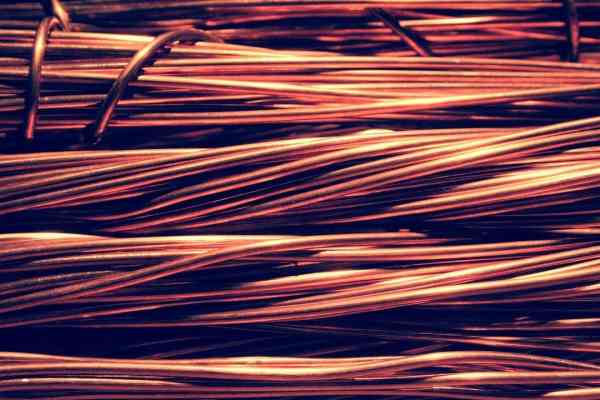

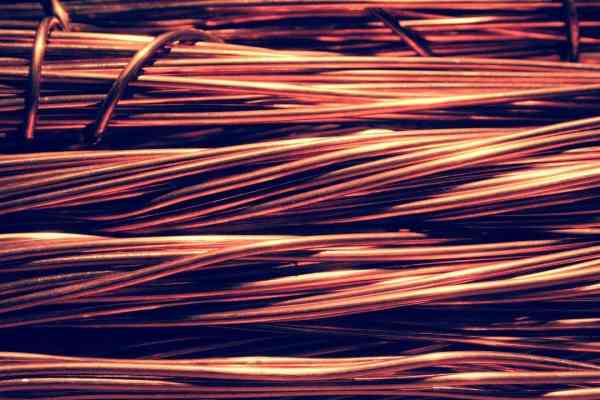

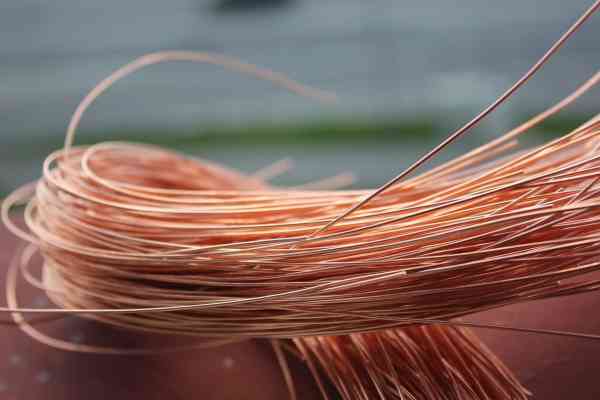

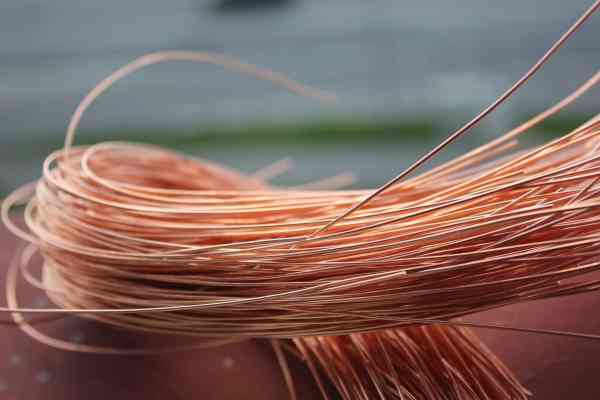

Copper

Commented by Nico Popp on June 29th, 2021 | 14:04 CEST

SAP, Barrick Gold, GSP Resource: How to invest smartly

Stocks rise and rise. A little more than a year ago, the hope that not everything would be so bad in the end boosted share prices. The end of the pandemic now seems to be near. Linked to this is the hope that the future will bring many new things and that established companies, in particular, will be able to secure a large piece of the pie. But which sectors are exciting? We take a look at two different industries and discuss the opportunities and risks.

ReadCommented by André Will-Laudien on June 29th, 2021 | 11:47 CEST

Varta, JinkoSolar, Ballard Power, Sierra Growth - Energy technology on the test bench

What will mobility look like in 10 years? Will we all be riding bicycles because climate regulations make it impossible to move around using electricity or fossil fuels? Or are there still revolutionary developments that go beyond the battery as a universal remedy? Germany continues to experience an energy shortage because we buy cheap nuclear power from abroad. That is how things can go when a messed-up energy policy is associated with climate protection goals. No matter how things go, the world needs copper for modern technologies, and this raw material is in short supply.

ReadCommented by André Will-Laudien on June 21st, 2021 | 12:52 CEST

Porsche, Gazprom, Teck Resources, GSP Resource - The raw materials rally continues!

