March 11th, 2025 | 07:10 CET

Olalla! And here comes the consolidation! Are these already buying opportunities for SMCI, Benton Resources, Palantir, and Meta?

Whenever investors use the term "one-way street", the market tends to correct. This time, several factors were at play, such as failed peace efforts, rising debt, increasing interest rates, and the threat of tariffs from the Trump administration. All four points have a long-term recessive effect, as they weaken consumer sentiment and purchasing power due to higher interest rates and product payments. In the short term, they also weigh on overheated growth portfolios. It is, therefore, worthwhile to take a closer look at the well-known protagonists. After all, buying opportunities arise time and again – timing is key!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SUPER MICRO COMPUT.DL-_01 | US86800U1043 , BENTON RESOURCES INC. | CA0832981090 , PALANTIR TECHNOLOGIES INC | US69608A1088 , META PLATFORMS INC | US30303M1027

Table of contents:

"[...] We knew the world was rapidly electrifying and urbanising and needing significant amounts of copper to do so. [...]" Nick Mather, CEO, SolGold PLC

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

SMCI and Palantir – Looking south for the time being

"Permanent fortune seekers" in tech stocks now have an extended half-time break for the time being. After a solid 3-year price rally with returns of up to 1000%, the NASDAQ 100 is now returning to a calmer state. The index has already lost over 2,000 points from its peak of 22,319 within just 3 weeks. The corrections may seem severe to outsiders, but those who have been invested for a long time are only losing the peak of a large mountain range.

Super Micro Computer's (SMCI) share price performance in 2024 was characterized by a rapid rise to over USD 1,200. This was followed by a 1:10 stock split and inconsistencies in the balance sheet. Investors fled the stock, driving the price, adjusted for the split, below USD 20. From there, the price doubled again quite quickly after the new auditor, BDO, was able to satisfy the SEC's demands. 4 out of 13 analysts on the LSEG platform currently recommend the shares as a "Buy". The average price target is USD 51.50. After the correction, there is again good potential at prices around USD 30.

The Palantir share price was able to top its old highs at USD 85 twice in recent weeks. It rose rapidly to over USD 120 after the annual figures. This was likely too big a gulp, and now, technically, the breakout lines from above are being tested again. Caution: The fundamental P/E ratio for 2026 is still a good 125. If there are significant sell-offs on the NASDAQ, a few percentage points will also be lost here. Set a stop at USD 78.50, but there will be buying opportunities again technically in the direction of USD 60.

Benton Resources – Success continues in Newfoundland

In the current environment, investors should look ahead a few years. Despite a challenging geopolitical situation, the megatrends of modern times will continue to advance vigorously. AI, high-tech, and performance computing require a large amount of energy and critical metals, which should now come primarily from the West, in order to at least protect the economy from political instability. Copper is one of the most important metals in the electrification of our world. It plays an important role wherever a lot of electrical energy has to be generated or transmitted. However, the global production of metals, especially copper, is limited to a few active mines locally. To meet demand, new properties have to be developed quickly.

