Technology

Commented by Stefan Feulner on February 3rd, 2025 | 07:10 CET

Alibaba, Credissential, ASML – Profiteers and losers of the AI quake

Last week, the new Chinese chatbot DeepSeek caused the stock markets, particularly semiconductor stocks, to falter. Chip giant Nvidia lost 17% of its market value in one day and almost USD 600 billion in market capitalization. Whether DeepSeek can truly follow in the footsteps of ChatGPT after the initial euphoria is questionable. However, new models are coming to market that could steal market share from the established players in the future.

ReadCommented by Juliane Zielonka on February 3rd, 2025 | 07:00 CET

Apple, First Nordic Metals, Barrick Gold - Technology sector meets commodity markets in transition

The global economy is showing its dynamic side at the beginning of 2025. Apple presents strong quarterly figures with record revenue of USD 124.3 billion. The Services division, in particular, stands out with a growth of 14% to USD 26.34 billion. First Nordic Metals Corporation offers high gold exploration potential thanks to its properties in the Scandinavian countries of Sweden and Finland. In Mali, West Africa, on the other hand, the leading gold producer, Barrick Gold, is facing further difficulties with the Malian government. This geopolitical development highlights the shift towards raw material projects in politically stable regions, which also offer a significant tax advantage.

ReadCommented by Juliane Zielonka on January 30th, 2025 | 07:10 CET

D-Wave, Power Nickel, Amazon - Copper as a key raw material for the technological revolution

The increasing demand for copper for new technologies such as quantum computers, power grids, and solar system expansion is putting pressure on the global raw materials market. D-Wave, a pioneer in quantum computing, requires copper for its highly complex systems. With fresh capital of USD 150 million, the Palo Alto-based company is continuing its growth strategy. In the immediate vicinity, the Canadian raw materials company Power Nickel is tapping into promising copper and precious metal deposits with its NISK project. The ongoing boom in raw materials is ideal for Power Nickel. The current drilling is delivering promising results from a nickel-copper-cobalt-PGE deposit and a high-grade copper-precious metal zone. Amazon, in turn, is pushing ahead with its zero-emissions strategy with its 58-MW solar projects in Japan. Here, too, copper plays a key role in the construction of the solar plants. The economic sustainability of individual countries depends heavily on their available raw material resources and suppliers. Three companies exemplify how copper is becoming the strategic metal of the digital transformation.

ReadCommented by Fabian Lorenz on January 28th, 2025 | 07:30 CET

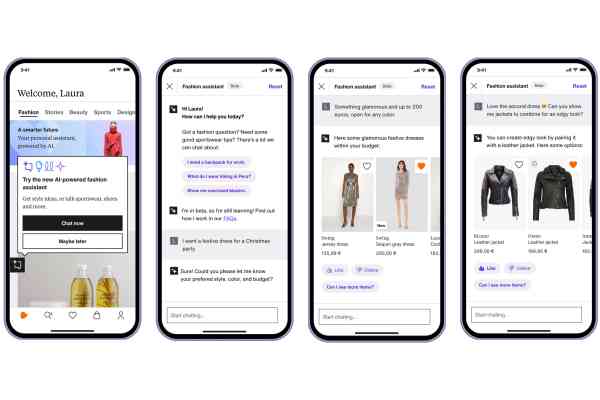

4,000% stock Carvana: TeamViewer, Bitcoin Group, Zalando, and Credissential offer opportunities

Away from the big tech stocks, multipliers are waiting. One example from the US is Carvana, which has risen 4,000% in two years. Credissential aims to challenge the online used car dealer. The startup wants to provide brick-and-mortar used car dealers with a response against Carvana using artificial intelligence. Scaling is planned for 2025. If successful, the stock is much too cheap. In the DAX, Zalando offers significant upside potential. The online retailer is back on the growth path and plans to compete with Shein and Temu through the acquisition of About You, with analysts recommending a "Buy". By contrast, TeamViewer's stock lacks momentum. Analyst opinions are divided. And is the Bitcoin Group stock finally waking up?

ReadCommented by Armin Schulz on January 27th, 2025 | 07:10 CET

Volkswagen, Nova Pacific Metals, D-Wave Quantum – Is a trade war about to break out?

Donald Trump is the new president of the United States of America, and he is moving at a rapid pace. On his first day, he issued several decrees, and his inaugural address was also impactful. He announced tariffs on imports. Goods from Mexico and Canada will be subject to 25% customs duties. And tariffs of up to 60% are being considered for products from China. If the US isolates itself like this, China, in particular, could significantly restrict its raw material exports, and the trade war would be officially underway. The race for critical raw materials has already begun. Trump has already put out feelers to Greenland and Canada. Where will high-tech industries source their raw materials from in the future?

