April 11th, 2025 | 07:15 CEST

Trump rally boosts Vidac Pharma: Further milestones in cancer research achieved!

Humanity continues to fight relentlessly against cancer. As one of the most common causes of death, researchers have been trying to unravel the secrets of this terrible disease for more than 175 years. Meanwhile, early detection and forms of therapy have come a long way, and many patients diagnosed with cancer often go on to live for many years after their diagnosis. However, it is still too early for triumph; progress is incremental and costs time and money. The dream of biotech investors is to find the needle in the haystack. Which publicly listed company will achieve the long-awaited breakthrough? Vidac Pharma has so far achieved recognized milestones and continues its research in a targeted manner. According to a recent study on the Company, investors could see a tenfold increase over the next few years. This is reason enough for us to take a closer look!

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

VIDAC PHARMA HOLDING PLC | GB00BM9XQ619

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Cancer research continues to advance

In 2024, significant advances have been made in cancer research and medicine that improve both the diagnosis and treatment of cancer. A total of twelve new cancer drugs have been approved, including six kinase inhibitors that specifically block certain signaling pathways in cancer cells. Companies like BioNTech have developed mRNA-based cancer therapies that stimulate the immune system to specifically target tumor cells. The first trials with vaccines are also expected to take place in the near future. These therapies are showing promising results, particularly for cancers that are difficult to treat. New blood tests enable the early detection of tumors by analyzing specific biomarkers in the blood. These tests could revolutionize cancer diagnostics and increase patients' chances of survival.

The combination of immunotherapy and genetic engineering, particularly CAR T-cell therapy, has also shown promise. In this approach, the body's immune cells are genetically modified to recognize and destroy tumor cells more effectively. Predictive models using AI enable more precise predictions about the course of the disease and the effectiveness of therapies, leading to individually tailored treatment strategies. Advances in early detection and treatment have increased survival rates for many types of cancer. In Germany, more than 50% of cancer patients now survive at least ten years after diagnosis. These developments show that cancer research has made significant progress. There is hope for improved patient diagnosis and treatment options, although the big breakthrough is still pending.

Vidac Pharma – Now entering Phase 2 and 3 with momentum

The biotech company Vidac Pharma was founded in 2012 and is led by Prof. Max Herzberg, one of the founding fathers of the Israeli life sciences industry. Vidac Pharma is developing drugs aimed at helping cancer patients by reversing the abnormal metabolism of cancer cells, thereby stopping their proliferation. Despite its modest size, the Company is already in the clinical development phase.

Currently, there is reason to celebrate. Vidac has received the final report from the Beilinson Hospital Helsinki Committee on its groundbreaking clinical trial for cutaneous T-cell lymphoma (CTCL). The report, submitted to the Israeli Ministry of Health, indicates promising results that will enable the Company to proceed with a pivotal Phase 2-3 study. If successful, this would be a major step towards product registration. This clinical trial was conducted under the direction of Prof. Emilia Hodak, one of the key opinion leaders in the field.

CTCL, a rare and debilitating lymphoma, affects patients for years with symptoms including severe skin inflammation and lesions caused by cancerous T-cells circulating in the blood and lymphatic system. There is currently no universally accepted standard of care for CTCL. Vidac's VDA-1102, an innovative topical ointment, blocks the hyperglycolysis characteristic of cancer cells while providing effective and targeted treatment. The Company recently completed an open-label Phase 2a study to evaluate the safety and efficacy of VDA-1102 ointment in adult patients with stage 1 relapsed mycosis fungoides (MF), the most common form of CTCL. 56% of the patients achieved a clinical response, and a complete response was achieved in 22% by week 8. A partial response was achieved in 34% of the subjects after 8 to 12 weeks, and all study participants remained progression-free during the 4-month study. VDA-1102 showed rapid efficacy and appears to work much more quickly than existing treatments.

Therapies for pediatric brain research with TME++

Vidac Pharma has announced the formation of TME++, a groundbreaking research consortium dedicated to developing treatments for pediatric brain tumors. The initiative was launched during the first Pediatric Brain Tumor Meeting in Jerusalem on March 9, which brought together leading international scientists and specialized clinicians to discuss new therapeutic strategies. The TME++ consortium was formed following the recent findings of Vidac Pharma's novel product, ALMAVID™, a Tumor Microenvironment (TME) modifier that also reactivates apoptosis (programmed cell death). A working group studying the use of small molecules in the treatment of brain tumors decided to explore ALMAVID™ in combination with conventional chemotherapy and immunotherapy.

