Copper

Commented by Stefan Feulner on November 24th, 2021 | 10:13 CET

Nordex, Kodiak Copper, Xiaomi - Long-term trend

The current copper chart could have been copied from the textbook "Technical Analysis of Financial Markets" written by John J. Murphy. After a ten-year high at USD 10,720.15, the red metal corrected to the support zone at around USD 8,800. After several months of sideways movement, it is now heading north again. Once the USD 9,700 mark has been overcome, a new attempt to reach the five-digit range should only be a matter of time. Copper is in demand as never before and will remain so in the coming years.

ReadCommented by Nico Popp on November 16th, 2021 | 11:56 CET

Varta, Nevada Copper, BYD: Fast 100% with this future trend?

What does the future look like in German inner cities? If we take a survey of Hamburg residents as a blueprint, a lot will likely change in our cities very soon. Hamburgers would prefer to see their city centers car-free and promote electromobility even more strongly. So far, it is primarily city dwellers who are leaning toward the future. But as soon as e-cars paired with autonomous driving bring the surrounding areas closer to the centers, rural residents are also likely to renounce their diesel quickly. Don't believe it? Then let us convince you and find out how you can invest in tomorrow's trends today.

ReadCommented by Stefan Feulner on November 5th, 2021 | 12:01 CET

Positive news at BYD, Nevada Copper and BMW

It is a first, delicate signal from the Fed concerning the tightening of the ultra-loose monetary policy. Starting in November, the purchases of securities to stimulate the economy are to be tightened somewhat. However, the Fed is still far from thinking about raising key interest rates. The monetary watchdogs are still insisting that inflation is only temporary. Given the high energy prices and holey supply chains, this problem will likely last far longer than previously assumed.

ReadCommented by Stefan Feulner on November 2nd, 2021 | 10:19 CET

Daimler, GSP Resource, Ballard Power - Far-reaching consequences

Exactly six years ago, at the 2015 climate conference in Paris, it was agreed to limit global warming to 1.5 degrees. However, there is a considerable gap between the plan and reality. According to climate protection experts, much more ambitious action plans are needed from countries to achieve the envisaged target. The first step, and not just in Germany, is to achieve climate neutrality from the second half of this century. At the summit in Glasgow, the reins are set to be tightened, with far-reaching consequences for the economy.

ReadCommented by André Will-Laudien on October 14th, 2021 | 13:55 CEST

Varta, Standard Lithium, Sierra Grande Minerals, Nordex - The next hype rolls in!

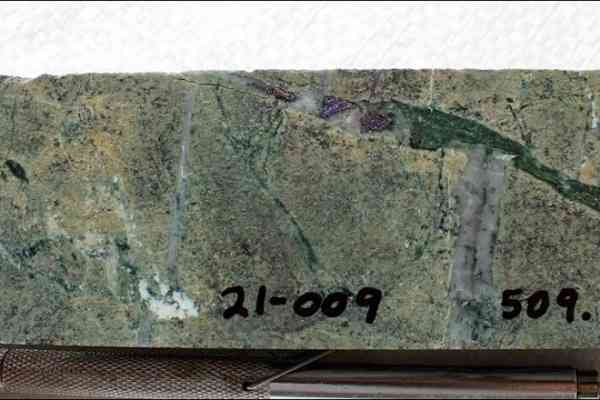

In Germany, politics is becoming significantly greener! But what do the mobility concepts of the climate protectors look like? In addition to the publicly demanded reduction of unnecessary business flights, the bicycle would also be an alternative for 30-kilometer journeys. Fossil energy has already become 50% more expensive in 2021, and gas prices are going through the roof. There is still a high demand for energy in Germany because we are currently buying cheap nuclear power abroad. This is how it can go when a botched energy policy is associated with climate protection goals. No matter how things go, the world needs copper for modern technologies, and this raw material, along with lithium and other critical metals, is just terribly scarce. How are the typical industry players doing?

ReadCommented by Nico Popp on October 4th, 2021 | 10:06 CEST

NEL, GSP Resource, China Evergrande: How to find the doublers

Speculative investments are the salt in the soup on the stock market. Of course, those who rely on ETFs and funds over the long term via a savings plan can already do a lot better than the vast majority of savers. However, those who develop a good knack for speculative individual stocks can give their portfolio a growth kick. Even if many newcomers to the stock market can hardly believe it: 100% and more is possible. Using three stocks as examples, we explain what is important and what is not a good prerequisite for investment.

