Technology

Commented by Armin Schulz on January 2nd, 2025 | 07:10 CET

Palantir – Data as gold, or should one add Desert Gold and MicroStrategy to the portfolio for 2025?

In today's world, digital technologies are integral to our lives, and as we navigate the internet, we disclose data that is now considered the gold of the 21st century. Tech giants leverage this data for personalised offerings, thereby securing competitive advantages. Palantir has made a name for itself as a big data analyst and has grown considerably as a result. The other option is to invest in gold or crypto companies. The price of gold and Bitcoin has risen significantly in the past year. We look at a company from each sector and see which stock deserves a place in your portfolio.

ReadCommented by Fabian Lorenz on January 2nd, 2025 | 07:05 CET

+500% return in 2025 with D-Wave, Plug Power, or BMW partner European Lithium stock?

500% price gain in 2 months! This is extraordinary but possible, as D-Wave's share price demonstrated at the end of 2024. Analysts believe that European Lithium's share price is capable of a similar price jump. Maybe not in 2 months, but there is massive upside potential expected by March. Experts believe that lithium can make a comeback in the new year. BMW partner European Lithium, with deposits in Austria and Ireland, should benefit from this. Additionally, the Company has other valuable resources, including rare earth elements. Plug Power shareholders are hoping for a hydrogen comeback. Can the turnaround succeed, or is insolvency looming at the start of the year? By contrast, quantum computing is likely to continue to electrify the stock market in the new year. So, will the rally continue for D-Wave & Co.?

ReadCommented by André Will-Laudien on December 30th, 2024 | 07:55 CET

Trump, Bitcoin and a gold rally in 2025? Barrick, Thunder Gold, Agnico-Eagle and D-Wave in focus

Geopolitical tensions, war, inflation, spiralling national debt and clueless politicians – a set-up that hardly impacted stock markets negatively in 2024. Fueled by immense expectations of productivity gains from high-tech advancements, cloud computing, artificial intelligence, and high-performance computing in the coming years, valuations on the NASDAQ soared to unprecedented heights. The local DAX 40 index was also able to keep pace, albeit with reduced momentum. As the year ends just shy of December highs, major uncertainties in 2024 also sparked a rush for precious metals. A troy ounce of gold peaked at USD 2,790, while silver exceeded the USD 32 mark several times - prices not seen in years. Technical analysts now predict a super cycle for commodities. The key point: compared to the overheated high-tech sector, the current metal prices for mining stocks are more likely to produce upward surprises than profit warnings. The time is ripe for a selective entry.

ReadCommented by Armin Schulz on December 27th, 2024 | 07:00 CET

Barrick Gold, Thunder Gold, MicroStrategy – Precious metals and digital assets as an investment in uncertain times

In a world that feels increasingly uncertain with each passing day, gold is becoming increasingly important. The times of high interest rates are over, and with central banks even considering interest rate cuts again, many investors are turning to the shiny metal. Why? While gold does not pay interest, when the alternatives do not offer decent returns either, it suddenly becomes quite interesting.

Geopolitical crises, which seem never-ending, also play a significant role. The war in Ukraine, tensions in the Middle East – issues like these are once again making gold a hotly sought-after safe haven. Central banks, which have bought a record amount of gold in recent years, are also helping to keep the price stable. Not to mention the still tangible inflation and economic risks.

In any case, the experts agree: the current consolidation in the gold price – that is, this minor setback – is likely to be only a breather. In the long term, the trend is clearly pointing upwards. And while gold continues to have its fans, many investors are also increasingly looking towards Bitcoin and other cryptocurrencies, which are also considered a hedge in the current climate.

ReadCommented by André Will-Laudien on December 23rd, 2024 | 08:10 CET

New elections in 2025 – A tailwind for electric mobility: VW, Mercedes, ARI Motors, BYD and Stellantis

The traffic light is history, and new elections will be held on February 23. If the current polls are to be believed, a centre-right coalition could emerge. A 180-degree turn in economic policy would be needed for Germany as a business location to stop the exodus of industry abroad. However, this requires signs of a consistent refocusing on burning issues. Citizens are burdened with high price increases, and e-mobility urgently needs new incentives. International investors have long since turned their backs on European markets and are investing primarily in the US. The very low valuations in this country, which have rarely been observed over a longer period of time, offer hope. There is a good chance of a noticeable turnaround in the automotive sector in particular.

ReadCommented by André Will-Laudien on December 20th, 2024 | 07:50 CET

Christmas is fast approaching: Tesla is breaking all records – 100% with BYD, NIO, 123fahrschule or VW?

