Technology

Commented by Armin Schulz on July 24th, 2025 | 07:05 CEST

Omnichannel Profits: How Alibaba's AI, naoo's communities, and PayPal's embedded finance are filling your coffers

The digital transformation is revolutionizing retail and marketing! E-commerce is breaking records, influencer campaigns are generating unprecedented reach, and innovative payment solutions are driving customer satisfaction to new heights. These three pillars are opening up global markets, increasing efficiency, and creating explosive growth opportunities. But the real gold lies in their intelligent integration. Those who seamlessly merge the online and offline worlds will dominate the market. This is precisely where pioneers Alibaba, naoo, and PayPal come in. Their strategies pave the way for profitable synergies.

ReadCommented by Armin Schulz on July 22nd, 2025 | 07:00 CEST

Xiaomi, Silver North Resources, Super Micro Computer: Who suffers and who benefits from the structural silver shortage?

Silver – the invisible engine of the tech revolution – is becoming a scarce commodity. Soaring prices reflect not only investor interest, but also a structural shortage. Demand from the solar industry, e-mobility, AI, electronics, and defense is depleting reserves, while production and recycling are lagging. The industry is currently fighting for every ounce. Forecasts see the silver price rising above USD 50 in the long term. But who is leveraging this trend, and where are the risks? Xiaomi depends on silver for its e-mobility and electronics divisions. Silver explorer Silver North Resources is actively developing silver deposits, and Super Micro Computer is driving consumption.

ReadCommented by Stefan Feulner on July 21st, 2025 | 07:05 CEST

Salzgitter AG, Volatus Aerospace, and Rheinmetall with spectacular news

The defense industry continues to shine with strong momentum. Despite some overly ambitious valuations, companies such as Rheinmetall, RENK, and Hensoldt are trading close to their historic highs. And analysts are still outdoing each other with ever higher price targets. Caution is advised with established arms and ammunition manufacturers. In contrast, young companies with innovations from niche markets are growing and have further potential.

ReadCommented by Fabian Lorenz on July 17th, 2025 | 07:10 CEST

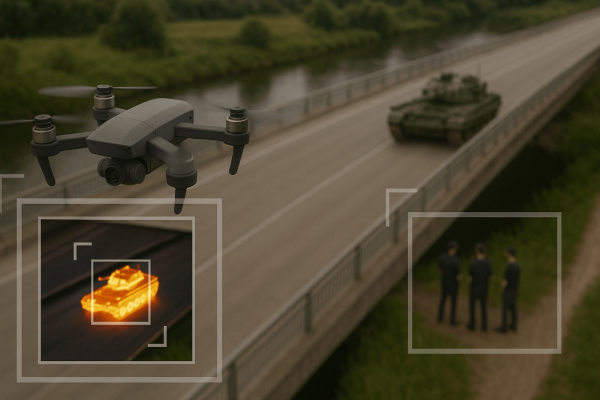

Armament stocks make a splash! RENK, DroneShield, Volatus Aerospace - Drones instead of tanks?

A major shake-up in the defense industry! KNDS is set to go public later this year, and the German federal government may participate in the IPO, which would also result in an indirect stake in RENK. KNDS has a stake in the gearbox specialist, and the two companies are jointly building the Leopard 2, among other things. But are tanks still relevant? The war in Ukraine has at least exposed their vulnerability and ushered in the age of drones. Volatus Aerospace and DroneShield are benefiting from this, with their shares having multiplied in recent months. However, more and more orders are now coming in from NATO. Revenue and profits are likely to explode in the coming years.

ReadCommented by Nico Popp on July 3rd, 2025 | 07:15 CEST

Microcap revolutionizes the building materials industry: Does Argo Living Soils hold the key to billion-dollar revenues?

Sustainable construction has been a growing trend for some time. As early as the late 1970s, regulations in Germany required builders to insulate properties according to specific standards. Since then, standards have continued to rise steadily. In some cases, this has become a cost issue – especially when older buildings must be brought up to modern energy efficiency standards. For some time now, the focus has also shifted to the building materials themselves. Materials such as cement and concrete are considered particularly energy-intensive and therefore anything but CO2-neutral. This is precisely where innovative technology comes in. A billion-dollar market is emerging.

ReadCommented by André Will-Laudien on July 2nd, 2025 | 07:25 CEST

1600% with Bitmine and Circle Internet – The next opportunities are lurking at Plug Power and naoo!

