Comments

Commented by Carsten Mainitz on October 28th, 2025 | 07:25 CET

Do not miss out! Almonty Industries – Price correction as an opportunity, Gerresheimer and the Damocles Sword of BaFin, TKMS underestimated!

As is well known, there is, of course, no universal rule for stock market success. Successful investors have their own strategies, which often sound very simple at their core. Commodities legend Jim Rogers summed it up with a straightforward formula: investors should simply be aware of supply and demand. Currently, this means that stocks like Almonty Industries rank among the favorites due to the prevailing market conditions. The same applies to defense stocks. But opportunities also exist in stock picking – here, it is worth taking a closer look at the beaten-down Gerresheimer.

ReadCommented by Nico Popp on October 28th, 2025 | 07:20 CET

Turnaround thanks to port business? Siemens, dynaCERT, Konecranes

The entire industrial sector must transition toward sustainability - and that includes logistics. The shipping industry, in particular, is seeing growing momentum. Global shipping currently accounts for around 3% of total emissions – and, as the Reuters news agency reports with reference to the International Maritime Organization (IMO), this share could rise to 5-8% by 2050 if no countermeasures are taken. Reason enough to take action. We highlight the different strategies being implemented and explain how the up-and-coming company dynaCERT could gain market share in this area.

ReadCommented by Fabian Lorenz on October 28th, 2025 | 07:15 CET

Better than BioNTech, Evotec & Co.? BioNxt Solutions faces key milestones and is considering an AI takeover – Stock in an upward trend

An exciting alternative to Evotec, BioNTech, and similar companies is BioNxt Solutions. The Canadian-German company's business model is a refreshing departure from traditional biotech companies with their huge research costs. BioNxt reformulates already approved active ingredients. For instance, Ozempic is set to be taken orally instead of by injection in the future. The sublingual cladribine formulation for multiple sclerosis is already well advanced, with its preclinical phase nearing completion. At the same time, CEO Hugh Rogers is considering an acquisition in the field of artificial intelligence to further accelerate development processes. The aforementioned development in the billion-dollar obesity market is also exciting. If a breakthrough succeeds, the Company could soon become a takeover candidate for Big Pharma.

ReadCommented by Armin Schulz on October 28th, 2025 | 07:10 CET

Energy Investing 2.0: Siemens Energy, RE Royalties, and RWE - Formulas for stable profits in times of change

The global energy transition will reach a historic tipping point in 2025. For the first time, renewables surpassed coal in the electricity mix, driven by record investments in solar and wind power. This revolution, fueled by investments of over USD 386 billion, is creating an entirely new ecosystem for profitable business models and strategic positioning. The focus is on three companies that are not only mastering this change but also actively shaping it and offering investors unique opportunities in a rapidly evolving market: Siemens Energy, RE Royalties, and RWE.

ReadCommented by Nico Popp on October 28th, 2025 | 07:05 CET

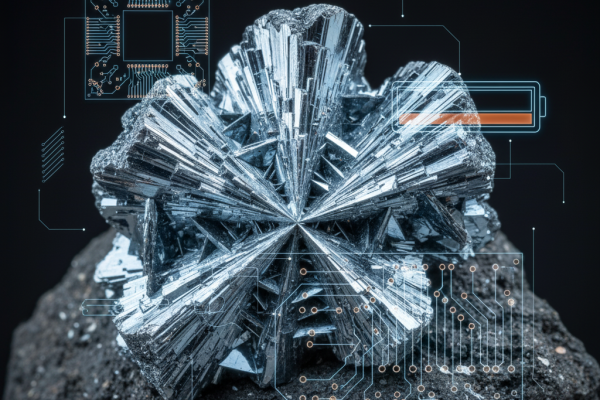

Antimony remains scarce and in demand: EnerSys, Aurubis, Antimony Resources

Antimony is a semi-metal with a silvery sheen, primarily used in lead-acid batteries, flame retardants, electronics, and military technology. In recent months, China has severely restricted its antimony exports. According to estimates, China produced around 60% of the world's antimony in 2024, followed by Tajikistan. China's dominance is heightening supply fears: as Reuters reported in June this year, US battery manufacturers are already referring to a "national emergency." This is reason enough to take a closer look at the supply chain in the West and examine the role of Antimony Resources, which recently attracted attention in the stock market.

ReadCommented by Fabian Lorenz on October 28th, 2025 | 07:00 CET

A MAJOR DEVELOPMENT IN GOLD! Will Newmont acquire Barrick Mining? Formation Metals and RENK also in focus!

This would be a major shake-up in the gold sector: Could Newmont acquire its longtime rival, Barrick Mining? Media reports suggest that this option is under consideration. Newmont is reported to have its sights set on the joint venture in the US state of Nevada. If the takeover actually goes ahead, it could be the start of a wave of acquisitions in the sector. Among the explorers, Formation Metals is an exciting candidate. The stock reacted yesterday with a jump in price following a successful capital raise. The CEO considers a resource expansion of up to 5 million ounces possible. Beyond gold, defense stocks are also consolidating. Analysts see further downside potential for RENK. Could the share price fall below EUR 60?

ReadCommented by Armin Schulz on October 27th, 2025 | 07:20 CET

China's export lockdown: How you can profit NOW with Almonty Industries, Standard Lithium, and MP Materials

Global dependence on critical metals is becoming a strategic Achilles' heel. China's recent export restrictions on tungsten and rare earths are dramatically exacerbating the supply crisis and driving up prices for raw materials that are essential to the energy transition. In this tense market environment, three companies are positioning themselves as key suppliers outside China, at just the right time to benefit from this historic market shift: Almonty Industries, Standard Lithium, and MP Materials.

ReadCommented by Nico Popp on October 27th, 2025 | 07:15 CET

Gold rush in Africa - Compelling Reasons for Côte d'Ivoire: Endeavour Mining, B2Gold, Kobo Resources

From time to time, business magazines report on investment opportunities in Africa. Time and again, authors refer to the continent's dynamic growth. The commodities sector in particular is strong. But how safe are investments in countries like Mali, Ghana or Zimbabwe? Seasoned Africa experts have always emphasized one thing: every country on the continent is different. Here, we highlight where Africa offers promising mining projects in the gold sector, draw parallels and outline the opportunities.

ReadCommented by André Will-Laudien on October 27th, 2025 | 07:10 CET

NASDAQ super bull market continues! Bet on Bitcoin now with Strategy, Metaplanet, Coinbase, Nakiki, and MARA Holdings

Another volatile week on the stock market is behind us. Once again, the NASDAQ hit a new high of 25,418 points amid much fanfare, with investment banks now predicting price targets of up to 27,500 before year-end! After a strong rebound in AI and tech stocks, the momentum could be sufficient this time, especially since many investors have long since reduced their aggressive portfolio positions. The discussion of the "wall of worry" continues. Meanwhile, the crypto world is once again in the spotlight, now increasingly seen as a "global currency" amid FIAT instability. This perspective cannot be ignored, as the US dollar's purchasing power has fallen by around 70% over the past decade. The focus, therefore, remains on Bitcoin and the companies active in this sector. Here is an overview of the opportunities and risks.

ReadCommented by Stefan Feulner on October 27th, 2025 | 07:05 CET

Hensoldt, Volatus Aerospace, Saab – Promising opportunities in the second line of defense

The defense industry is booming, and order books continue to fill up amid global rearmament. Nevertheless, established companies like Rheinmetall, RENK, and Hensoldt are already ambitiously valued, offering a limited risk-reward ratio. It is worth taking a look at the second tier, where more and more defense startups are coming to the fore and are likely poised to outperform the big players in the near future.

Read