Defense

Commented by André Will-Laudien on December 8th, 2025 | 07:05 CET

The high flyers of 2026: who will lead the next rally? Almonty, Rheinmetall, BYD, and Mercedes-Benz in focus

As the year draws to a close, investors are already thinking about the next investment year. This is understandable, as hardly any other period in history has brought as much return as the past year. AI, defense, and high-tech stocks led the way, with some even reaching 1,000% in individual cases. However, the price trends also show that stocks that have performed well will eventually enter a consolidation phase. In the case of Almonty, the share price rose tenfold, and even after the correction, it was still up almost 700% at the beginning of December. In addition to fundamental data, timing also plays a decisive role in success. We are thinking about the coming year. Will the old favorites also be the new winners?

ReadCommented by Nico Popp on December 8th, 2025 | 07:00 CET

Even in times of peace, these defense stocks have a future: NEO Battery Materials, Hensoldt, DroneShield

There is a lot at stake for Ukraine these days: Will there be a dictated peace, will the war continue, or is a long-term viable solution in sight after all? Some defense stocks have fallen in recent weeks. However, regardless of the current peace negotiations, it looks as if Europe in particular will have to invest heavily in military capabilities in the coming years. We explain why and present some exciting stocks.

ReadCommented by André Will-Laudien on December 5th, 2025 | 06:55 CET

Super Rally 2026 – Who will climb to the top of the yield Olympus? Nel ASA, Plug Power, RE Royalties, mutares, or Steyr?

At the end of the year, it makes sense to rethink some stories. After an exuberant boom year in 2025, selecting new "top performers" is becoming increasingly difficult. Defense appears to have run out of steam. Nvidia, a representative of the AI sector, has been hovering around USD 180 for the past three months, investors' favorite Palantir is settling in at the USD 170 mark, and even the flagship indices DAX and NASDAQ have been moving only up or down by around 1,000 points for weeks. Get out of stocks? That would be logical, but we know that selling only happens when the cannons start firing! We take a look at some stocks that caused quite a stir in 2025. What will happen next?

ReadCommented by Armin Schulz on December 4th, 2025 | 07:20 CET

Take advantage of the panic: Why buy Rheinmetall, Almonty Industries, and DroneShield now?

A sharp drop in share prices is shaking the defense industry. Triggered by short-term hopes for peace, the markets are ignoring the unchanged robust fundamentals: bulging order books and rising global defense budgets. This discrepancy opens up strategic entry opportunities. Three key companies, artillery and vehicle manufacturer Rheinmetall, critical raw materials supplier Almonty Industries, and drone defense specialist DroneShield, are in focus and stand to benefit from sustained demand.

ReadCommented by André Will-Laudien on December 3rd, 2025 | 07:30 CET

Gold, drones, and specialty glass! Just like that, 200% gains out of nowhere with DroneShield, AJN Resources, and Gerresheimer

The stock market is showing its volatile side. While AI, defense, and tech stocks are consolidating, gold and silver are skyrocketing. Sector rotation is therefore in full swing at the end of the year. It is time to take a closer look at some notable movements, because every bull and bear market contains the seeds of the next reversal. DroneShield up 1,000% and then down 75%, AJN Resources suddenly up 200% from a standing start, and Gerresheimer, a fallen angel down 60%, a battered member of the German SME sector. We take a closer look at these stocks – where is it worth taking action?

ReadCommented by Armin Schulz on December 3rd, 2025 | 06:55 CET

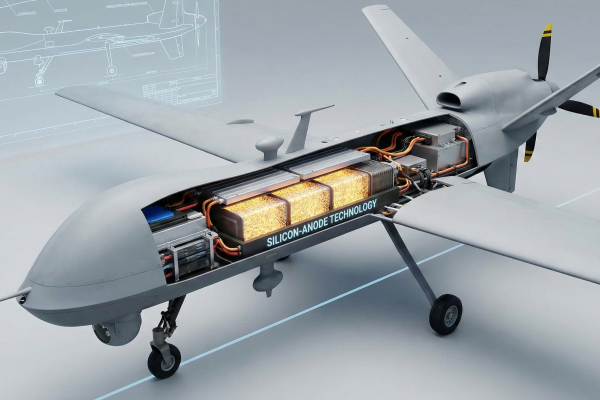

Benefit from the megatrends of electrification, AI, and security with BYD, NEO Battery Materials, and DroneShield

The next technological revolution is unfolding not only on the roads, but also in the air and in data centers. Outstanding high-performance batteries that offer more energy, faster charging times, and maximum safety are driving this development far beyond the automotive industry. They are fueling a race for the optimal cell chemistry and opening up great opportunities in future markets such as artificial intelligence, robotics, and defense. This momentum is strengthening electric vehicle market leader BYD, Canadian battery specialist NEO Battery Materials, and drone security expert DroneShield.

ReadCommented by Carsten Mainitz on December 2nd, 2025 | 07:20 CET

Watch out! Take advantage of the price correction in Almonty Industries, Rheinmetall, and RENK!

According to a study by consulting firm EY-Parthenon and DekaBank, direct defense investments by European NATO countries are expected to rise to EUR 2.2 trillion by 2035. Based on this enormous surge in demand, companies and analysts are forecasting strong growth with rising margins. The medium- and long-term outlook is therefore positive. A possible price consolidation presents a good opportunity to pick up a few shares at a low price. Another exciting investment area is critical metals, which are indispensable for the defense industry, among others. Tungsten producer Almonty Industries stands out positively in this regard.

ReadCommented by Fabian Lorenz on November 28th, 2025 | 15:40 CET

Takeover of Puma? Buy DroneShield and Antimony shares now?

A bombshell at Puma! Takeover rumors surrounding the sporting goods group are gaining momentum again. The share price exploded by over 14% yesterday. Could there even be a short squeeze? Commodity investors take note. Antimony Resources has established itself among investors this year, celebrated operational successes, and its shares still appear to be inexpensive. In the latest report, the resource estimate for the antimony project in North America was doubled. The potential for this critical metal is expected to be finalized as early as the first quarter of 2026. With an order in the bag, DroneShield's stock gained more than 20% this week. A rebound or a new upward trend?

ReadCommented by André Will-Laudien on November 27th, 2025 | 07:20 CET

Black Week sales, Bitcoin flop, DAX steady – another interest rate cut? Almonty, Rheinmetall, thyssenkrupp, and TKMS

And up it goes again! It is the season of rising prices. After the widely expected autumn correction turned out to be very mild, many investors believe: That is it! True to the motto "Buy every dip!", they are piling back into the order books. Too few shares are available, so should investors continue buying at high prices? Caution is advised with some stocks. The euphoria surrounding the IPO of thyssenkrupp's marine subsidiary TKMS has completely evaporated, and investors in Düsseldorf-based defense group Rheinmetall are taking profits on a larger scale for the first time. After all, if the war in Ukraine ends, the rearmament cycle could slow down. We will guide you through the Advent bargain hunt!

ReadCommented by Carsten Mainitz on November 27th, 2025 | 07:05 CET

Everything is lining up! Take advantage of lower prices to enter Antimony Resources, RENK, and Hensoldt!

Is peace finally coming? Efforts to end the war between Russia and Ukraine have intensified significantly in recent days. But Russia remains the unknown factor. As a result, stock market volatility driven by shifting news or rumors is to be expected in the near future, especially for defense stocks. Setbacks offer investors opportunities to build up positions. In addition, special topics such as critical metals or raw materials that are indispensable for the defense industry and other key sectors remain attractive. This is where the undervalued Antimony Resources stands out.

Read