November 14th, 2024 | 07:15 CET

The acquisition carousel is gaining momentum! Evotec, Vidac Pharma, BioNTech, and Formycon in focus

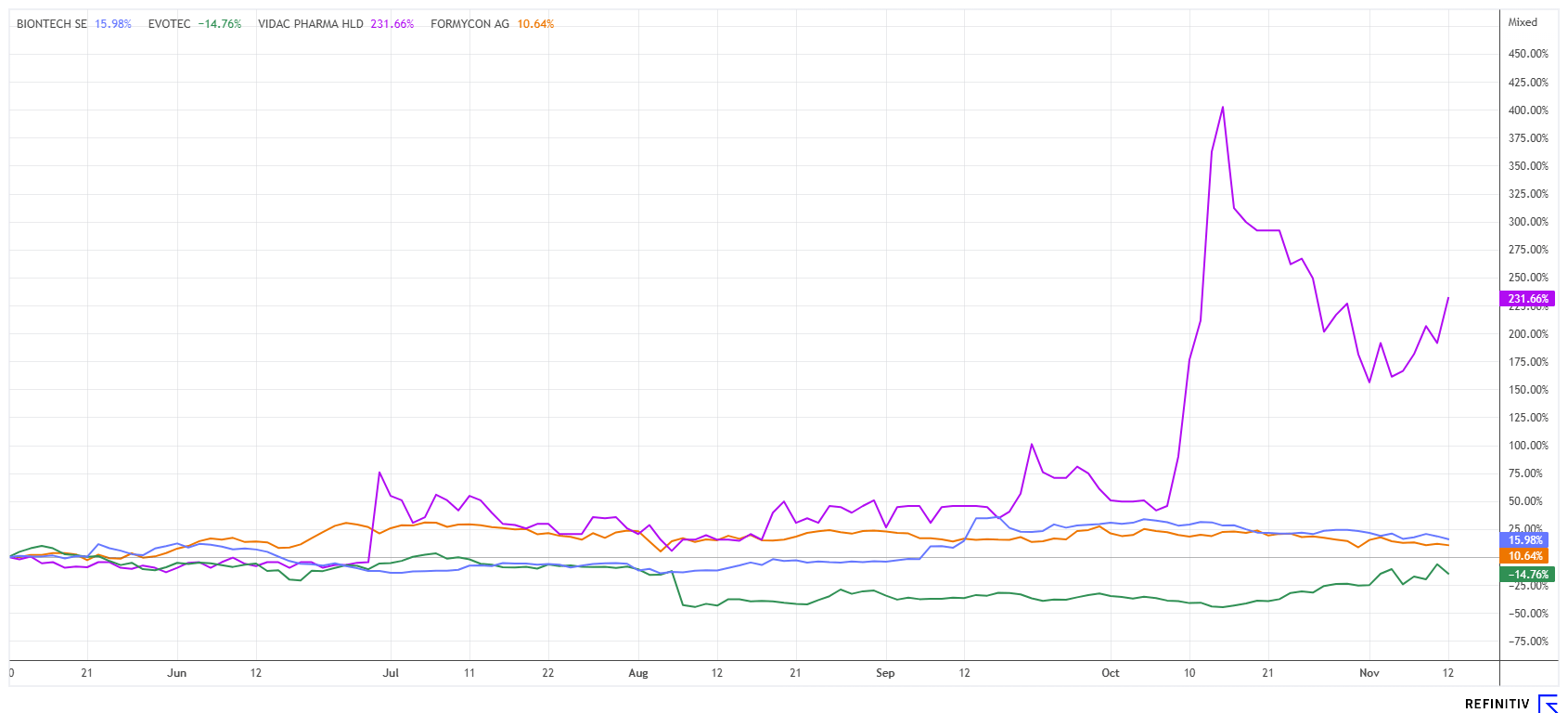

The biotech sector is in the spotlight again today. Triton's entry into Evotec means that another deal is in the works, and investors should now take notice. Many still remember MorphoSys, where there were short-term gains of up to 400% at the beginning of the year. Before that, the stock had been trading with high volumes. Will Formycon or Vidac Pharma be next on the list? Formycon is now getting significantly more attention because the stock switched to the Prime Standard. Evotec has once again disappointed operationally, yet the value has increased by a good 50% in just two months. Those who analyze carefully can profit again. A sharp analytical eye is worthwhile.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , FORMYCON AG | DE000A1EWVY8

