RareEarths

Commented by Stefan Feulner on February 20th, 2024 | 08:15 CET

Rheinmetall, Almonty Industries, Applied Materials - From high to high

The rally in chip stocks continues unabated. After ARM opened its books last week, investors bought as if there was no tomorrow. This week's figures from top dog Nvidia promise to be exciting. Will the share continue its upward trend, or will Wednesday herald an extended correction? Defense stocks are also at the forefront of the outperformers. As orders in the sector continue to rise, investors should take a look at the producers of the raw materials needed for the systems.

ReadCommented by Armin Schulz on February 19th, 2024 | 07:15 CET

Defense Metals, BYD, Rheinmetall - No high-tech technology without this resource

In today's technology-driven world, rare earths have become indispensable building blocks for modern high-tech applications. From high-performance electric vehicles, which promise environmentally conscious mobility, to sophisticated equipment in the defense industry, whose importance increases in times of geopolitical tensions - rare earths are everywhere. These elements, often invisible yet crucial, enable the functionality and efficiency of devices and systems used in our daily lives, such as smartphones. Rare earths have become a silent backbone of technological innovation and security policy, whose availability and control can play a decisive role in economic success and strategic superiority.

ReadCommented by Fabian Lorenz on February 14th, 2024 | 07:00 CET

Plug Power, Bayer, Defense Metals: Shares in panic mode

Is everything not so bad at Plug Power, after all? In January, the hydrogen specialist triggered panic among investors with an announced capital increase. Now, the CEO is suddenly rowing back. So, should one buy the stock now? One analyst advises caution. Bayer shareholders are also in panic mode. The downward trend of the share simply cannot find a bottom. Even at this level, analysts are cautious. Defense Metals, on the other hand, is benefiting from panic - because this concerns the supply of rare earths. The dependence on China is enormous. Defense Metals aims to change this with its rare earth project in Canada. The Company CEO expressed confidence in an interview, stating that an important agreement has been reached with the local population, and important dates are on the horizon.

ReadCommented by Stefan Feulner on February 6th, 2024 | 07:15 CET

BYD, Defense Metals, Rheinmetall - Strategic breakthroughs open up new opportunities

Rare earth metals play a crucial role in many modern technologies, especially in electromobility and the defense industry. Their unique properties make them irreplaceable for specific applications. Demand is increasing dramatically due to ambitious climate targets and the rearmament that has occurred since the start of the war in Ukraine. China holds a quasi-monopoly on the entire value chain. In Western countries, there is a lack of alternatives to escape dependence on the Middle Kingdom.

ReadCommented by Stefan Feulner on January 23rd, 2024 | 06:45 CET

BASF, Manuka Resources, Lynas - Corrections offer long-term opportunities

A "supercycle" is defined as an extended period in which the demand for certain goods exceeds the available supply. In the long term, this leads to a steadily growing supply gap and, thus, to sharply rising prices. In our current situation, where independence from countries like China and Russia is also sought, critical raw materials such as copper, vanadium and rare earth metals will become increasingly scarce over the next few years due to demand resulting from the energy transition. The current correction in these underlying stocks should, therefore, offer a long-term opportunity.

ReadCommented by André Will-Laudien on January 23rd, 2024 | 06:30 CET

Hydrogen sell-off: Invest now in high-tech blockbusters! Nel ASA, Defense Metals, AMD, Rheinmetall

Two important trends are emerging after 3 trading weeks on the stock market in 2024. The hydrogen sector is experiencing the long-awaited sell-off, while AI-related high-tech stocks are making new highs every day. Last week, the NASDAQ 100 Index reached a new all-time high of 17,340 points. Stocks such as Microsoft, Nvidia, Supermicro and AMD are moving upward daily with massive turnover. As chips also require a lot of strategic metals, the rare earth region of Wicheeda in Canada has also attracted media attention. As a result, the explorer Defense Metals has seen a significant increase in stock market turnover. No surprise: industrialized countries are looking for safe countries of origin for indispensable metals. Where are the opportunities for investors?

