greenhydrogen

Commented by Nico Popp on January 16th, 2026 | 07:00 CET

Trash to gas: How A.H.T. Syngas, EQTEC, and 2G Energy are making companies self-sufficient

German industry is undergoing one of its toughest trials. The "trilemma" described by analysts - volatile energy prices, rising CO2 taxes, and the physical uncertainty of the power grids - has driven production costs to a level that poses a massive threat to competitiveness. While politicians debate hydrogen pipelines that will take years to complete, innovators are already creating a new reality: decentralized energy supply from waste materials. Three players are emerging in this booming sector, working together to solve the puzzle of energy self-sufficiency. While CHP market leader 2G Energy provides the hardware for a green future with its engines and British supplier EQTEC validates gasification technology worldwide, Germany's A.H.T. Syngas Technology closes the crucial gap for small and medium-sized enterprises. With compact plants, A.H.T. transforms industrial waste into the clean gas that keeps the engines running – regardless of Putin's war or price jumps on the Leipzig energy exchange EEX.

ReadCommented by André Will-Laudien on January 15th, 2026 | 07:30 CET

Acquisition Breakthrough: D-Wave, First Hydrogen, and Plug Power in focus

In an increasingly fast-paced world, investors are seeking timely information on stocks that have been highly volatile in recent weeks. Often, the key opportunities lie in turnaround situations, driven partly by operational news and partly by technical chart patterns. Today's selection of stocks reflects exactly this picture. D-Wave is impressing with a complementary acquisition deal, First Hydrogen with a successful capital raise, while Plug Power is unfortunately facing negative analyst commentary. What is happening on the price board?

ReadCommented by Nico Popp on January 14th, 2026 | 07:05 CET

Between euphoria and industrial realism: How Linde, Hapag-Lloyd, and dynaCERT are defining the new reality of the hydrogen economy

We are witnessing a decisive turning point in the global hydrogen economy: The phase of speculative euphoria that characterized the beginning of the decade has given way to a phase of industrial realism and technocratic implementation. In investor circles and industry analyses, the term "mean reversion" has become established – a return to reality, away from unrealistic hyper-growth scenarios and toward physically feasible projects. According to the International Energy Agency's (IEA) Global Hydrogen Review 2025, the hydrogen sector continues to grow steadily and reached demand of nearly 100 million tons in 2024, but the structure of this growth is more complex than previously forecast. In this new environment, where regulatory interventions such as FuelEU Maritime and emissions trading (EU ETS) set the pace, three distinct winner profiles are emerging: infrastructure giant Linde, logistics heavyweight Hapag-Lloyd, and technology bridge builder dynaCERT, which occupies a highly compelling niche.

ReadCommented by Fabian Lorenz on December 30th, 2025 | 07:00 CET

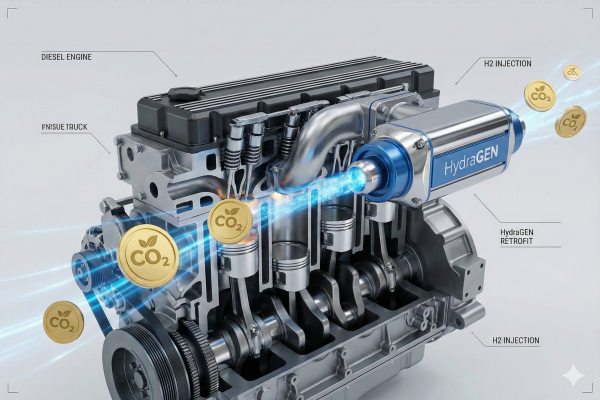

HYDROGEN STOCK with 10x POTENTIAL! Nel ASA, thyssenkrupp, and dynaCERT are starting the new year in different ways

Hydrogen stocks have had a challenging year. However, analysts see the potential for 10x growth in the new year, specifically, for the cleantech company dynaCERT. Operational tailwinds are coming from market entry in Mexico and sales successes in Europe. Successes in Asia are expected to follow in 2026. The decisive factor for 2026 will be whether dynaCERT makes progress in terms of order volume, capacity utilization, and recurring revenues. With its retrofit solution, dynaCERT is setting itself apart from large plant manufacturers such as thyssenkrupp nucera and Nel ASA. Analysts praise the former for its efficient structures and full coffers. The other is aggressive despite its share price being at an all-time low.