CEO Dr. Max Herzberg presented significant progress on a new formulation of VDA-1102 designed for subcutaneous administration to enhance systemic delivery and achieve therapeutic concentrations across the blood-brain barrier. This breakthrough was demonstrated in a study for a five-year-old child with recurrent ependymoma, a rare and aggressive brain cancer.

"Any progress in treating children with brain tumors is critical in this often-overlooked area," said Dr. Herzberg, who will lead the consortium. "Working with three university-based research groups and two leading hospitals brings new perspectives and accelerates innovation. Our new formulation is not only promising for pediatric brain tumors but could also pave the way for the treatment of other solid tumors. Combined with our ongoing and upcoming clinical studies in the field of oncodermatology, this is a crucial step for Vidac Pharma." Here, there are tangible signs of progress.

Analysts give thumbs up

In June last year, analyst Peter Thilo Hasler of Sphene Capital took a closer look at Vidac Pharma. His target price of EUR 4.90 is based on the assumption that Vidac Pharma will receive approval for its current core product VDA-1102-AK. The expert calculates the share value primarily from a three-stage discounted cash flow (DCF) entity model. In addition, a Monte Carlo analysis was conducted to simulate alternative revenue, earnings, and other KPI scenarios, resulting in equity values ranging between EUR 4.04 and 5.40 per share. Based on capital and earnings estimates for the years 2028 to 2033, an economic profit model even yields equity values of up to EUR 6.50 per share. The "Buy" rating assignment was conclusive based on the valuation methods used.

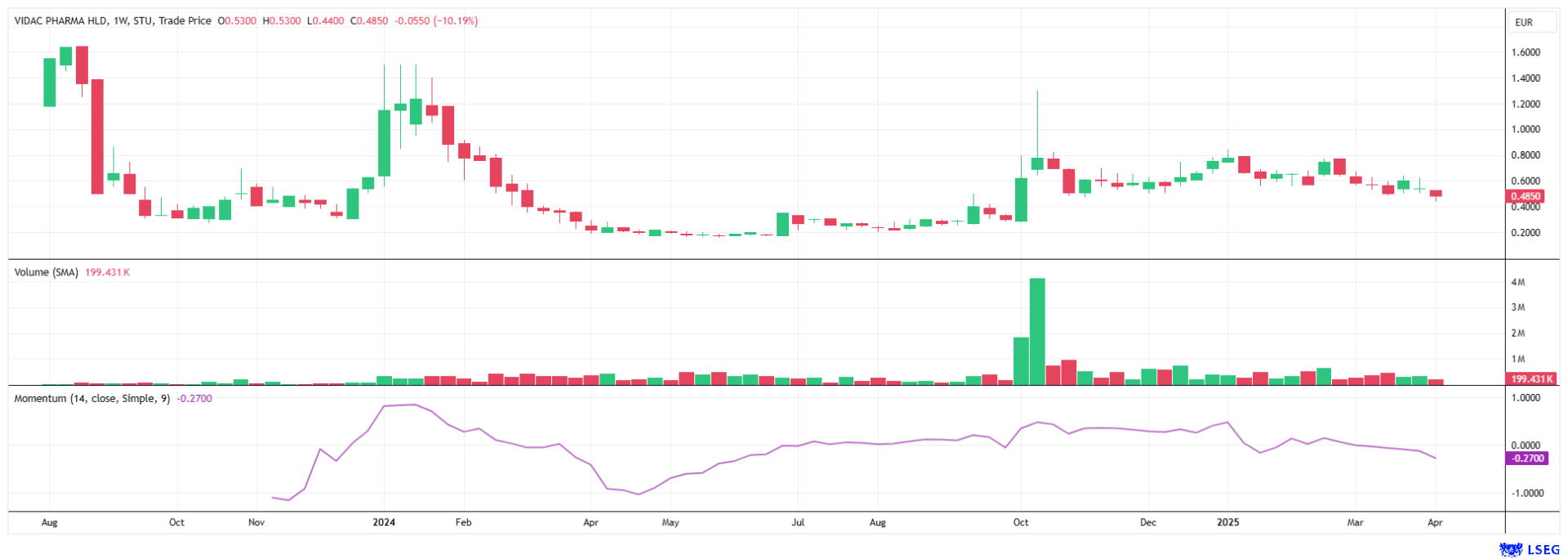

The year 2025 has been very volatile so far, hindering a steady development of share prices. Due to the ad hoc economic policy program of the US administration under Donald Trump, market volatility continues to rise. All the measures announced so far will increase inflation and interest rates. In this environment, Vidac Pharma is holding its ground and continues to attract investor interest. Positive news is the order of the day, so it is only a matter of time before the valuation premiums reach the target price of EUR 4.90, as calculated by analyst Peter Thilo Hasler. Buy!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.