AI

Commented by Juliane Zielonka on February 6th, 2025 | 08:30 CET

Palantir, First Phosphate, BYD – AI, battery raw materials, and e-mobility are driving growth

Fresh quarterly figures and new projects for the electrified world shape this week's stock market. Palantir is posting impressive quarterly figures and achieving new price jumps on the stock market. Investors can expect further growth from the US company with the DOGE project from Trump and Musk. DOGE is streamlining bureaucratic structures, a huge opportunity for Palantir. Raw material producer First Phosphate is positioning itself in the booming market for LFP batteries and is planning sustainable large-scale production of battery raw materials in Canada. Meanwhile, Chinese electric automaker BYD is strengthening its presence in Germany with the appointment of an experienced domestic sales director and setting ambitious sales targets of 50,000 vehicles per year. The details.

ReadCommented by Stefan Feulner on February 4th, 2025 | 07:20 CET

Baidu, dynaCERT, BYD – Using the Trump hammer

After the Trump trades and the subsequent rally, is the Trump hammer coming next? After the stock markets reached historic highs in recent weeks, a sharp correction followed on Monday. The reason for this was the tariffs imposed by the US on Canada, Mexico, and China. The consolidation could continue to expand, given that the Buffett Indicator, which looks at the market capitalization of all US companies in relation to economic output, is at an all-time high. Nevertheless, there are undervalued value stocks that could escape the downtrend.

ReadCommented by Stefan Feulner on February 3rd, 2025 | 07:10 CET

Alibaba, Credissential, ASML – Profiteers and losers of the AI quake

Last week, the new Chinese chatbot DeepSeek caused the stock markets, particularly semiconductor stocks, to falter. Chip giant Nvidia lost 17% of its market value in one day and almost USD 600 billion in market capitalization. Whether DeepSeek can truly follow in the footsteps of ChatGPT after the initial euphoria is questionable. However, new models are coming to market that could steal market share from the established players in the future.

ReadCommented by Fabian Lorenz on January 28th, 2025 | 07:30 CET

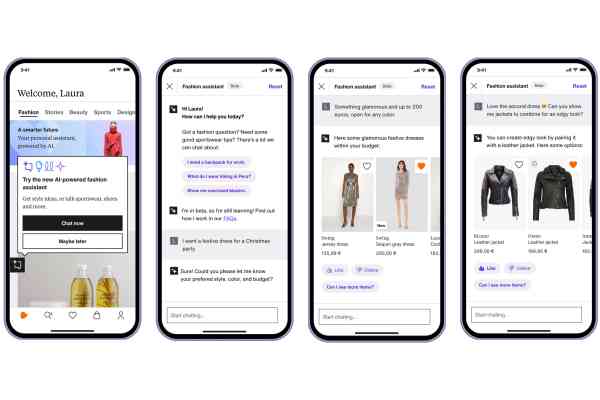

4,000% stock Carvana: TeamViewer, Bitcoin Group, Zalando, and Credissential offer opportunities

Away from the big tech stocks, multipliers are waiting. One example from the US is Carvana, which has risen 4,000% in two years. Credissential aims to challenge the online used car dealer. The startup wants to provide brick-and-mortar used car dealers with a response against Carvana using artificial intelligence. Scaling is planned for 2025. If successful, the stock is much too cheap. In the DAX, Zalando offers significant upside potential. The online retailer is back on the growth path and plans to compete with Shein and Temu through the acquisition of About You, with analysts recommending a "Buy". By contrast, TeamViewer's stock lacks momentum. Analyst opinions are divided. And is the Bitcoin Group stock finally waking up?

ReadCommented by André Will-Laudien on January 28th, 2025 | 07:20 CET

DeepSeek hits right in the eye! Selective correction on the way! Watch out for Nel, Siemens Energy, First Hydrogen, and SMCI

The Chinese language model DeepSeek is stirring up the AI market. The entire tech sector is reacting nervously and showing significant price losses. Artificial intelligence (AI) is proving indispensable in many areas. Large language models like ChatGPT are already helping to solve complex tasks, and their further development promises enormous advances for the economy and society. The new Chinese language model is seen as a serious challenge to US dominance in AI and threatens the dominance of the hyped US companies. The AI assistant introduced on January 10th recently overtook rival ChatGPT as the top-rated free software application in Apple's App Store in the US. A shot across the bow for Nvidia and associated companies. Some green energy stocks are also coming into focus. Is it time to jump on board now?