ReadCommented by Armin Schulz on December 23rd, 2025 | 07:05 CET

The strategic positioning of Plug Power, dynaCERT, and Nel ASA in the USD 110 billion market

2025 marks the long-awaited turning point for the hydrogen economy: with global investments of over USD 110 billion, annual volumes recently exploding by 70%, and groundbreaking infrastructure projects such as Germany's 400 km core network, the vision is becoming a commercial reality. Technological milestones, such as Bosch's production-ready fuel cell truck system, and ambitious EU targets underscore the enormous potential for decarbonization. In this dynamic environment, it is innovative companies that are translating these macroeconomic dynamics into concrete growth opportunities. Against this backdrop, it is worth taking a closer look at the pioneers Plug Power, dynaCERT, and Nel ASA.

ReadCommented by Nico Popp on December 10th, 2025 | 07:05 CET

Second hydrogen wave with Linde, BASF, dynaCERT: Why 2026 will be the year of truth

fundamentally from the hype cycles of 2020 and 2021. Back then, enthusiasm was driven largely by visionary PowerPoint presentations rather than real-world progress. The transition to 2026, however, marks the start of a new industrial reality. Investors who have followed the sector for years now recognize a clear shift in market dynamics - one based less on hope and more on regulatory certainty and technological maturity. As Der Aktionär correctly notes, a new tailwind is emerging for industry. We explain what improved framework conditions and the market launch of large-scale plants in Europe could mean for the shares of Linde, BASF, and dynaCERT.

ReadCommented by Fabian Lorenz on December 8th, 2025 | 06:55 CET

Nearly 2,000% returns! Siemens Energy, Nel ASA, and First Hydrogen shares! Hydrogen or SMR nuclear power!

Siemens Energy shares are unstoppable. Analysts are enthusiastic about the DAX-listed company. The outlook for the coming years is bright, and a 2,000% return could soon be achieved. First Hydrogen shares have not yet benefited from the AI energy boom in the US. The Company aims to make SMR nuclear reactors more efficient and safer. In addition, North Americans are benefiting from the willingness of their governments to go full throttle on the issue. Full operational momentum, however, has been missing at Nel for quite some time. Revenue growth and order intake are not fueling any share price speculation. Can a new EU initiative give the hydrogen sector new momentum?

ReadCommented by Stefan Feulner on December 2nd, 2025 | 07:15 CET

Enphase, dynaCERT, Fluence Energy – Now it is getting interesting

At the start of the last trading month of 2025, global stock markets are faltering once again. There is nervousness and fear of a major correction. AI-related stocks in particular are currently on the selling lists of major investors due to their sometimes horrendous valuations. In contrast, companies in the renewable energy sector have undergone a broad wave of consolidation in recent months. As a result, there are attractive entry opportunities here.

ReadCommented by Armin Schulz on November 28th, 2025 | 07:05 CET

The comeback is here: How to capitalize on the hydrogen boom with Plug Power, First Hydrogen, and Nel ASA

After a steep decline, the hydrogen industry is on the verge of a spectacular turnaround. Global decarbonization targets and massive infrastructure programs, such as Germany's planned 9,000 km pipeline corridor, are catapulting the market for green hydrogen into a new phase of growth. These political impulses are now triggering an explosive comeback and creating an investment-friendly environment in which the once-ostracized pioneers can accelerate their operational profitability. Plug Power, First Hydrogen, and Nel ASA are seeking to capitalize on this upswing. We analyze the current situations.

ReadCommented by Carsten Mainitz on November 26th, 2025 | 07:10 CET

New EU initiative boosts the hydrogen market! Pure Hydrogen, Nel, and SFC Energy stand to benefit!

With the Hydrogen Mechanism, the EU has launched a new and important instrument on the market. The launch took place just two weeks ago, so it is still too early to draw any interim conclusions. However, the approach has the potential to take the hydrogen market to a new level of development, as the platform brings together supply and purchasing interest and provides information on available financing instruments. Smaller providers, such as Pure Hydrogen, should benefit in particular.

Read