Pharma

Commented by André Will-Laudien on March 6th, 2025 | 07:00 CET

NETRAMARK HOLDINGS – Medical Revolution: How AI is Shortening Drug Approval by Years!

Artificial Intelligence – now it is really taking off in the medical field! Among many other applications, big data and artificial intelligence (AI) applications are revolutionizing the optimization of clinical phases in drug approval by accelerating processes, reducing costs, and significantly increasing the success rate. AI can analyze large amounts of data from electronic health records, genomic data, and patient registries to identify suitable clinical trial participants more quickly and accurately. This significantly reduces recruitment time and improves accuracy. Machine learning can be used to analyze previous study results to develop more efficient study designs. Based on real-time data, adaptive study protocols enable dynamic adjustment of experimental conditions. The Canadian technology company NetraMark Holdings Inc. (WKN: A3D5X9 | ISIN: CA64119M1059 | Ticker symbol: AIAI) develops solutions for the pharmaceutical industry to utilize Generative Artificial Intelligence (Gen AI).

ReadCommented by Armin Schulz on March 3rd, 2025 | 07:40 CET

Novo Nordisk, NetraMark Holdings, BioNTech – How three pioneers are paving the way for tomorrow's medicine

On January 6, 2025, the FDA announced new guidelines for AI-powered clinical trials to accelerate the approval of life-saving therapies. This has put a spotlight on companies that combine technology and biotechnology. They are addressing pressing challenges: chronic widespread diseases, complex cancer progression, and inefficient drug development. With artificial intelligence, mRNA platforms, and strategic alliances, they are revolutionizing not only therapies but also the way pharmaceutical companies research and scale up. However, the road is rocky – regulatory hurdles, supply bottlenecks, and the race for the next blockbuster shape their stories. Who are the players disrupting billion-dollar markets with innovative approaches?

ReadCommented by André Will-Laudien on March 3rd, 2025 | 07:35 CET

Biotech: Takeover candidates for 2025! Things are heating up at Evotec, BioNxt, Bayer, and Formycon!

The DAX 40 index is hitting new highs, following a gigantic wave of buying from the US. The rally is already well advanced, but due to ongoing geopolitical upheavals, high-tech and defense stocks are still performing well. In recent weeks, the positive trends have also spread to the biotech sector again. Stocks such as BioNxt have already gained over 150% in the last six months. What is driving this? Formycon has seen a severe price drop, while Bayer and Evotec are slowly getting back on track. Are we going to see takeovers now? What are the triggers for dynamic investors?

ReadCommented by André Will-Laudien on February 27th, 2025 | 07:50 CET

Attention – Biotech is taking off! Evotec, Vidac Pharma, BioNTech, and Novo Nordisk in focus

With new index highs and huge daily trading volumes, the biotech sector has been back in the spotlight for several weeks. At Evotec, the personnel merry-go-round continues, while BioNTech has announced an acquisition in the oncology field. After the big crash in Novo Nordisk shares, the first share buybacks are now taking place, but growth rates have been revised downwards. Vidac Pharma has just completed a roadshow and will present its latest progress at the Sachs Health Science CEOs Forum in Zurich. Share prices across the sector appear to have turned in the last quarter. It is now time for investors to take a closer look again. We offer a few insights.

ReadCommented by Armin Schulz on February 27th, 2025 | 07:30 CET

Bayer, BioNxt Solutions, Evotec – Artificial intelligence as a gamechanger in pharmaceutical research

New technologies and innovative solutions will completely transform the future of medicine. To prepare for this as well as possible, hurdles such as bureaucracy, financial issues, and outdated structures must be overcome. At the same time, management must set the course, as development is continuing at a rapid pace – whether through artificial intelligence (AI) in drug research or customized therapies for individual patients. One thing is clear: anyone who wants to keep up here must think differently. But how are companies tackling this in practice? Three examples reveal why flexibility and fresh ideas are crucial right now for staying ahead in the long term.

ReadCommented by Juliane Zielonka on February 19th, 2025 | 08:00 CET

Pharma in Focus: Bayer, BioNxt Solutions, Novo Nordisk – Market Expansion, Innovation Acceleration, and a Costly Breach of Trust

The pharmaceutical and biotech market is on the move. Bayer AG aims to win the hearts of 1.2 million Japanese patients suffering from heart failure with promising study data. A drug that has already been successful in 90 countries is to be given an additional benefit. The biotech company BioNxt Solutions is attracting attention with new personnel in the finance and business areas. Its innovative drug delivery solutions could significantly improve the quality of life for millions of patients with neurodegenerative or chronic diseases. The move to a state-of-the-art research facility could accelerate the development of the active ingredients in its pipeline. Unfortunately, Novo Nordisk faces a setback following an M&A: the billion-dollar acquisition of an antihypertensive therapy turns out to be a costly mistake.