ReadCommented by Juliane Zielonka on January 24th, 2025 | 07:25 CET

Almonty, Rheinmetall, Palantir - Strategic decisions in global competition

Geopolitical tensions and technological innovations are the driving forces behind the current market movements in the defense and AI sectors. The leading tungsten producer, Almonty Industries, plans to move its headquarters to the US to strengthen domestic raw material independence for the defense industry. The timing is ideal as China tightens trade restrictions on both raw materials and US defense companies. Meanwhile, in Germany, the Federal Cartel Office has approved a far-reaching German-Italian defense project between Rheinmetall AG and Leonardo S.p.A. - the aim is to strengthen European security, particularly with regard to ground troops. The US tech company Palantir Technologies is further expanding its position in the AI market and is increasingly using AI platform technology for commercial customers. We look at what investors need to know now.

ReadCommented by André Will-Laudien on January 24th, 2025 | 06:50 CET

Artificial intelligence and crypto mania – the 500% duo! Bitcoin, MicroStrategy, Credissential, Palantir and D-Wave

Since the tech bubble of 2000, no other year of investment has seen such huge gains for just a few sectors as 2024. And it looks like 2025 will be no different! Bitcoin, high-tech, artificial intelligence and armaments were and are the blockbuster topics for making quick money. MicroStrategy, D-Wave, Palantir, and Nvidia are the current protagonists of this incredible spectacle. Now these stocks have priced in a golden future, in some cases with P/E ratios of over 100. What comes next? Even experts are at a loss - nobody expects a correction here as all the shorts of recent weeks have turned into painful experiences. The keywords are "momentum & liquidity" – is fundamental analysis useless?

ReadCommented by Juliane Zielonka on January 23rd, 2025 | 08:00 CET

XXIX Metal, Apple, D-Wave - Three beneficiaries of the 500-billion-dollar AI revolution

At high speed, the US government announces the "Stargate" project - a historic USD 500 billion investment in the country's AI infrastructure. The strategic partnership between tech giants such as OpenAI, SoftBank, and Oracle will include the construction of 20 state-of-the-art data centres. Initial construction work in Texas has already begun. Tons of copper will be needed to build the infrastructure and data centres, which means golden times are dawning for copper exploration companies. On the one hand, demand for copper is increasing due to rapid technological advances, and on the other hand, analysts say that the price of copper could double this year. Microsoft and Nvidia emphasize the strategic importance of healthcare in the AI deal. This is precisely where Apple has an opportunity for the future. If they manage to make a breakthrough with the Apple Watch in the diabetes market, there is the potential for billions of dollars in profits. D-Wave, a quantum computer manufacturer, also seems to be on the fast track. The Silicon Valley company produces, among other things, energy-efficient AI computing solutions. Music to the ears of investors...

ReadCommented by Juliane Zielonka on January 20th, 2025 | 15:50 CET

D-Wave, European Lithium, BYD – Silicon Valley, the Alps, China: The tech axis of the future

The digital revolution is advancing in quantum leaps: the Silicon Valley company D-Wave is accelerating conventional computing processes by a factor of 2,000 with its groundbreaking quantum computing technology. Analysts predict that its share price will double this year. The Austrian company European Lithium is profiting from the unbroken demand for the same raw material. With its property in beautiful Carinthia, the exploration and mining company has the potential to take the lead among European lithium producers. Automaker BMW is already on board, having invested millions. Analysts predict a growth of 500% for European Lithium shares. In this phase of transformation, shifts in power are also becoming apparent: BYD, originally a battery manufacturer and now China's largest electric vehicle producer, plans to take over two German Volkswagen plants – a symbolic turning point in European industrial history. Where are the best opportunities for investors?

ReadCommented by Fabian Lorenz on January 20th, 2025 | 07:20 CET

D-Wave, Rheinmetall, First Phosphate: Stocks with 100% or more potential!

First Phosphate shares jumped 10% on Friday, ending the week on a high note. The economic valuation had caused a sensation. With high-purity phosphate – a critical mineral – the Company could generate USD 700 million in cash flow in 3 years according to the PEA. Its market capitalization is USD 33 million, and analysts also see significant upside potential. Rheinmetall started the new year with a 15% price increase. Rising NATO defense spending and numerous orders have driven buying activity. In the field of air defense, Germany's largest defense contractor aims to set a new standard. One of the hot stocks of 2024 is facing more headwinds in the new year: D-Wave Quantum. Two leading tech CEOs have expressed skepticism. Does this mean the hype is over? Who will win the race?

Read