September 16th, 2025 | 07:05 CEST

Stock market with explosive potential – Where are the winners? Daimler Truck, dynaCERT and Plug Power

The stock market is currently developing very selectively. In addition to the megatrends of artificial intelligence, high-tech, and defense, investor interest is gradually shifting to future-focused sectors that have not yet felt much of the general bull market. The hydrogen sector in particular has hardly benefited from the general bullish mood so far. In addition to industrial applications within the energy transition, hydrogen technologies offer significant potential in heavy-duty transport, local transport and mining. The goal is to significantly reduce diesel consumption and thus contribute to emissions reduction. This is particularly true in cases where battery-powered trucks reach their limits in terms of range, weight, or charging times. The market for fuel cell infrastructure is growing rapidly. The EU plans to invest around EUR 5 billion in this area by 2030. Pilot projects and government subsidies are driving development forward, and private investors are now starting to take notice. Where do the opportunities for investors lie?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

Daimler Truck Holding AG | DE000DTR0013 , DYNACERT INC. | CA26780A1084 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Daimler Truck AG – The hydrogen bus hits the road

The implementation of the energy transition is taking shape. Daimler Buses is setting a good example in the international bus business. The Setra H2 Coach, currently being tested, is the first hydrogen-powered coach with a range of 800 km. This technological milestone leverages key components from the GenH2 Truck, which Daimler Truck has been developing for years. The Company is thus continuing its strategy of consistently exploiting synergies between its bus and truck divisions.

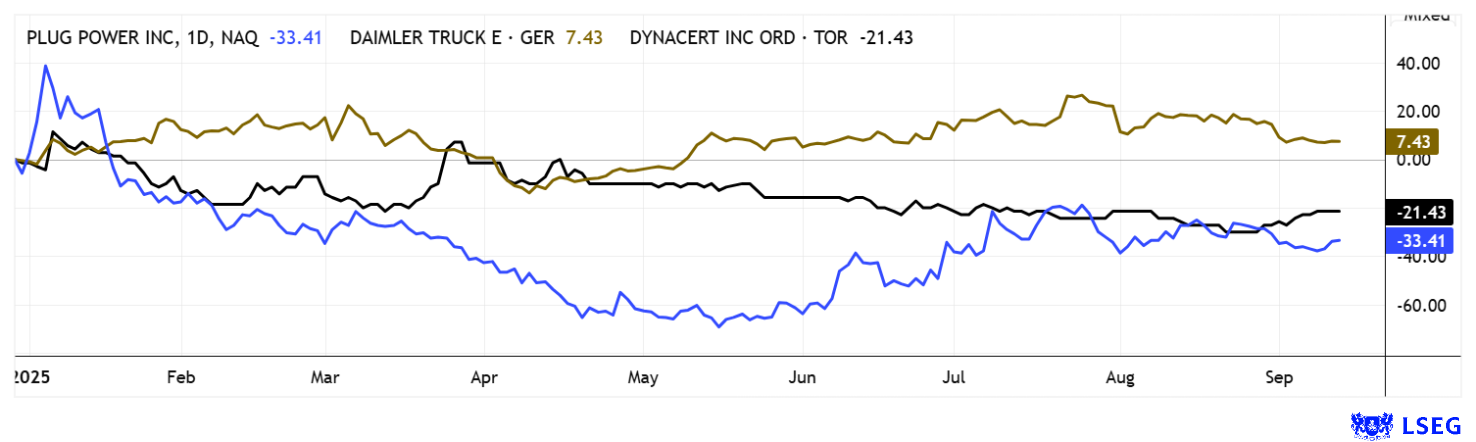

Even though series production of fuel cell trucks will still take some time, Daimler is signaling its intention to address the issue of hydrogen in the coach segment at an early stage with the H2 Coach. Relevant for investors: Daimler is continuing to pursue its two-pronged e-roadmap. Since 2018, battery-electric models such as the eCitaro have been pioneers, with the new eIntouro intercity bus making its debut at Busworld Europe and the first BEV coach towards the end of the decade. On this basis, the fuel cell variant is set to go into series production in the early 2030s as the next step. Daimler Truck's share price has already performed well in 2025, rising by over 50%. It is currently consolidating at a high level and offers a new entry opportunity. The analyst consensus on the LSEG platform gives a medium-term price target of EUR 42.60, a good 10% above the current price. A 2025 P/E ratio of 10 and a dividend yield of 5% reflect the cyclically low valuation. Investment bank Jefferies has issued a "Buy" recommendation with a price target of EUR 50.

