July 23rd, 2025 | 07:05 CEST

The hot phase for nuclear energy is beginning! Oklo, First Hydrogen, Nel, Siemens Energy, and Plug Power

For a long time, nuclear power was considered a thing of the past; however, a significant shift in energy policy is now underway worldwide. The US is at the forefront of this movement. Under Donald Trump, a comprehensive action plan to rebuild the nuclear industry was recently adopted. The goal is nothing less than to quadruple the country's nuclear power capacity, in particular through the massive expansion of small modular reactors (SMRs), which are compact, decentralized mini nuclear power plants. They are considered efficient, safe, and scalable. The message is clear: the United States wants to regain its position as the dominant nuclear power, both in terms of energy policy and technology. Which companies are in the spotlight?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

First Hydrogen Corp. | CA32057N1042 , NEL ASA NK-_20 | NO0010081235 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , PLUG POWER INC. DL-_01 | US72919P2020 , OKLO INC | US02156V1098

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Oklo Inc. – The time has come to reap the rewards

Since we first looked at SMR specialist Oklo, there have been two waves of movement in the share price. The USD 20 mark has always been a notable support level. Similarly, there appears to be a ceiling at USD 70. The Company is still being showered with fantasies about the latest US nuclear plans. Investors are completely ignoring the time factor. Even with SMR reactors, it takes at least 5 to 8 years from planning to implementation before a new complex goes online. In the US, NuScale Power was originally a pioneer with its 77MW SMR concept. However, construction of a model at the Idaho National Laboratory was halted at the end of 2023 due to high costs and low demand.

Last week, Oklo announced the successful completion of Phase 1 of its preliminary application review by the US Nuclear Regulatory Commission (NRC) for its first power plant project. At the same time, on July 16, the US Department of Energy also announced a pilot program to accelerate the development of advanced reactors and strengthen the domestic nuclear fuel supply. Siemens Energy does not build its own SMRs, but plays a central role in their implementation as the global market leader for turbines and so-called "power island" components. In a strategic partnership with Rolls-Royce SMR, Siemens Energy will supply steam turbines, generators, and auxiliary systems for the British 470 MW Generation III+ SMR model. This technology will initially be implemented in the UK, with possible later deployment in Sweden and the Czech Republic. This also puts Siemens Energy in the spotlight of the growing nuclear energy movement.

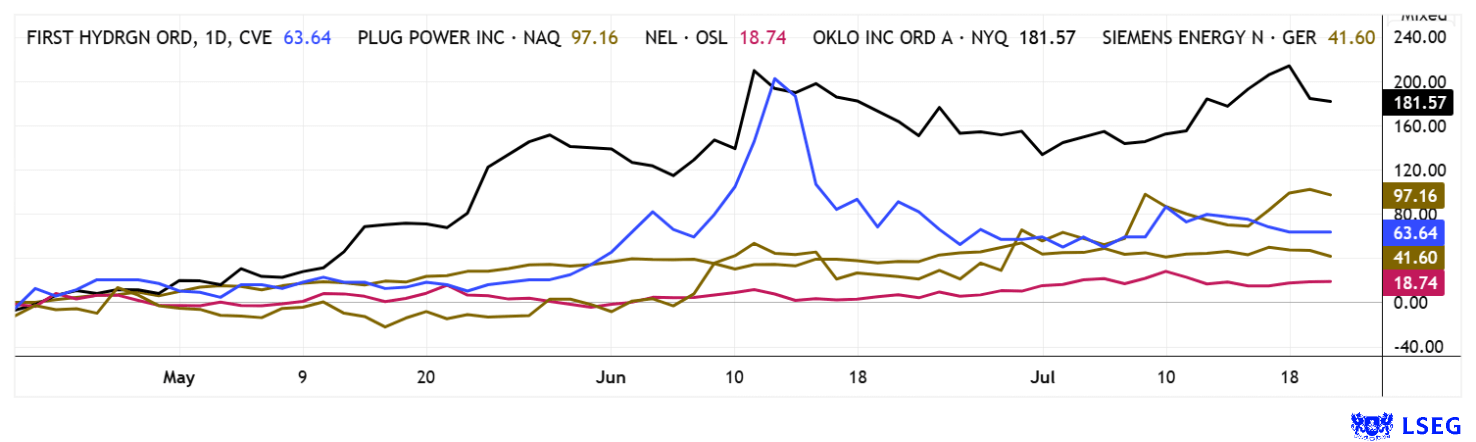

Like Siemens Energy, Oklo shares are in extremely high demand, with both companies already posting triple-digit gains in 2025. Looking at the LSEG platform, Oklo has a 12-month average price target of USD 65.50, while Siemens Energy is expected to reach EUR 82.40. Following their strong rally, both stocks currently appear to be well-valued.