ReadCommented by Armin Schulz on February 19th, 2025 | 07:10 CET

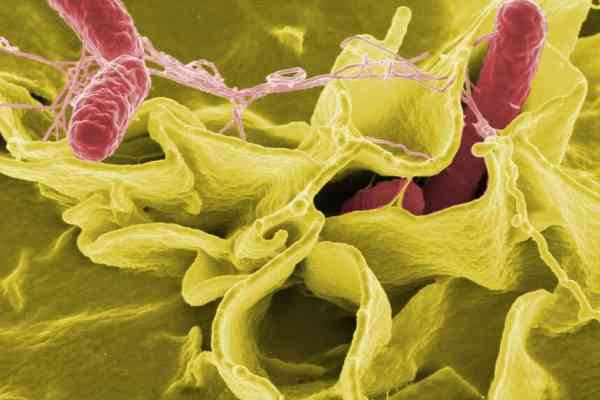

Bayer, Vidac Pharma, Pfizer – Dementia, cancer, obesity: The race for the billion-dollar markets

The pharmaceutical industry is in the throes of a major upheaval – it is no longer just about research but also about big money. Whoever is ahead now secures not only fame but, above all, extremely lucrative markets. Looking at how companies are currently driving forward mergers or acquiring startups, it is clear: The battle for the next blockbuster drugs has long since become a billion-dollar gamble. There is a lot of activity, especially in areas such as cancer, dementia, and obesity. Everyone wants to be the first to patent the golden active ingredient. We take a look at three companies that are researching the next blockbusters.

ReadCommented by Fabian Lorenz on February 12th, 2025 | 07:00 CET

Analysts on the TUI CRASH! Bayer to make millions! dynaCERT stock is set to skyrocket!

Will the dynaCERT stock see a breakthrough soon? The odds are looking good. In an analyst interview, the top German manager cites an increase in revenue, sales, and earnings as a clear goal for the next 12 months. In that case, the stock would currently be a bargain. The TUI share, however, does not appear to be a bargain for investors. The quarterly figures led to a sell-off yesterday. Yet revenue and earnings were in line with expectations. What do analysts say? Bayer's stock also trended weak yesterday, despite new potential millions in revenue from a drug approval.

ReadCommented by Fabian Lorenz on February 10th, 2025 | 07:30 CET

BIOTECH stocks in RALLY MODE: Valneva, BioNxt Solutions, Evotec – BUY signal or correction?

After the 50% rally, the stock of BioNxt Solutions is currently consolidating. However, the next buy signal could be generated soon. There will likely be some exciting announcements this year and perhaps even a strategic partnership. The new R&D site in Munich will likely also attract attention for the innovative biotech company in Germany. After the catastrophic year, things have quieted down for the time being at Evotec. Or is it more that the air has been let out? After all, there is a lot of uncertainty about what skeletons might still be in the closet and how things should continue strategically. The stock market does not like that. In contrast, Valneva has had an impressive rally since mid-January. Last week, there was another big announcement. After 50%, is there more potential with the French company?

ReadCommented by Juliane Zielonka on January 31st, 2025 | 06:55 CET

Vidac Pharma, Bayer AG, Novo Nordisk: Three companies that will shape the pharmaceutical landscape in 2025

The pharmaceutical industry is again demonstrating its market power between innovation and risk: Vidac Pharma reports a milestone in colorectal cancer therapy with VDA1275. The combination of the active ingredient with a chemotherapeutic agent achieves a 38.9% tumor reduction in preclinical studies. This synergy effect raises hope for gentler chemotherapy treatments and more innovative approaches. Bayer AG is making waves at the JP Morgan Health Conference with its pharmaceutical pipeline: the prostate cancer drug Nubeqa™ achieves blockbuster status with revenue of EUR 1 billion. In women's health, the first non-hormonal therapy for menopausal symptoms is expected to reach the US market as early as 2025. Novo Nordisk, on the other hand, is threatened with a class-action lawsuit in the billion-dollar market for obesity drugs: the REDEFINE-1 study on the promising drug CagriSema revealed weaknesses in the study design. After the results were made public, the share price fell by 18%. While Vidac Pharma and Bayer impress with precise study results, the Novo Nordisk case shows the fragility of methodological fuzziness. The details.

Read