June 30th, 2025 | 07:35 CEST

Takeover fever! Biotech and artificial intelligence boost Evotec, NetraMark Holdings, Novo Nordisk, and Bayer

The biotech sector is currently undergoing an exciting transformation, as big data and artificial intelligence are rapidly changing the way new drugs are discovered, developed, and tested. The use of learning algorithms allows molecular target structures to be identified more quickly and potential active ingredients to be evaluated more efficiently. Start-ups and established players alike are increasingly turning to data-driven platforms to reduce research costs and increase the success rate of clinical trials. As a result, capital is increasingly flowing into companies that use modern data analysis to drive biotechnology. Approaches that enable personalized medicine - treatments precisely tailored to an individual's specific condition - are in particularly high demand. For investors, this represents a promising growth sector with enormous disruptive potential. But who are the most interesting players?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NETRAMARK HOLDINGS INC | CA64119M1059 , EVOTEC SE INH O.N. | DE0005664809 , NOVO NORDISK A/S | DK0062498333 , BAYER AG NA O.N. | DE000BAY0017

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec – Big data is a huge help in research

The Hamburg-based biotechnology company Evotec is venturing into a field that has been medically underserved until now: acute kidney injury (AKI). In collaboration with the international research network NURTuRE-AKI, Evotec is launching a large-scale project to investigate this potentially fatal complication, which occurs particularly after cardiac surgery. Around one-third of patients who undergo heart surgery are affected, with around two million cases worldwide each year for which there are currently few effective treatment options.

Using clinical data and biological samples from over 950 affected patients, Evotec aims to decipher the mechanisms behind the transition from acute to chronic kidney failure. These findings will be incorporated into the Company's proprietary molecular patient database, E.MPD. This data collection provides Evotec with a sensitive research tool that is expected to accelerate the identification of new therapeutic approaches and diagnostic markers. This opens up a potentially lucrative future market for the Company in nephrological drug discovery.

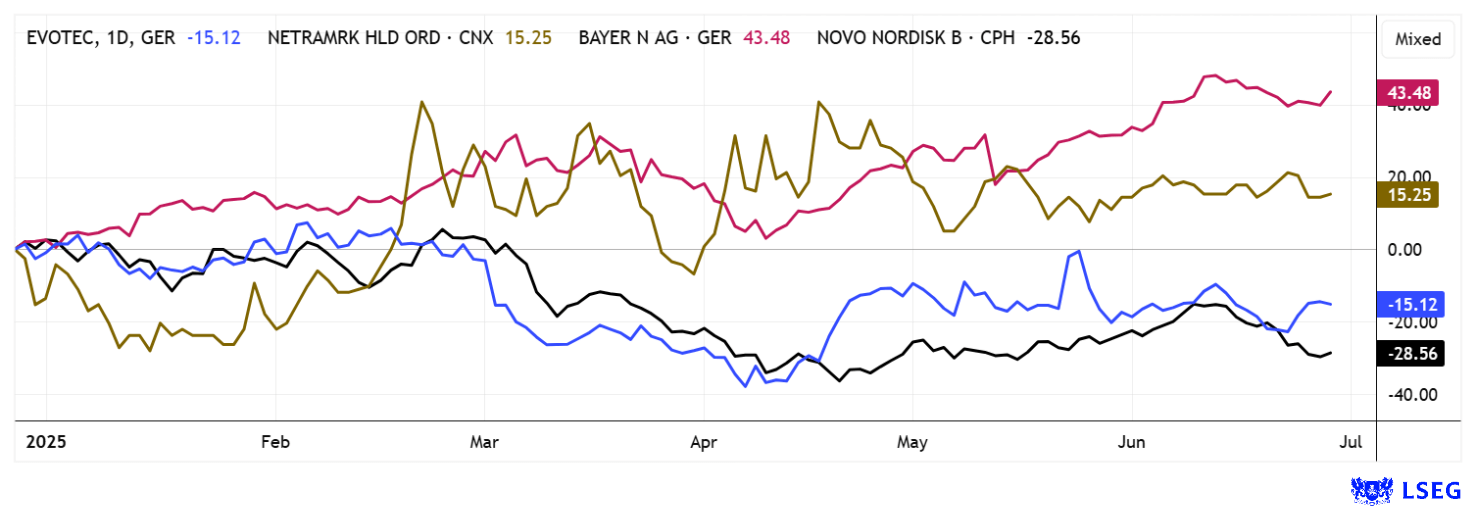

The share price benefited last week from an upgrade to "Buy" with a price target of EUR 11.70 by Warburg Research.This not only raises hopes among investors for a fundamental turnaround but also fuels speculation about potential takeover interest. If Evotec broadens and deepens its pipeline as announced, the Company may once again become the focus of strategic investors or pharmaceutical giants. The rumor mill is already close to boiling point again. Analysts on the LSEG platform expect prices of around EUR 10.45 over the next 12 months. If Big Pharma comes knocking, the potential could be well over 50%!**

