Comments

Commented by Nico Popp on July 27th, 2021 | 10:20 CEST

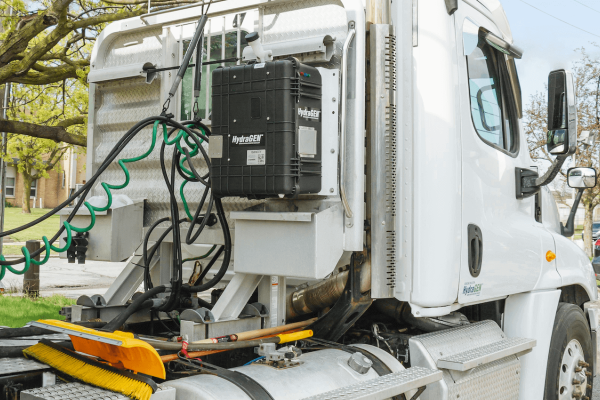

NEL, dynaCERT, Daimler: The winners of the mobility revolution

Whether with hydrogen or with battery technology, mobility is transforming. In this article, we discuss where the journey could lead, why established automakers are gaining ground with ambitious plans, and whether there are still innovative solution providers around the mobility of the future that the market has not yet noticed.

ReadCommented by Carsten Mainitz on July 26th, 2021 | 13:55 CEST

BioNTech, Cardiol Therapeutics, CureVac - What is next?

Are you smiling or shaking your head? Both are easily understandable reactions that investors might have in light of the latest statements from the Deutsches Aktien Institut (DAI). The DAI calls for better conditions for IPOs of growth companies to prevent such companies from migrating to foreign stock exchanges, as happened with BioNTech, among others. "Especially companies with specialized business models and high financing needs are dependent on foreign investors," explained Uta-Bettina von Altenbockum. However, this is not a new phenomenon either. Other countries have been creating better framework conditions for corporations and better tax incentives for investors for a long time. Own goal. What opportunities are there?

ReadCommented by Armin Schulz on July 26th, 2021 | 12:55 CEST

First Majestic Silver, Silver Viper, Fortuna Silver Mines - Is silver picking up again?

Inflation in the US climbed again in June, reaching 5.4%, the highest level since 2008. With the expansion of the money supply in the US, it is no wonder. The money supply also increased significantly in Europe. In some cases by EUR 50 billion in one week. Nevertheless, the inflation rate in Germany fell slightly to 2.3%. An end to money printing is not in sight. In contrast to gold, silver is a sought-after raw material in the industry. The price increase in precious metals has stopped since June, and there has been consolidation. It is only a matter of time when the price of silver will pick up again as inflation forces people to invest their money in assets. So today, we take a look at three silver stocks.

ReadCommented by Stefan Feulner on July 26th, 2021 | 12:18 CEST

Twitter, wallstreet:online, Snap - Rally or Crash?

What is next for the global stock markets? Several experts are already passing around price targets of 20,000 points for the DAX due to a lack of investment alternatives. At the same time, the bear camp sees the bursting of the bubble, which was created by the massive financial injections of the FED, coming our way as early as this summer and predicts a crash of unimagined proportions.

ReadCommented by André Will-Laudien on July 26th, 2021 | 11:04 CEST

Varta, Deutsche Rohstoff AG, Nordex: Multipliers in the commodity sector!

Commodity companies are currently sitting in the front row. But not all of them can profit! Only if a company has invested in recent years can it now deliver. Mining operations worldwide are currently working at the limits of their capacity, and supplying customers is also causing increasing problems. That is because supply chains have been badly hit by a lack of transport capacity, skyrocketing freight rates and pandemic-related outages. It is particularly noticeable in industry: Procurement prices for raw materials and precursors are going through the roof. We take a look at the books of some of the companies involved.

ReadCommented by Nico Popp on July 26th, 2021 | 09:48 CEST

NEL, Pure Extraction, Volkswagen VZ: Where one piece of news can change everything

Sustainability is one of those things - The closer you look, the more complex the situation becomes. Just recently, a study by the non-governmental organization ICCT showed that even hydrogen vehicles fueled with green hydrogen could have sustainability flaws. The reason: the tanks are sometimes made of carbon fibers. Their production can generate about as many greenhouse gases as the production of batteries for e-cars. We look at three stocks related to hydrogen and mobility and explain what opportunities investors can associate with them.

ReadCommented by Carsten Mainitz on July 23rd, 2021 | 14:37 CEST

Endeavour Silver, Aztec Minerals, ThyssenKrupp - Spoilt for choice: silver, gold or steel?

Despite recent setbacks in commodity prices and share prices, most experts believe that the current commodity bull market will continue for some time. The drivers are likely to be the global economic stimulus programs to overcome the consequences of the Corona Crisis, the climate crisis and the associated need for an energy turnaround, as well as the Chinese economy's continuing hunger for raw materials. The Chinese recently announced their intention to liquidate raw material reserves to stop the market price rally, putting a damper on some raw material prices. Still, many analysts believe this is more likely to be a short-term flash in the pan, given the overall situation. Below are three favorably valued stocks with which investors can profit from commodities.

ReadCommented by Stefan Feulner on July 23rd, 2021 | 13:24 CEST

SFC Energy, Enapter, Everfuel - The hydrogen of the future

Green hydrogen is the energy source of the future. Without it, there will be no climate change. The German government has also recognized this and is since focusing on a national hydrogen strategy. Green hydrogen is produced by the electrolysis of water, using only electricity from renewable sources. Only green hydrogen is truly climate-friendly, as it is made without fossil fuels. Currently, the correction in the respective shares offers favorable entry opportunities. Place your bets on the market leaders.

ReadCommented by Armin Schulz on July 23rd, 2021 | 12:47 CEST

Nel ASA, dynaCERT, Plug Power - Investments in hydrogen increase worldwide

Sustainability is a trend that is gaining more and more momentum. This can be seen well in the investments announced in the hydrogen sector. In February, members of the Hydrogen Council, which is made up of 109 global companies, wanted to put USD 80 billion into developing hydrogen projects. By July, that sum had increased by USD 70 billion to USD 150 billion. Europe is a frontrunner in hydrogen technology thanks to funding from the EU Commission's Important Projects of Common European Interest (IPCEI). According to McKinsey, it is only a matter of time before hydrogen is traded like all other commodities. Today we highlight three companies in the hydrogen segment.

ReadCommented by André Will-Laudien on July 23rd, 2021 | 11:37 CEST

CureVac, XPhyto Therapeutics, BioNTech, NanoRepro - Continuous testing or vaccination or both?

Public confusion reigns. The pandemic seems to be locked in chains over the summer, and the population is happy about initial relief with incidences below 10. But now, the first vacationers are already coming back, partly from risk or mutation areas and have to go for testing again as vaccinated persons. It is often forgotten that even those who have been fully vaccinated can be carriers of the virus and can also fall ill, so it should be clear to everyone that personal protective measures must continue to be kept high. Our life with the COVID virus will last much longer than many want to believe...

Read