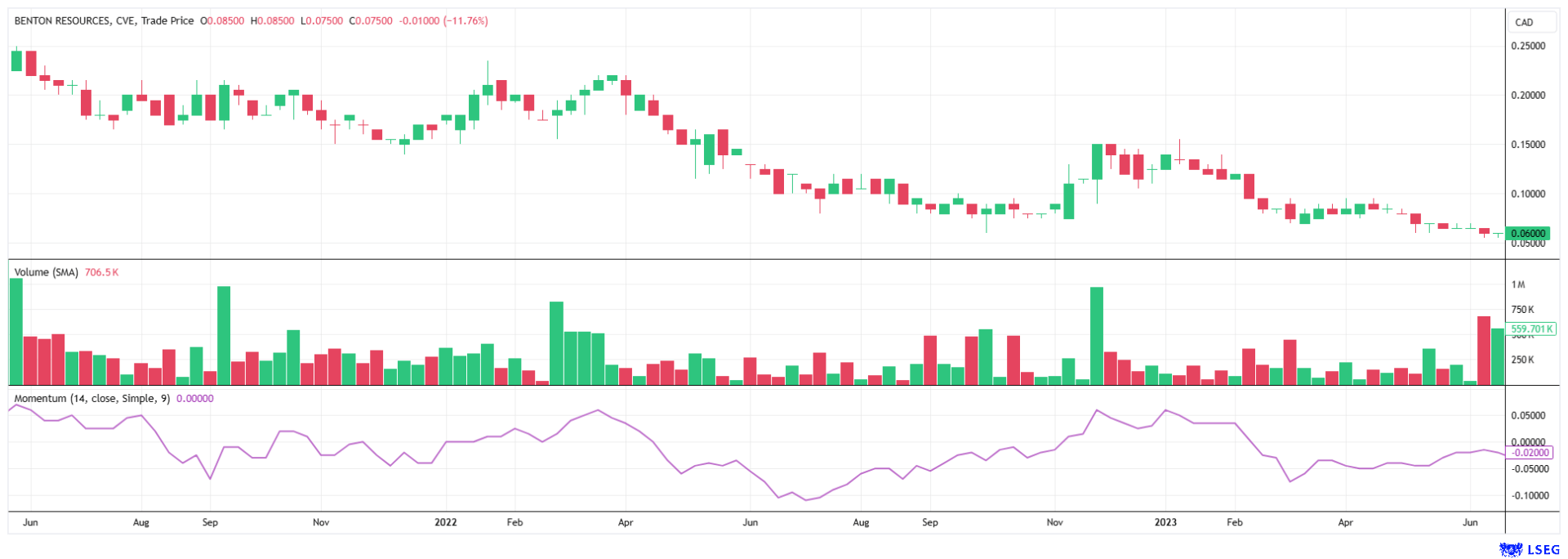

The Canadian explorer Benton Resources owns some prospective gold and copper properties. In addition to a diversified and highly prospective property portfolio, the Company also holds large strategic equity positions in other mining companies. The centerpiece of its current geological activities is the Great Burnt project in Newfoundland, which has an estimated mineral resource of 667,000 tons at 3.21% Cu (indicated) and 482,000 tons at 2.35% Cu (inferred). Significant progress was reported in early March.

The Company recently completed hole GB-25-60, the second west-east drill hole testing an area of the GBMZ considered to be less prospective based on historic drilling. The hole continued eastward to reach the Footwall Zone. It intersected a 15.00-meter section of mineralization with 10.40 meters of massive and semi-massive sulfides with heavy chalcopyrite. Management believes additional drilling is needed to upgrade these historical zones with weaker mineralization. However, the good partial results give hope!

In addition, the Company is encouraged by the intersecting of two significant zones of stringer to semi-massive style mineralization beneath the North Stringer Zone ("NSZ") surface expression. The current drill program, totaling 3,220 meters to date, is testing several new areas and zones, including the North Stringer/Footwall zones. A further focus is being placed on various magnetic and geophysical anomalies near surface, as well as areas where highly anomalous copper and gold mineralization has been discovered at surface. Most of the drill holes have intersected weak to strong mineralization; the assay results should be published soon. In total, approximately 205.6 million Benton shares have been issued to date. With a share price of around CAD 0.08, this results in a current valuation of CAD 16.5 million. For those familiar with the copper shortage story, this level represents a smart entry point.

Meta Platforms – Moving forward with investments in AI

The Company, founded by Mark Zuckerberg and behind Facebook, Instagram, and WhatsApp, has set ambitious goals to accelerate its use of artificial intelligence. The founder and CEO recently announced that Meta Platforms will dramatically increase its investment in AI and Big Data infrastructure this year. These investments are intended to lay the foundation for future growth and help Meta enter the exclusive USD 3 trillion club of Microsoft and Apple.

The plan includes spending USD 60-65 billion in the next 12 months alone, a significant increase over the previous year. Improved AI models are expected to improve the efficiency of recommendation algorithms, which will reach more users in a targeted manner and increase the accuracy of advertising on the Company's platforms. At USD 625, the market capitalization of USD 1,600 billion is still a good 45% away from the milestone. However, those who know Mark Zuckerberg can expect that he will work hard to achieve this goal. In the current consolidation cycle of tech stocks, the price has already been set 20% lower than in February. The trend is likely to continue to decline for a bit longer.

Finally, the major markets are seeing a correction. The tech rally has lasted a long time. Now, investors could turn to cheaper stocks again. Due to higher precious metal and commodity prices, resource stocks such as Benton Resources should also be on the radar again. After all, some stocks have become significantly cheaper due to the increased volatility. Benton Resources is extremely interesting in terms of critical metals. Broad diversification protects against one-sided portfolio swings.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.