Defense

Commented by Armin Schulz on July 18th, 2025 | 07:10 CEST

Rheinmetall's boom in demand, Power Metallic Mines' key role in critical raw materials, and BYD in crisis?

The global hunt for strategic metals is driving markets into breathtaking volatility. Military expansion and the electromobility boom are driving demand for key raw materials, while geopolitical rifts pose a threat to supply. Whoever masters these bottlenecks controls future technologies and security-critical chains. Investors sense opportunities worth billions, but only a few players are positioning themselves decisively at the critical points. We therefore take a look today at Power Metallic Mines, an indispensable supplier, as well as Rheinmetall and BYD, which represent the raw material-hungry industries.

ReadCommented by Fabian Lorenz on July 18th, 2025 | 07:00 CEST

20% in one week! Steyr Motors, Zalando, and Globex Mining shares!

Comeback for Steyr Motors. After a share price explosion in March and the subsequent crash, things had quietened down around the share. However, operations appear to have continued at full speed. Things could get interesting on July 31. Globex Mining also seems to be poised for a comeback. After doubling around the turn of the year, the mining incubator's shares corrected. However, with positive news flow and continued strong gold prices amid a commodities boom, the chances of renewed gains look promising. In Germany, retail is not exactly booming. Zalando is countering this with the takeover of its competitor ABOUT YOU. The transaction has now been completed. Will the share price rise now? Analysts certainly see considerable upside potential.

ReadCommented by Nico Popp on July 17th, 2025 | 07:15 CEST

Silver becomes a defense metal: Silver North, Rheinmetall, Siemens Healthineers

US President Donald Trump's ultimatum to Russia is less than four days old, and it is already clear that it will go unanswered. Russia is continuing its attacks on Ukraine and shows no signs of backing down. At the same time, the defense industry is continually striking new deals, expanding capacity, and investing in innovation. Many of these innovations require silver. We explain the surge in demand for this precious and industrial metal and highlight investment opportunities.

ReadCommented by Fabian Lorenz on July 17th, 2025 | 07:10 CEST

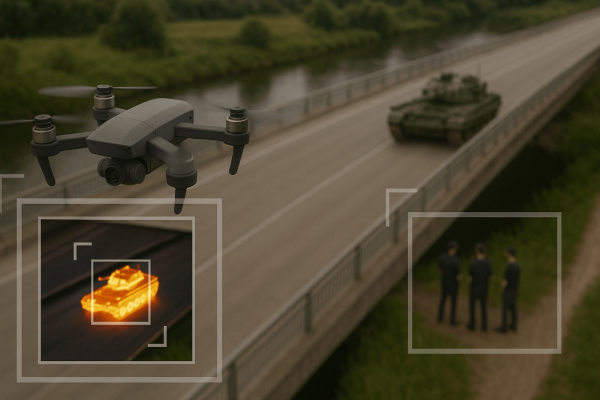

Armament stocks make a splash! RENK, DroneShield, Volatus Aerospace - Drones instead of tanks?

A major shake-up in the defense industry! KNDS is set to go public later this year, and the German federal government may participate in the IPO, which would also result in an indirect stake in RENK. KNDS has a stake in the gearbox specialist, and the two companies are jointly building the Leopard 2, among other things. But are tanks still relevant? The war in Ukraine has at least exposed their vulnerability and ushered in the age of drones. Volatus Aerospace and DroneShield are benefiting from this, with their shares having multiplied in recent months. However, more and more orders are now coming in from NATO. Revenue and profits are likely to explode in the coming years.

ReadCommented by Fabian Lorenz on July 17th, 2025 | 07:00 CEST

300% share Almonty Industries: What is next? Strategic partnerships like MP Materials?

Following its NASDAQ listing on Monday, things have quieted down somewhat for high-flyer Almonty Industries - a healthy pause after a year-to-date rally of over 300%. This may even present a buying opportunity or a chance to increase positions. The tungsten gem is likely to generate significant positive news flow in the coming months, including the production start at its tungsten mine in South Korea, new analyst coverage, and possibly even a strategic partnership, similar to what MP Materials achieved. The latter recently made headlines with a US government investment and a partnership with Apple. Although tungsten is not classified as a rare earth element, it can be considered just as critical for defense and high-tech applications.

ReadCommented by Fabian Lorenz on July 16th, 2025 | 07:25 CEST

WINNING STOCKS for the second half of the year!? Rheinmetall, Bayer, and Hotstock PanGenomic Health

Hard to believe: Bayer shares are among the winners in 2025. And even the news flow is positive. Does the Leverkusen-based company even have a new blockbuster in the pipeline? What do analysts say? PanGenomic Health shares could be among the stars of the second half of the year. With a new health app, the Company is entering a billion-dollar market in the US and benefiting from the Trump administration. If it succeeds in securing market share, the stock should have plenty of upside potential. Analysts believe that the air is getting thinner for Rheinmetall shares. However, it is likely only a matter of time before the EUR 2,000 mark is broken.

ReadCommented by Armin Schulz on July 16th, 2025 | 07:00 CEST

Nasdaq listing & USD 90 million: Almonty Industries plans its next steps and ensures further growth

With its move to the NASDAQ, Almonty Industries has completed its "Americanization". Following listings in Toronto and Sydney, the tungsten specialist is now in the spotlight of the largest capital markets. The stock market bell was probably heard in Beijing as well. The move to the NASDAQ is a logical step following the Company's relocation of its headquarters to Delaware and the appointment of high-ranking US military strategists to its board of directors. The 20 million new shares generated USD 90 million in revenue. The task now is to channel the money into mines, processing, and reserves in order to build up the entire value chain outside China. This scenario opens up opportunities for growth-oriented investors.

ReadCommented by Stefan Feulner on July 15th, 2025 | 07:05 CEST

Nasdaq-listed Almonty Industries receives substantial cash injection

Tungsten specialist Almonty Industries has capitalized on the momentum. Geopolitical risks and growing global concerns about raw material and security supply chains are increasingly leading Almonty to be seen as a reliable supplier and key provider of this critical metal in the West. With its listing on the US Nasdaq stock exchange, a significantly oversubscribed capital increase, and gross proceeds totaling USD 90 million, the Canadian company has moved up to a new league. It is now on a par with billion-dollar companies such as MP Materials in terms of securing scarce raw materials.

ReadCommented by Fabian Lorenz on July 15th, 2025 | 07:00 CEST

Attention! MULTIPLICATION potential! Hensoldt, D-Wave, and naoo shares with Buy recommendations

German defense stocks appear to have quickly ended their consolidation phase. Driven by Buy recommendations, they are marching back toward their all-time highs. Hensoldt is recommended by Deutsche Bank, among others. However, the Company could face significant challenges ahead! Meanwhile, there is a bombshell from naoo: for the first time, analysts have taken a closer look at the Swiss social media insider tip. Experts see strong growth in the coming years and believe a multiplication of the stock price is possible. D-Wave's share price has already multiplied. Nevertheless, analysts see further upside potential for the quantum high-flyer.

ReadCommented by Nico Popp on July 14th, 2025 | 07:20 CEST

Following in the footsteps of MP Materials: Why Almonty Industries is a potential global market leader

The stock market high-flyer of 2025 is tungsten producer Almonty Industries – with returns of more than 400% this year alone, the figures speak for themselves. But has the market fully grasped the whole story behind this unique tungsten company, which has been battling China's dominance in the complex market for this metal used in defense and high-tech applications for over ten years? We shed light on the background and explain why Almonty Industries is a potential global market leader.

Read