly USD 95 billion against expected 2025 revenues of USD 7.3 billion implies a multiple of 12 – remarkable! The reaction from Japanese Bitcoin collector Metaplanet was comparatively mild. After reaching a weekly high of EUR 3.78 on Tuesday, the stock corrected by about 20% to EUR 3.07. It will be interesting to see how trading unfolds today, Monday.

Nakiki SE – The timing for BTC purchases seems perfect

Nakiki shares have performed strongly over the past week. Trading volumes rose sharply, reaching over 100,000 traded shares at times, with premiums of around 10% and a peak of EUR 0.83. No new company data was released. CEO Andreas Wegerich is now focusing on his roadshow, which starts today and aims to inform German small- and mid-cap investors about the Company's new Bitcoin strategy. He will be joined by Marc Guilliard, a recognized Bitcoin expert and initiator of the world's first Bitcoin hotel near Stuttgart, which he has fully geared toward digitalization and Bitcoin payments. Interested parties are likely to listen with curiosity to learn how the comparatively small Nakiki SE, with a market capitalization of just under EUR 4 million, plans to follow in the footsteps of Strategy or Metaplanet. The big advantage for Nakiki lies in the timing. While industry leaders are currently suffering from the decline in cryptocurrency values, CEO Andreas Wegerich will be able to move to the buying side in a few weeks with fresh capital and make purchases at significantly lower prices than at the beginning of October, when Bitcoin reached its all-time high of USD 125,965. In early morning trading, Bitcoin reached around USD 111,500, after briefly touching USD 107,000 on Friday evening. Very exciting!

D-Wave – The hype knows no end

The development of quantum computing specialist D-Wave Quantum is simply incredible. The hype is driven by the fact that fully leveraging AI today requires seemingly infinite computing power – and D-Wave aims to provide it. Incidentally, the Company is not yet generating any revenue or profits; that is expected only from 2030 onward. Until then, the fantasy is that all AI users will sooner or later have to buy from D-Wave in order to stay competitive in the race for speed. Despite constant recommendations in all the financial media, investors should be aware that D-Wave is already valued at nearly USD 12 billion and that the stock has risen by almost 3,300% since October 2024. Rheinmetall's rise of over 2,000% seems insignificant by comparison! It would come as no surprise if the hype were to be dampened by bad news one day, prompting everyone to sell at once. One can only imagine how much downside would then exist! Nevertheless, short-sellers can only lick their wounds at the moment, as the stock is trading near its all-time high!

Another tariff announcement for a hype market that is already stretched to the limit. Investment specialists are calling the current phenomenon the "Everything Bubble", meaning that anything that is not nailed down is being bought. As a result, by mid-last week, new record highs were reached in the DAX, NASDAQ, defense and military stocks, strategic metals, as well as gold and silver! Investors should adjust their stops and remain alert!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.