The stock market has surprises in store every day, with crypto- and AI-related business models currently causing a stir. Stocks such as Galaxy and Mara Holding are still among the harmless ones, with gains of 200 to 400%. Things really got going with Bitmine Immersion and Circle Internet. While Bitmine posted a 1,000% rally on Monday, Circle Internet took a whole month to increase its value sixfold. However, it is not necessarily the business model that determines whether stocks take off or not. Often, all it takes is a wave of discussion on the internet or social media channels and the wave breaks. Plug Power and naoo could be the next candidates for a rise. We analyze why.

ReadCommented by Armin Schulz on July 2nd, 2025 | 07:00 CEST

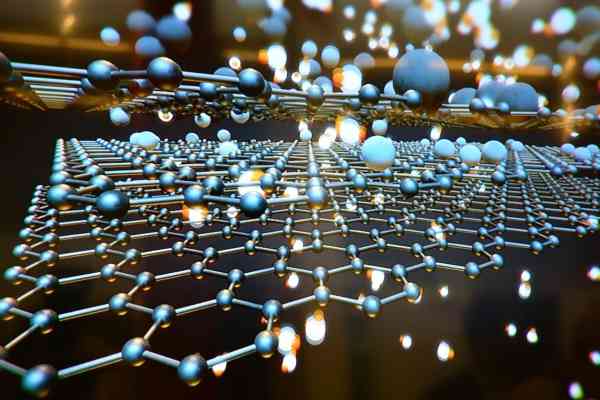

From microcap to market leader: How to get in on the booming billion-dollar graphene market with Argo Living Soils

Graphene sounds like something out of a science fiction novel, but it is already being used today where it matters most: in our roads and buildings. This miracle material, which is 200 times stronger than steel and as conductive as copper, is revolutionizing concrete and asphalt. It makes infrastructure more durable, drastically reduces CO₂ emissions, and lowers construction costs. For investors, this creates a perfect storm of technological advancement and sustainability pressure. Those who get in early with the companies driving this change will position themselves at the forefront of a billion-dollar market.

ReadCommented by André Will-Laudien on July 1st, 2025 | 07:20 CEST

Climate protection meets infrastructure: Argo Living relies on graphene for low-emission concrete

The construction industry is responsible for approximately 8% of global CO₂ emissions, and construction is taking place virtually everywhere. Anyone in the cement manufacturing industry who can significantly reduce greenhouse gas emissions is making a measurable impact on global climate targets. This creates visibility, political support, and ESG relevance, all of which are drivers for rising company valuations. The topic is highly relevant because several trillion USD will be invested in new infrastructure worldwide by 2050, including through programs such as the US Inflation Reduction Act (IRA), the EU Green Deal, and the reconstruction of Ukraine once the time comes. Investors are specifically looking for companies that are also included in these public budgets, as green building materials are considered a key technology. Argo Graphene Solutions (formerly Argo Living Soils) is perfecting this concept, and its stock is on the rise.

ReadCommented by Stefan Feulner on July 1st, 2025 | 07:10 CEST

Rheinmetall, Antimony Resources, Xiaomi – Right on trend

Although the air is getting thinner due to high valuations, especially on the US stock markets, the major indices are still striving for new highs, with the NASDAQ-100 technology exchange even climbing to another all-time high of over 22,660 points. In addition to popular defense stocks, companies involved in the production of critical metals are also trending strongly. In addition to tungsten producer Almonty Industries, another yet unknown player could soon be making a breakthrough.

ReadCommented by André Will-Laudien on July 1st, 2025 | 07:05 CEST

Innovation meets prevention: The next generation of security technologies from Volatus Aerospace

The world is in turmoil! Geopolitical conflicts, tensions between power blocs, and growing security requirements are straining public budgets and presenting governments and authorities worldwide with complex challenges. With the increasing use of digital solutions, human error must be minimized and excessive working hours reduced. This requires sophisticated technology to protect highly sensitive infrastructure such as energy, transportation, defense, and communications. As a rule, this infrastructure must be efficiently monitored and maintained for maintenance and liability reasons. In the digital age, every security-related decision is based on a foundation of data: high-resolution, up-to-date, and reliable. The regular collection and intelligent analysis of this data is essential for public institutions as well as for military applications. Volatus Aerospace (TSX-V: FLT; WKN: A2JEQU; ISIN: CA92865M1023) has its finger on the pulse!

Read