There was a minor decline on Friday. Rarely could the DAX in recent weeks get caught up in a correction. But on triple witching, it fell from the morning onwards and lost a full 2% to 15,420 points over the course of the day. The all-time high at 15.808 is now a bit removed, and the sidelines also had to give up a bit. The S&P 500 had its first bad week since the significant May correction. However, the chart technicians are still calm; it was probably just a correction in the uptrend. Commodities were largely spared from the correction, Brent and WTI oil at highs near USD 74 and 71 respectively, and copper still just under USD 10,000.

ReadCommented by Armin Schulz on June 18th, 2021 | 12:33 CEST

Kodiak Copper, Deutsche Telekom, Varta - What is going on in commodities?

The hype around wood lasted until May 25, after which the rally ended and the price consolidated by a whopping 40%. Gold was trading above USD 1,900 last week. In parallel to this article's writing, the price is below USD 1,800. A minus of about 5.5% within five days, and the industrial metal for electrification and copper, dropped by 8%. Currently, all factors speak for a further increase in commodity prices. Real interest rates are still negative, and inflation should also remain high. The Fed could not help calm the markets, although interest rate hikes were not announced until 2023. However, the Fed intends to continue its bond purchases. Consolidation can always occur after strong increases, and so we will see long-term rising commodity prices, especially for precious metals and copper.

ReadCommented by André Will-Laudien on June 9th, 2021 | 10:55 CEST

NIO, JinkoSolar, Siemens Energy, Nevada Copper - This is the copper sensation!

The copper shortage continues as demand is continuously increasing. The current slightly weakening copper price should not hide the general state of the market. Resources are scarce, procurement markets are depleted, and demand remains at a high level. Current trends in the economy are further exacerbating this situation. Modern electric vehicles use about three to four times as much copper as a conventional internal combustion vehicle. It should not be forgotten that the construction of the charging infrastructure also requires significant amounts of copper. New mines are not currently in sight, but there is news from Nevada.

ReadCommented by André Will-Laudien on June 9th, 2021 | 10:41 CEST

BYD, Nordex, Kodiak Copper: The green revolution!

They have not yet been seen in the state elections of Saxony-Anhalt! However, the political green wave in Germany is starting to warm up for the federal election. Consumers expect greater awareness of the Paris Climate Agreement with corresponding measures in our country, especially in Europe. Already today, this is getting investors to focus correctly on the issues of the future. In plain language, this means continued tax incentives of the highest magnitude for so-called "environmentally friendly technologies" that include solar plants and wind power, including, above all, battery-powered mobility and hybrid vehicles. We shed light on some of the favorite stocks.

ReadCommented by Stefan Feulner on June 2nd, 2021 | 09:59 CEST

Volkswagen, Nevada Copper, Geely - Things are heating up!

The fear is going around. The new enemy of the economy is no longer the pandemic but the consequences due to the easing. In May, growth in Chinese industrial activity reached its highest level for 2021 due to rising demand from domestic and global markets. Commodity prices are skyrocketing due to supply shortages, and supply chains are broken, affecting the economy. Due to the green revolution, the trend of expensive metal prices will continue. The losers will be the end consumers, while the winners will be the producers of the scarce goods.

ReadCommented by Stefan Feulner on June 1st, 2021 | 11:26 CEST

Nordex, GSP Resource, Intel - Attention: it is not too late!

Months ago, we already drew your attention to the rising copper price due to the expected shortage. Currently, the base price is at a ten-year high. Due to the enormous demand resulting from the energy transition, the trend is likely to continue in the coming years. Large copper producers such as Freeport McMoRan, Glencore or Copper Mountain have already been able to multiply their prices. But it is not too late to jump on the current supercycle.

ReadCommented by Carsten Mainitz on May 31st, 2021 | 11:45 CEST

BYD, Kodiak Copper, Xiaomi - Copper: Buy or cash in?

The demand for copper will continue to grow. These are the findings of the recently published study by the International Copper Association (ICA). The ICA predicts that by 2030, more than 250,000 tons of copper per year will be used as part of the windings in electric traction motors. But copper is also in demand in many other industries. Demand exceeding supply or supply bottlenecks can make the raw material more expensive overnight at any time. For this reason, today, we take a look at a budding copper producer. Of course, large demanders such as BYD or Xiaomi must not be missing in the consideration. After all, our everyday companion, the smartphone, contains 15% copper. Let us surprise you with three exciting investment ideas.

ReadCommented by Nico Popp on May 27th, 2021 | 07:50 CEST

Kodiak Copper, ThyssenKrupp, BYD: Three trends in one share

Copper is the metal of the moment. There are several reasons in favor of copper. Firstly, copper is benefiting from the global economic recovery following the end of the pandemic. The industrial metal has always been the primary beneficiary when infrastructure is invested in or otherwise built. It is precisely in this way that countries want to boost their economies after the pandemic. At the same time, there is a dynamic demand from the e-car industry. E-cars and charging infrastructure, none of that works without copper. And last but not least, inflation is getting to us - the Bundesbank is already expecting inflation rates beyond the 4% mark. Again, commodity prices tend to benefit.

Read