What an investment year 2024 has been! Just three days ago, the NASDAQ 100 index was up over 30%. Now, in the middle of the week, there was a strong 'one-day reversal' – the first significant weakness in months. Those who boldly invested in high-tech stocks enjoyed even larger gains, such as Nvidia soaring by 180% or Palantir Technologies surging 340%. In some sectors, however, performance was dismal. European automotive stocks, for instance, dropped an average of nearly 20%, grappling with fundamental adjustment pressures and a dramatic decline in margins. Tesla and BYD, on the other hand, demonstrated how effective stock marketing works in the automotive sector, posting gains of 82% and 39%, respectively, this year. The big question now is: what is next for 2025?

ReadCommented by Juliane Zielonka on December 20th, 2024 | 07:40 CET

Future technologies: How Rheinmetall, Power Nickel and Super Micro are shaping the digital revolution

Digitization is spreading rapidly across all areas of the economy – from the military to the energy transition and artificial intelligence. Rheinmetall has received a major order from the government to digitally upgrade the Bundeswehr, with EUR 2 billion allocated for this project. Junior explorers such as the Canadian company Power Nickel, which is planning the first carbon-neutral nickel mine in North America, will also benefit from this. Nickel is an essential component of electronic components and storage media. In the booming AI sector, the Company Super Micro Computer is well-positioned and plans to expand its production in Malaysia despite the threat of a Nasdaq delisting. We provide the details.

ReadCommented by Armin Schulz on December 20th, 2024 | 07:30 CET

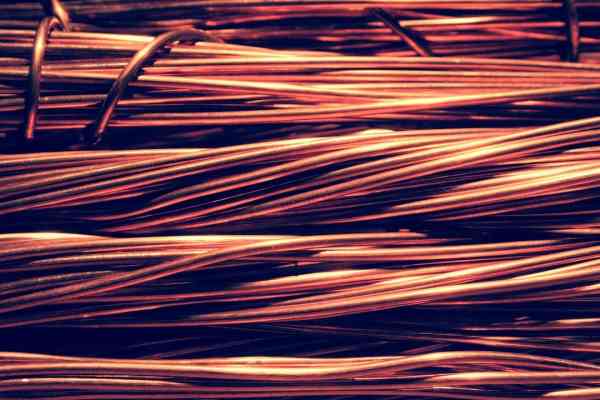

Mercedes-Benz, XXIX Metal, D-Wave Quantum - Copper shortage: Is a bottleneck looming due to new technologies?

Copper is an elementary industrial raw material whose importance is steadily increasing due to technological innovations and global megatrends. In particular, the rapid expansion of electromobility, the development of quantum computers, and artificial intelligence are driving demand to new heights. Electric vehicles require many times more copper than conventional vehicles with combustion engines due to batteries, engines and charging infrastructure. At the same time, demand is increasing in data centres and networks that rely on high-performance cables and cooling systems. Experts predict that global copper demand will increase by millions of tonnes by 2030 – and with it, new challenges for production and supply.

ReadCommented by Stefan Feulner on December 17th, 2024 | 12:30 CET

BYD, dynaCERT, Block – Favourites for the future

The stock market is entering the last full trading week of an eventful year, 2024. However, the next 12 months also promise high volatility due to ongoing global conflicts and new governments, including the US and Germany. Will the stock market be able to ignore the negative events once again, or will it fall into a correction? In addition, investors are again looking for the stock market stars of the new year. A major focus is on companies that have not yet been able to confirm their performance on the stock market in the past year.

ReadCommented by André Will-Laudien on December 17th, 2024 | 07:45 CET

Vote of confidence: What is the future of high-tech and crypto? SMCI, Myriad Uranium, MicroStrategy and Palantir in focus

Yesterday, Chancellor Scholz asked the Bundestag for a confidence vote. There were 394 no votes for a continuation of the federal government, thus paving the way for elections in February 2025. How will energy policy, in particular, change? CDU rival Merz wants to tackle the issue by including all available sources. Does that mean a return to nuclear energy? The situation in Germany is dramatic. After the shutdown of seven large power plants in 2024, a new term is making the rounds: 'dark doldrums'. The term describes periods when there is hardly any wind, and the sun does not provide any energy either. The remaining fossil fuel power plants are running at full capacity, fuelled by coal, oil and gas. Internationally, nuclear power has long been recognised as a central energy source, even under the 'NetZero' framework, and the development of new technologies is advancing. What should investors pay particular attention to now?

Read