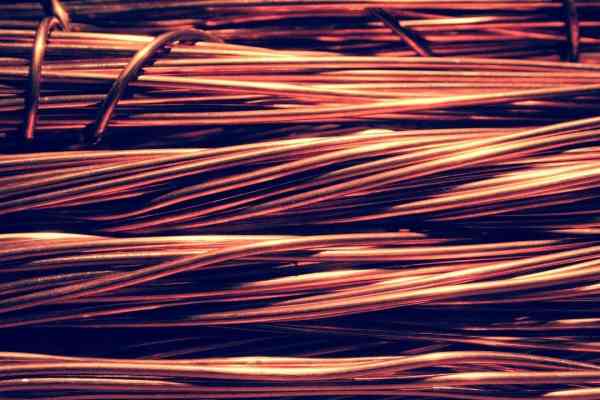

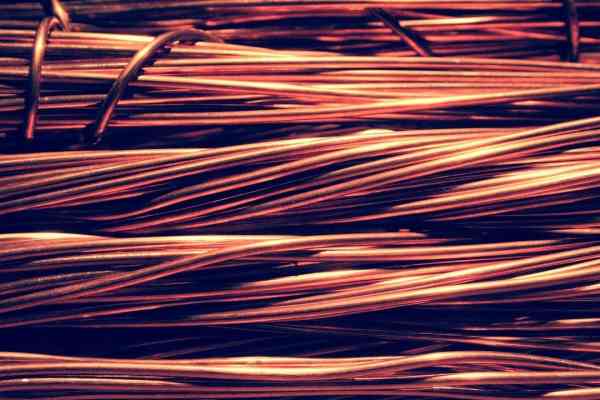

Copper

Commented by André Will-Laudien on January 7th, 2022 | 11:46 CET

Varta, Nordex, Kodiak Copper: The 100% opportunity with copper in 2022!

The climate decisions made in Glasgow in November are casting their shadows far ahead. It is becoming clear to the protagonists: electromobility and efficient electricity storage are increasingly important for the energy transition. Consistent decarbonization requires research, development and production of drives, batteries and components. The red conducting metal copper is an essential component of electrical components of all kinds. Today, an e-drive vehicle requires three to four times the amount of copper as an internal combustion model, plus the great demand in industrial manufacturing processes. The earth's reserves are exhaustible, and copper, in particular, is pretty much on the edge. We take a look at some interesting investment opportunities.

ReadCommented by Nico Popp on January 5th, 2022 | 09:22 CET

A portrait of three hot stocks: Rock Tech Lithium, Nevada Copper, Porsche

Shift down a gear, change lanes, and then feel the engine's thrust. Friends of sporty driving must have been relieved when the new German government presented the coalition agreement, and it did not include a speed limit. Powerful overtaking maneuvers are generally most successful with an electric car. So sustainability and driving pleasure do not have to be a contradiction in terms. But for e-cars to be truly green, they need sustainably mined raw materials and companies that can make the most of them. We present three shares that not only make driving fun on the road but also give your portfolio a boost.

ReadCommented by Carsten Mainitz on December 30th, 2021 | 11:30 CET

Nevada Copper, Nordex E.ON - What is next in 2022?

Several ingredients are needed to make the energy transition and electromobility a sustainable success. First and foremost, raw materials such as copper and lithium. Then there is a need for energy sources such as solar and wind, and finally, a suitable infrastructure. Therefore, within the megatrend, there are various starting points for profiting with corresponding shares. We have three promising stocks in our bag. Who will win the race in 2022?

ReadCommented by Armin Schulz on December 23rd, 2021 | 12:39 CET

Varta, Nevada Copper, JinkoSolar - Copper in desperate demand

The world is changing. Efforts are increasingly being made to protect the climate, and entire branches of industry are being converted as a result. The energy industry is increasingly relying on renewable energies, and the automotive industry has proclaimed the end of the combustion engine. The new technologies emerging, as a result, require a wide variety of raw materials, but above all, copper. Demand will increase faster than supply can be expanded. The result - rising copper prices. Not for nothing has this raw material been called the red gold. The coming years promise to be exciting on the copper market.

ReadCommented by Armin Schulz on December 22nd, 2021 | 14:10 CET

Kodiak Copper, Nordex, BYD - Are raw materials becoming scarce?

The Institute of the German Economy has presented a study on the raw material situation of the Bavarian economy. However, it can be assumed that the results will also apply to the rest of the world. As a result of the new technologies currently finding their way into the automotive industry, the demand for certain raw materials increases significantly. A total of 22 commodities are considered very risky. Copper is only ranked 23rd, but the study underlines the importance of the raw material for electrification in many areas of industry. If demand continues to grow strongly, there is a procurement risk for the German industry - a good reason to take a look at three companies that operate with copper.

ReadCommented by André Will-Laudien on December 15th, 2021 | 12:30 CET

Infineon, Nevada Copper, Nvidia - The high-tech industry in the copper trap!

Copper is an essential metal for the high-tech industry because of its extreme conductivity. Since 2019, there has already been a supply deficit, and from 2020 to 2021, the price has increased fivefold. A study on copper commissioned by the International Copper Association (ICA) shows that by 2030, more than 250,000 tons of copper per year will be used as part of the windings in electric traction motors in electric vehicles on the road. The increase in copper demand follows the development of the global automotive market, as electric and plug-in hybrid cars will account for around 19% of the total market by 2030. How is the gap closing?

ReadCommented by Carsten Mainitz on December 10th, 2021 | 11:26 CET

BASF, Kodiak Copper, Salzgitter - Inflation stays longer

For the first time in almost 30 years, the German inflation rate rose above the 5% mark in November. According to an initial estimate by the Federal Statistical Office, goods and services cost 5.2% more than a year earlier. Energy and raw material prices, which have risen sharply, account for a major share of this increase. Given the increased demand for special materials to achieve the energy turnaround, the trend is likely to be confirmed in the coming years.

ReadCommented by Stefan Feulner on December 6th, 2021 | 11:41 CET

NIO, Nevada Copper, Volkswagen - Business is booming

It is hard to imagine climate change without electromobility. The shift from combustion engines to battery-powered vehicles promises bright growth prospects for the automotive lobby. Despite the rosy outlook, a problem is emerging, one that has been known for years and is likely to become even greater in the future - the shortage of raw materials. Above all, the sharp rise in prices for essential metals is expected to eat into the margins of the automotive industry.

ReadCommented by Carsten Mainitz on December 2nd, 2021 | 12:52 CET

Nevada Copper, Varta, Aumann - Catching up!

Electromobility is inextricably linked with raw materials such as copper and lithium. The demand for e-cars and batteries is increasing enormously. This megatrend is also pulling up the relevant raw material prices. How can investors profit from this development, and which of the three stocks has the best opportunities in the coming year?

ReadCommented by André Will-Laudien on November 26th, 2021 | 11:28 CET

The copper sensation continues! Nordex, Nevada Copper, JinkoSolar, Daimler

When it comes to calculating the copper market in the next few years, expert opinions differ. According to a study by Wood Mackenzie, primary copper demand will increase by 30% to approximately 25 million tons by 2030. The main argument for further rising prices remains the global copper shortage because demand continuously exceeds supply, and recycling rates cannot cover industrial stockpiling either. The German copper smelter Aurubis is trading at an all-time high and wants to build a multi-metal plant in the USA. Such news is confirmation of an awakening among investors to allow new mining and processing operations to emerge. There are few new mines in sight at the moment, but there is news from Nevada.

Read