ReadCommented by Juliane Zielonka on January 18th, 2024 | 08:00 CET

Opportunities in times of Crisis: Defense Metals, Rheinmetall and Thyssenkrupp shares as promising investments in Energy and Defense

Geopolitical unrest is shaking the global economy - those who bet on companies such as Defense Metals, Rheinmetall or Thyssenkrupp in good time have the chance to make substantial profits! Defense Metals, as a supplier of rare earth metals, under the leadership of President Dr. Luisa Morena and CEO Craig Taylor, is not only advancing the promising Wicheeda rare earth project but is also revolutionizing the entire supply chain for rare earth metals in North America with Ucore Rare Metals Inc. Rheinmetall is strengthening the German armed forces and also expands its expertise in renewable energies. Thyssenkrupp is feeling the effects of the global unrest elsewhere, is exploring ahead and can look forward to the green light for a special project.

ReadCommented by Armin Schulz on January 10th, 2024 | 07:15 CET

Evotec, Defense Metals, PayPal - There is movement here. Where is it worth getting in?

In the dynamic environment of the stock market, it is often significant movements in individual shares that attract the attentive eye of investors. Volatile securities lure investors with the promise of quick profits, but they may signal more than just short-term market fluctuations. When stocks start to move and deviate from their usual trading patterns, it can indicate fundamental changes in the business environment, industry-specific developments or macroeconomic turning points. For the savvy investor, this might be the opportune moment when promising entry opportunities reveal themselves. However, caution is advised: Only those prepared to look behind the scenes and analyze the factors behind the volatility can truly profit from market movements.

ReadCommented by Fabian Lorenz on January 3rd, 2024 | 07:20 CET

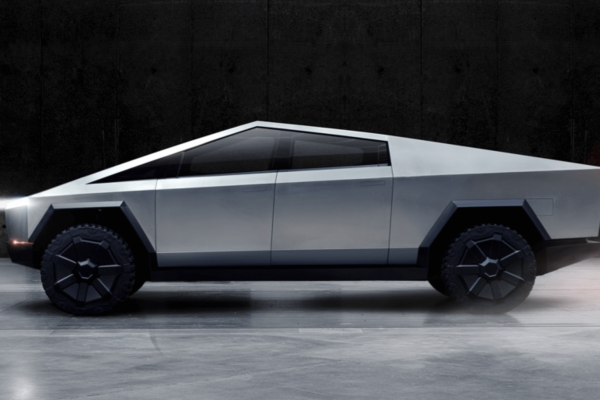

100% share price increase in a few days! Plug Power, BYD and Defense Metals shares

Within just a few days, the Defense Metals share price more than doubled shortly before Christmas. Even if the price level of the developer of a rare earths project in Canada could not be fully maintained, the share is entering 2024 with new momentum. Important data is due soon. If these are also positive, the current valuation of around CAD 50 million could be a real bargain. Plug Power is not a bargain despite the massive drop in the share price. The hydrogen specialist needs to grow and accelerate its path to break even. The e-commerce giant Amazon should help with this. BYD can only dream of doing big business in the US so far. The market is closed to Chinese e-car manufacturers. Is it justified?

ReadCommented by André Will-Laudien on December 27th, 2023 | 07:00 CET

The 2024 share rocket without e-funding - BYD, Defense Metals, Porsche and Volkswagen

With the supplementary budget 2023, the fate of the e-funding was sealed. On December 16, the purchase premium hammer came down in an "ad hoc announcement" from Berlin: The funding of up to EUR 4,500 for the purchase of a new e-vehicle has expired with immediate effect. This was announced by the Federal Office for Economic Affairs and Export Control (BAFA). The deadline for applying for the funding ended on December 17, 2023, meaning that e-mobility is now a thing of the past. Only the reduced tax rate under the company car scheme and the general exemption from vehicle tax remain. Consumer advocates are complaining about the unequal treatment of different mobility concepts that have prevailed for years, and the Federal Constitutional Court will likely have to deal with this issue in due course. Time for investors to rethink - where are the opportunities in the investment year 2024?

Read