First Hydrogen – The new strategy hits the mark

Canadian technology company First Hydrogen (FHYD) is presenting an innovative energy concept. With the establishment of its subsidiary "First Nuclear Corp." in March, the Company intends to leverage its entry into nuclear energy to implement its "Hydrogen-as-a-Service" strategy. The aim is to install small modular reactors (SMRs) in areas where access to the power grid is limited, such as remote regions of Canada or for industries operating in remote locations. These reactors will generate low-emission hydrogen on site, which will be stored and supplied to filling stations and industrial applications. A technical transformation with charm that also fits well into modern ESG concepts!

The hydrogen produced in this process falls into the "pink" or "yellow" category because it is produced using nuclear energy. The EU wants to make a decision on the classification of the new types of hydrogen by 2028. Studies show that hydrogen from nuclear power is climate-neutral in operation, but the overall environmental balance, for example in the construction and disposal of reactors, is still under discussion. Sweden, meanwhile, has taken concrete steps: on May 21, the country passed a law to finance new nuclear power plants, including SMRs. Countries such as Poland and the Czech Republic are flirting with international partners for SMR projects to decarbonize their energy systems in the future. Ukraine also sees SMRs as a prospect for rebuilding its destroyed energy infrastructure.

For a country with a large land area such as Canada, the combination of decentralized power supply and hydrogen production makes particular sense. First Hydrogen already has active business connections in Europe, which will help with strategic implementation. After a price explosion to CAD 1.32 in June, consolidation has now set in, pushing First Hydrogen's share price down to CAD 0.72. However, given the long-term trends in energy, climate, and infrastructure, FHYD could become an exciting sustainable investment. Take advantage of the low prices to get in now!

Nel ASA and Plug Power – Environmental goals give way to geopolitical strategy

US President Trump's decision to withdraw from the Paris Climate Agreement and stay away from future climate summits is considered groundbreaking. At the same time, however, the US is the largest emitter of greenhouse gases on the planet, ahead of China. This is a real slap in the face for countries that are pushing ahead with climate protection out of solidarity and concern for future generations. It is no wonder that the two best-known hydrogen stocks, Nel ASA and Plug Power, are struggling to regain their footing. Over a three-year period, the stocks have lost between 80 and 90%, although they have not recently returned to the lows seen during the April sell-off.

Nel ASA reported its Q2 figures last week: Revenue down 48% to NOK 174 million, EBITDA negative at NOK 86 million. The only positive factor remains the high cash position of NOK 1.93 billion. The Norwegians are increasingly focusing on the PEM segment and see positive momentum thanks to several feasibility studies with industrial customers and a more favorable political environment for investment in the EU. Plug Power is suffering from an extremely high cash burn rate and a massive operating loss of over USD 2 billion in 2024. Revenue has fallen sharply and the gross margin is deep in negative territory. The Company financed itself through several capital increases and loans, which significantly diluted its valuation. However, sentiment could soon reverse if political pressure eases, subsidy programs remain in place, and "Project Quantum Leap" delivers the targeted savings of USD 150 to 200 million per year.**

Investors appear to be betting on this, as PLUG shares have tripled in value since June to over USD 1.80. With an enormous increase in the number of shares, market capitalization has once again reached the USD 2 billion mark. There are currently no analysts with a positive outlook for Nel ASA; however, some experts see a light at the end of the tunnel for Plug Power. The 12-month price forecast is USD 1.95, around 10% above yesterday's price. Is this the first sign of a spring awakening?

**Energy stocks are back in demand on the stock market. This is due to the strategic role that electricity supply now plays. Whether in private or public households, electricity demand is rising. High-tech companies around the world are competing for computing and electricity capacities, as they seek to actively utilise new technologies such as artificial intelligence. Things are getting exciting in the SMR nuclear sector, where Oklo and First Hydrogen are performing strongly.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.