dynaCERT – On a clear course for international expansion

The solutions offered by Canadian technology company dynaCERT are available more quickly. The Canadians are already successfully demonstrating how it can work in large-scale production. With its patented HydraGEN™ technology, the Company is setting new standards for low-emission driving and environmentally friendly heavy-duty operation. The system significantly reduces diesel consumption, demonstrably lowers CO₂ emissions, and opens up additional sources of income for fleet operators through recognized VERRA certificates. In North America and Europe, freight forwarders are already installing the system and integrating hydrogen technology into their fleets to prepare for upcoming regulatory requirements, such as stricter emission limits. Other regions are also already implementing initial projects. Recent successes range from installations at the port of Rochefort to endurance testing at the 2025 Dakar Rally. The mining industry is also already relying on HydraGEN™: Caterpillar haul trucks and large generators in South America and Canada run on the technology, which works reliably even at extreme temperatures and altitudes.

A major market breakthrough is now marked by the entry into Mexico, one of the largest truck markets in the world. Through a partnership with Texas-based company Hydrofuel Technologies, an initial order of 100 units has been placed, which will be delivered within the next 12 months. Hydrofuel will act as the distributor for both Mexico and Texas. Francisco Bricio, CEO of Hydrofuel, highlights the potential: "Mexico ranks seventh worldwide in terms of the number of trucks in operation and ninth in terms of diesel truck production. It therefore makes perfect sense to bring forward-looking technology like dynaCERT's HydraGEN technology to this market." dynaCERT COO Kevin Unrath emphasizes: "Together with Hydrofuel, we can further develop the Mexican market and drive the global transition to lower-emission transportation."

Yesterday, more news arrived. dynaCERT has appointed John Amodeo as its new Chief Financial Officer. Amodeo has more than 40 years of experience in senior financial and management roles, including in the North American metal, steel and brewing industries. He is a Chartered Professional Accountant and a graduate of the University of Toronto and Harvard Business School. With his expertise in global business development and market strategies, Amodeo will support dynaCERT's national and international expansion plans. The goal is to increase sales volumes of the Company's climate protection products. A stroke of luck in terms of personnel!

With fresh capital of CAD 5 million from the financing in July and the US stock market listing, dynaCERT is now focusing on strong visibility in international markets. For investors, the stock combines technology leadership with solid sales potential and high leverage on transportation, mining and infrastructure projects. With a market capitalization of only CAD 70 million, dynaCERT is even valued at a discount to the investments made over the last 10 years. The stock is highly liquid and tradable in Germany and Canada. The analysis firm GBC sees a price target of CAD 0.75 for the next 12 months – shares are currently trading at CAD 0.14 on the stock market. Seize the opportunity!

Plug Power – Technical stabilization is evident

American hydrogen pioneer Plug Power has gone through tough times. Between 2020 and 2022, the share price rose by more than 2,000%, but then fell just as steeply again by mid-2025, with losses of up to 98%. Investors turned away from the stock in droves because CEO Andy Marsh repeatedly revised his growth expectations downward. However, after three successful billion-dollar placements between USD 1.00 and USD 1.75, the share price now seems to be stabilizing. Technical analysts see a floor at USD 1.00 to USD 1.40, and if all goes well, a breakout towards USD 1.75 could also identify a saucer with a handle.

Fundamentally, the picture has changed slightly for the better over the last three months. Based on last year's revenue of USD 629 million, estimates for 2027 are USD 1.1 billion. However, profits are not expected until 2029. At least 7 out of 25 analysts are now recommending a "Buy", with an average expected target price of USD 2.18. This indicates a gain of over 40% on the last price of USD 1.55. However, due to its terrible price history, the stock is only suitable for hardened traders or ultra-long-term investors.

Global stock markets are racing from one high to the next – an ideal environment for high-growth technology and sustainability stocks. While industry giants like Daimler Truck and Plug Power are opening up opportunities, dynaCERT is increasingly coming into focus with its unique Greentech solution. The Company combines climate protection with increased efficiency in mobility and industry, positioning itself as a winner in the massive wave of investment in sustainable infrastructure. For investors who want to get in early on forward-looking technologies, dynaCERT offers the potential for real price multipliers.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.