NetraMark Holdings – A new era for drug trials has begun

Canadian technology company NetraMark is making even more of an impact in the field of artificial intelligence. A new study is currently causing a stir. Research indicates that the Company's proprietary AI platform, NetraAI 2.0, has been able to evaluate clinical data significantly more effectively than conventional AI systems, such as ChatGPT, DeepSeek, or classic machine learning methods (ML). The key difference: NetraAI accurately identifies patient subgroups, known as subpopulations, which can be critical to the success of clinical trials. This is something other models have not yet achieved. What makes NetraAI special is the combination of explainable AI and a novel, dynamic learning system that has been optimized specifically for medical data. While large language models such as ChatGPT fail to meet the "real" challenges of clinical research, NetraMark's approach opens up new avenues for personalized therapies and targeted drug development.

In a study on depression, NetraAI achieved extremely high prediction accuracy of up to 100% and helped identify patients who would respond best to treatment. In pancreatic cancer, the AI accurately identified survival patterns in small subgroups with only 2 to 3 meaningful variables. ChatGPT and DeepSeek, on the other hand, did not deliver usable results because they were unable to distinguish between groups in a meaningful way or extract clinically useful information. Traditional machine learning models also remained at around 60-66% accuracy and offered no transparency. NetraAI works differently: it explains which patients it can predict and which it cannot. As a result, it delivers understandable, statistically sound results. For investors, it is clear that NetraMark offers not only technological leadership but also substantial market potential in an industry that relies on precision, trust, and efficiency.

Anyone looking to bet on the next big breakthrough in the biotech and AI world should keep an eye on this company. After a performance of over 300% since November 2024, the value has now consolidated. Investors who are not yet on board should act quickly!

CEO George Achilleos presented NetraMark Holdings at the 15th International Investment Forum, IIF, on May 21, 2025. Watch the video here: https://youtu.be/asqAzE7_2-M

How Bayer and Novo Nordisk are responding innovatively to challenges

Two of Europe's most prominent pharmaceutical companies, Bayer and Novo Nordisk, are facing profound transformations. While Bayer continues to grapple with multi-billion-dollar legal risks from glyphosate lawsuits in the US, Novo Nordisk is experiencing a sharp correction due to growing competition in the lucrative obesity segment. Rather than slipping into paralysis, both companies are pursuing a clear path forward: leveraging artificial intelligence as a driver of innovation.

Bayer recently presented clinical data on new active ingredients supported by AI-based analysis and target identification, for example, in diabetes and prostate cancer. Novo Nordisk is also accelerating its pipeline through strategic technology partnerships. Since 2024, the Danish global market leader has been utilizing a powerful AI platform developed by Microsoft Research. Now, the Danes are also entering the quantum era. To this end, they are intensifying their collaboration with NVIDIA. The goal is to use the Gefion supercomputer and generative AI to accelerate drug development and complex simulations.

The integration of AI into the entire value chain is intended to accelerate innovation and reduce costs. Both companies are proving that those who meet today's challenges with tomorrow's technologies can emerge from the crisis with new competitive strength. The comprehensive integration of AI into research, development, and clinical processes not only marks a leap in efficiency but also a clear commitment to the future viability of European pharmaceutical innovation. Bayer has already recovered to EUR 27.80, while Novo Nordisk has recently seen a zigzag movement in the EUR 60-70 range. Both stocks are miles away from their highs, but sentiment is gradually improving. With a market capitalization of EUR 26.5 billion, Bayer remains extremely vulnerable to takeover - especially if the Company does decide to split up under pressure from financial investors.

Artificial intelligence is more than just a trend; it is becoming the driving force behind the next wave of innovation in the healthcare industry. In the pharmaceutical sector, companies such as Bayer and Novo Nordisk are already consistently relying on AI-supported processes to accelerate research, diagnostics, and drug development. However, alongside the industry giants, one up-and-coming innovator is currently attracting considerable attention: NetraMark. With a state-of-the-art, explainable AI approach, the Company is revolutionizing the analysis of complex patient data and opening up new avenues for targeted personalized therapies.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.