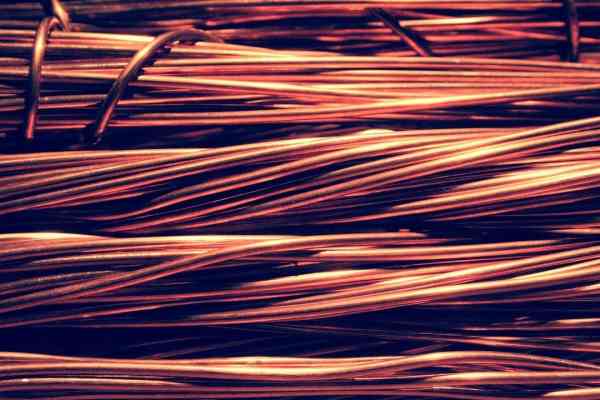

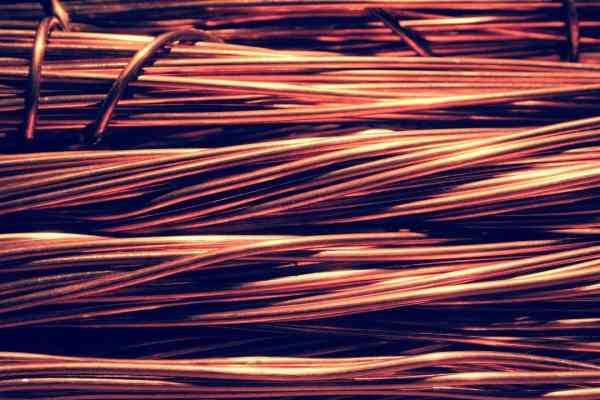

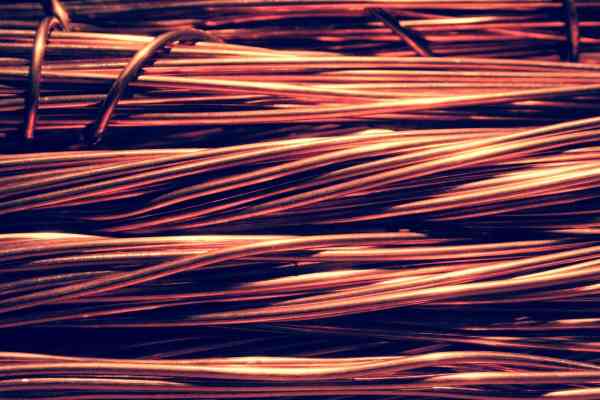

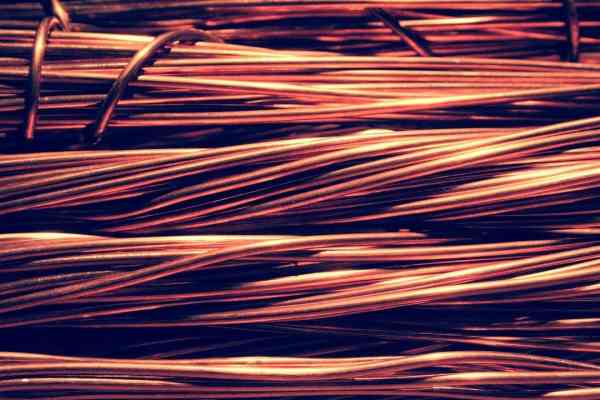

Copper

Commented by André Will-Laudien on April 27th, 2021 | 12:00 CEST

BYD, NIO, Nikola, Nevada Copper - The Tesla hunters step on the gas!

The appointment of the candidates for chancellor in Germany has led to a significant increase in the Green Party. While at the same time, the current government parties have been punished. For consumers, this means continued tax incentives of the highest magnitude for so-called "environmentally friendly technologies," which, in addition to solar panels and wind power, include above all battery-powered mobility and hybrid vehicles. The German Federal Office of Economics and Export Control (BAFA) is subsidizing the purchase of electric cars throughout Germany until the end of 2025 - this year, the bonus is particularly high. This environmental bonus supports not only the purchase but also the leasing of electric cars. One half of the subsidy comes from the manufacturer, the second half from BAFA. The stock market likes to hear this, and the manufacturers' shares are selling like hotcakes. It seems that this bull market can start again with every political statement.

ReadCommented by Nico Popp on April 21st, 2021 | 09:19 CEST

NEL, Varta, Kodiak Copper: The market has missed this news

The mobility revolution is real. Last year, stocks like NEL sparked hydrogen fantasy among investors, but battery-powered electromobility will come back into focus in 2022. The reason: Companies such as Volkswagen and Daimler are increasingly committing to electromobility. And that opens up opportunities. We present three stocks.