ReadCommented by André Will-Laudien on September 28th, 2021 | 14:06 CEST

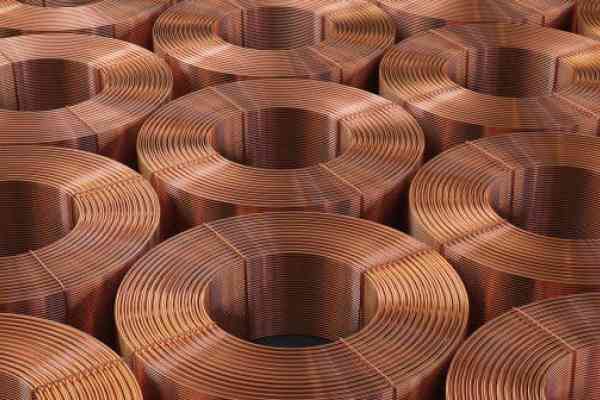

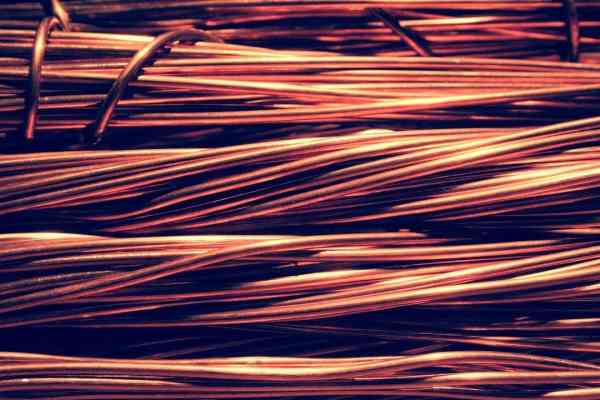

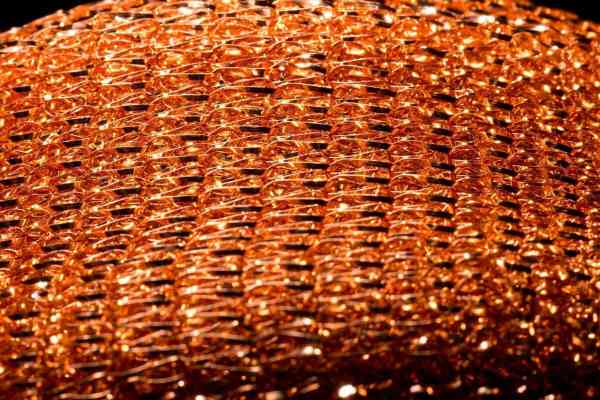

BYD, Fisker, Kodiak Copper, Varta: Nothing works without Copper!

Electromobility is becoming increasingly crucial for the energy transition in transportation. And with it the research, development and production of drives, batteries and components. In addition to electricity storage, however, vehicle cabling and the assembly of e-components are also coming to the fore. Today, an electric vehicle requires three to four times the amount of copper as it did 20 years ago, plus the demand in industrial manufacturing processes. The earth's deposits are exhaustible, and copper, in particular, is pretty much on the edge. A spot price of just under USD 10,000 per kilo clearly shows how the markets are processing this situation. Rising prices!

ReadCommented by Stefan Feulner on September 28th, 2021 | 12:04 CEST

Nordex, GSP Resource, NIO - These are the election winners

Germany has voted, and the decision was very close. According to the leading candidates Scholz and Laschet, the government should be in place by Christmas at the latest. Whether it is a traffic light or Jamaica, the Greens will almost certainly be part of the coalition. As a result, this means that the energy transition and climate protection topic will be more in the focus of politics than ever before. The expansion of infrastructure topics such as energy, construction and transport promises growing sources of income and full order books for the companies concerned.

ReadCommented by Carsten Mainitz on September 23rd, 2021 | 12:51 CEST

Kodiak Copper, Nordex, E.ON - It is not too late!

Certain framework conditions must be in place to successfully implement the energy transition and the roll-out of electromobility. First, sufficient electricity must be produced from renewable energies. Secondly, an efficient energy infrastructure must be established and thirdly, large quantities of relevant raw materials such as copper are required. The three companies below cover the central fields and should therefore be among the winners. Who is making the running?

ReadCommented by Armin Schulz on September 22nd, 2021 | 11:19 CEST

GSP Resource, Varta, Rio Tinto - The post-fossil age has begun

The phase-out of fossil fuels is already underway. If we want to do something for the climate, this step is unavoidable. The phase-out is to be offset either by nuclear power or renewable energies. In Germany, we are saying goodbye to both nuclear power and fossil fuels. At the same time, the introduction of renewable energies means that more metals are now needed. Whether silver, rare earths, nickel, cobalt or copper - these metals are necessary for technological progress. Copper, in particular, is essential for electrification, and demand is rising steadily. That is due to the growing sales of electric cars, for which more copper is needed than for combustion engines. Today we look at three companies that have a lot to do with copper.

Read