ReadCommented by André Will-Laudien on January 24th, 2025 | 06:50 CET

Artificial intelligence and crypto mania – the 500% duo! Bitcoin, MicroStrategy, Credissential, Palantir and D-Wave

Since the tech bubble of 2000, no other year of investment has seen such huge gains for just a few sectors as 2024. And it looks like 2025 will be no different! Bitcoin, high-tech, artificial intelligence and armaments were and are the blockbuster topics for making quick money. MicroStrategy, D-Wave, Palantir, and Nvidia are the current protagonists of this incredible spectacle. Now these stocks have priced in a golden future, in some cases with P/E ratios of over 100. What comes next? Even experts are at a loss - nobody expects a correction here as all the shorts of recent weeks have turned into painful experiences. The keywords are "momentum & liquidity" – is fundamental analysis useless?

ReadCommented by André Will-Laudien on January 7th, 2025 | 07:30 CET

Super Rally 2025: Artificial intelligence, crypto and the hunger for energy! TOP performance with MicroStrategy, XXIX Metal, BYD and Mercedes

The sudden cancellation of the government environmental bonus for e-vehicles at the end of 2023 has led to a significant drop in the number of electric vehicles being registered. However, interest in electric vehicles remains, albeit constrained, partly due to the high prices of many electric models. New government measures are expected to boost electric mobility again starting in 2025, with potential incentives of up to EUR 3,600 – though the implementation will likely only happen after the elections. What is being treated as an election promise for Germany has become the norm for the rest of the world. The increasing demand for energy driven by the electrification of various sectors, from high-tech and artificial intelligence to the crypto arena, which is even now being considered as a "reserve currency," highlights how quickly the world is changing in this disruptive environment. However, what all economic and political trends have in common is the need for access to strategic metals, especially copper! Where are the opportunities for investors?

ReadCommented by Armin Schulz on December 23rd, 2024 | 08:15 CET

Nel ASA, dynaCERT, Super Micro Computer – Portfolio realignment: What should be in the portfolio?

At the end of the year, many investors critically review their portfolios in order to align them with the challenges and opportunities of the year ahead. This phase, often referred to as "window dressing" or year-end rally, offers investors the opportunity to review their investment strategies, take profits, offset losses in a targeted manner or tactically reweight positions. At the same time, the new year represents a fresh start, with a renewed focus on future developments, macroeconomic trends and long-term goals. We take a look at three interesting stocks and analyse the opportunities for the coming year.

ReadCommented by Armin Schulz on December 18th, 2024 | 07:15 CET

RWE, F3 Uranium, Super Micro Computer – Profiting from the world's growing hunger for energy

Global energy demand is skyrocketing, fuelled by technological progress and the enormous appetite for electricity for electric vehicles and AI-powered data centres, whose consumption could more than double by 2028. At the same time, the energy transition faces unresolved challenges: Weather-dependent wind and solar energy supply electricity in an unreliable manner, bureaucratic hurdles slow down the expansion, and without sufficient storage, alternatives for the base load are lacking. Given these developments, nuclear power is increasingly seen as the only reliable option for both satisfying the growing hunger for energy and ensuring a stable and climate-friendly energy supply in the long term.

ReadCommented by André Will-Laudien on December 12th, 2024 | 07:30 CET

Find the 100% opportunities for 2025! Rheinmetall, Renk, Globex Mining, C3.ai and Palantir in focus

After a 30% rise in prices in the major indices since the beginning of the year, investors are asking themselves how they can weatherproof their portfolio for 2025. On the one hand, a well-defined stop strategy for overheated high-tech stocks is an option. Therefore, the topic of trailing stops should be studied in more detail and implemented. For new investments, there are always interesting setbacks to get back in on the next party. This scenario currently applies to the defense stocks Renk and Rheinmetall. Globex Mining covers almost the entire range of strategic metals that are indispensable for high-tech and defense manufacturers. Furthermore, some AI stocks like Palantir or C3.ai deserve a critical look. Accumulated profits could quickly disappear again here. We are delving deeper into the analysis.

Read