ReadCommented by Stefan Feulner on April 20th, 2021 | 07:00 CEST

BMW, Nevada Copper, Geely - The supercycle is unstoppable!

Since January of last year, the copper price has more than doubled and is currently trading at a 9-year high. The trend is clearly towards further rising prices. Due to the switch to alternative energy such as wind power or solar energy and the displacement of the combustion engine by the electric car, a multiple of the carrier metal is needed. Experts from major American banks such as Citigroup or JP Morgan are already talking about a new "supercycle" on the commodities market, a sustained upward price trend. Demand is rising and supply is falling. Back the winners of the energy turnaround!

ReadCommented by Nico Popp on April 12th, 2021 | 07:50 CEST

NIO, Varta, Nevada Copper: Where the best opportunities lurk in the value chain

The theory around value creation is simple: the more a raw material is refined or processed, the greater the margin a company can ultimately achieve. While a kilo of Kobe beef fillet costs around EUR 400, a savvy chef will conjure up ten dishes from it and take in four-figure sums. There are many reasons to invest at the end of the value chain, but the risk also increases. If the chef cannot cook, he will not make sustainable sales even with the best ingredients. The situation is similar in the value chain around electromobility.

ReadCommented by Carsten Mainitz on April 7th, 2021 | 09:30 CEST

BYD, Kodiak Copper, Varta - Buying rate?

Electromobility, energy and digitalization are continuing as a trend. Even if some prices have run hot in the meantime, the current price consolidation offers tempting entry opportunities. With the three shares presented, investors can bet on different facets of the trend. Which stock offers the most significant potential?

ReadCommented by André Will-Laudien on April 6th, 2021 | 10:22 CEST

Sierra Growth, BYD, Ballard Power - Copper versus hydrogen!

Emission-free mobility - who will make the race? In the last 3 weeks, there have been strong movements in battery metals. Nickel almost doubled to USD 19,500 within 12 months, followed by a correction to USD 16,000 in April. Copper fared better. Here the price fell back from USD 9,500 to USD 8,750. However, the gain over the year for both metals is still just under 100%. In the first quarter of 2021, there was a jolt in the development towards e-mobility because VW blew the big attack against Tesla. After all, VW sells 10 times more cars than its Californian competitor, and now the battle for electric customers is really getting underway...

ReadCommented by Carsten Mainitz on March 31st, 2021 | 11:45 CEST

Varta, Nevada Copper, Porsche - In the wake of the electromobility megatrend!

Demand for copper is increasing, and not only as a result of electromobility. Almost three times as much copper is used in an e-car as in a vehicle with a combustion engine. The world's largest consumer of the industrial metal is China, especially the construction sector. Chile and Peru top the list of the largest copper producers, followed by China and the United States. The metals price has been bullish over the last 12 months, showing a 75% increase. The future is bright not only for the price of copper or the shares of copper producers but also for related demand industries. We present you with three promising investments.

ReadCommented by Stefan Feulner on March 24th, 2021 | 10:14 CET

Daimler, Kodiak Copper, SFC Energy - This will be expensive!

Germany is stepping on the gas! Stop, don't rejoice too soon. Unfortunately, it's not about the German government accelerating vaccination programs and fighting the Corona pandemic. Instead, domestic automakers have been causing a stir in recent days. A move away from internal combustion engines and the consistent expansion of the electric vehicle divisions should help them return to their old strength. However, the exceptionally high demand for the raw materials needed for electric mobility could lead to significant bottlenecks and dramatic price increases in the near future. The winners are clear.

ReadCommented by André Will-Laudien on March 23rd, 2021 | 13:23 CET

Nevada Copper, BYD, Varta: Revaluation in copper?

Incredible, what speed! A few months ago, the German automotive industry was still sleepy and hardly reacted to Tesla's announcements to put the mobility of the future on a new footing. Then, last week, Volkswagen ignited the electric flock, and then yesterday came the announcement of the truck-electro cooperation from Traton Group, consisting of VW, Scania and MAN. They are to invest EUR 1.6 billion in the research and development of e-trucks by 2025. Daimler-Benz and Volvo had recently talked about a hydrogen powertrain. VW gained 7% yesterday and Daimler barely moved from the spot. So the capital market pendulum is seemingly swinging back in the direction of electromobility.

ReadCommented by Stefan Feulner on March 19th, 2021 | 07:05 CET

BMW, Nevada Copper, Nikola - The return of the giants!

For a long time, the term electric mobility was associated with the US company Tesla, led by the jack-of-all-trades Elon Musk. Germany, the land of carmakers, was in a slumber for a long time. But now, the industry giants are coming back with a vengeance. After Volkswagen kicked things off this week with its "Power Day," many other German car brands follow suit. Due to the enormous growth in the electromobility sector, raw material prices required for this new type of technology are also exploding.

Read