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec - Now it's out

There was great euphoria, but disappointments also lurk behind Evotec's fabulous share price rise. Although Triton acquired a substantial stake, how things will proceed is still unclear. Thus, prices above EUR 9 were an opportunity to take profits. Just three months ago, the shares of the Hamburg-based drug manufacturer were still trading at EUR 5.30. Evotec still has some cleanup work to do. A cyber attack and high costs for the expansion of production facilities have weighed on the Company. In addition, the unexpected departure of long-time CEO Dr. Lanthaler caused great unrest. Ultimately, the Company is still threatened by SEC investigations regarding irregular insider trading. In the last quarter, Evotec recorded a decline in revenue to around EUR 185 million. However, with the new management team headed by Dr. Christian Wojczewski, the Company could now be on the verge of a new upswing. Prices around EUR 8.50 may appeal to investors with staying power looking to add to their holdings, but speculators may wait for lower entry opportunities after the initial surge.

BioNTech – The market is waiting for operational successes

Investors had eagerly awaited BioNTech's Q3 figures, but they were not as exhilarating as expected. The share price did not show any significant movement, and the value is still trading around EUR 100. In the past quarter, the Mainz-based company benefited from the fact that new COVID-19 vaccines were approved here and in the US earlier than last year. Sales increased by 39% year-on-year to EUR 1.2 billion, which was well above consensus estimates; the bottom line was even better at EUR 198 million. The markets had been bracing themselves for losses. However, the cautious outlook was disappointing. After accumulated losses of over EUR 900 million, there will be a minus for the full year, with revenues expected to be in the range of EUR 2.5 to 3.1 billion. The cash position of around EUR 17.8 billion remains impressive. However, with a market capitalization of EUR 24.6 billion, it is already well-priced.

Vidac Pharma – Capital injection boosts momentum

Vidac Pharma is one of the biotech shooting stars on the German stock market, with its share price having risen by over 230% in the last six months. The Company is now receiving a reinvestment of EUR 600,000 from shareholders to advance the clinical trials of its cancer drug candidates. Vidac will use the funds to conduct a series of clinical trials, including a second Phase 2b clinical trial of VDA-1102 in advanced actinic keratosis (AK), an early form of skin cancer that can develop into cutaneous squamous cell carcinoma (CSCC). Vidac is initiating the regulatory preparations for this study and has also signed a contract with the research dock CRO. Prof. Dr. Thomas Dirschka, one of the world's leading experts on AK and head of the leading dermatological research institute, CentroDerm GmbH, will be the principal investigator.

"I am very pleased with this vote of confidence, which enables us to continue the development of our drugs in onco-dermatology and solid tumors," said CEO Max Herzberg after the shareholders' meeting. "We will continue the testing of our two therapeutic candidates, including the highly promising VDA-1275, in a timely manner."

The new Phase 2b study with VDA-1102 will be conducted in patients with advanced AK, as an earlier successful Phase 2b study in these high-risk patients revealed a higher sensitivity to the drug candidate. The study will focus on highly proliferative lesions that are most likely to progress to CSCC. Due to the specific mode of action of VDA-1102, healthy cells are unaffected, so side effects are minimal. Separately, VDA-1102 has been shown to be safe and effective in treating cutaneous T-cell lymphoma, for which Vidac has completed a Phase 2a proof-of-concept study, the results of which will be published soon. Vidac's latest therapeutic candidate, VDA-1275, is currently in advanced preclinical studies.

The share price rocketed above EUR 1 in October, prompting many investors to take profits. A new entry can now be made in the EUR 0.62 to 0.67 zone. Turnover is consistently impressively high, allowing for all types of positioning.

Formycon – Change to the Prime Standard

Without any significant effect on the share price, but with a great deal of public attention, Formycon AG changed to the Prime Standard of the German Stock Exchange. This means that the Munich-based company is subject to the highest transparency requirements and can thus attract new institutional investors. Stefan Glombitza's contract as CEO has been extended by three years. Glombitza is to lead the biosimilar company through the next development phase; so far, the Company has the first approved products, which now have to prove their worth in the pharmaceutical markets. At least Formycon has already completed a very long development phase. The market capitalization is just under EUR 850 million, with estimated revenues of EUR 61.50 million and EUR 90.8 million for the years 2024 and 2025. Analysts expect a positive EBIT for the first time in 2026 and a profit for investors at the bottom line. Those who have bought in over the last three years have experienced significant dilution and, so far, no performance. At EUR 47, a level may have been reached that will yield good returns over a two-year period.

Interest in biotech stocks has returned. Movements of 50 to 300% have been possible again this year. Of course, timing is always crucial in this sector. Vidac stands out with a good pipeline, while the market expects significantly more from BioNTech's cancer research. Evotec is likely to enter the next round of speculation. We will stay close to the action!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.