Comments

Commented by Carsten Mainitz on July 29th, 2021 | 10:25 CEST

Blackrock Silver, K+S, Barrick Gold - China first!

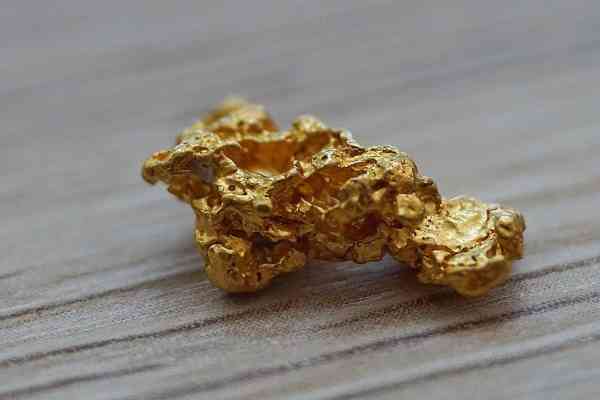

The Chinese government is demonstrating with all its might who has the last word. The regulation of industries and business models, which, as recently seen in the Chinese education sector, destroys the existence of companies and has weighed heavily on Chinese stocks in recent days. If the situation continues to escalate, it could easily negatively color the world's stock markets' mood. That is when it is worth looking at precious metals stocks, as they usually benefit disproportionately from rising commodity prices in times of crisis. Who will come out on top?

ReadCommented by Nico Popp on July 29th, 2021 | 08:48 CEST

Alibaba, Kainantu Resources, Yamana Gold: Asian Investments? Here is how it goes!

Asia is the boom region par excellence. However, China, in particular, has weakened in recent months. For years, China was considered an anchor of stability for the region - and even the world. Since February, however, Chinese shares have lost around EUR 1 trillion in market value. The market is speculating about US capital controls, which could hit China in particular. The restructuring of China's education system, which many private providers are suffering from, is unsettling. We explain why long-term investors need not fear.

ReadCommented by Stefan Feulner on July 28th, 2021 | 13:42 CEST

Commerzbank, Aztec Minerals, MorphoSys - Save yourself!

The fear of rapidly rising interest rates was taken away from investors at the past meetings of the central banks. In addition to the ECB's change in monetary policy strategy, where the inflation target of "below or close to 2%" was set aside, the Federal Reserve is blithely continuing its money printing. Despite a 5.4% increase in prices in June, US monetary watchdogs continue to focus on a growing economy and a robust labor market and continue to hold off on a monetary policy response. These hesitant measures put financial stability at risk - the best conditions for investment in precious metals.

ReadCommented by André Will-Laudien on July 28th, 2021 | 13:24 CEST

Tencent, Prosus, Troilus Gold, Baidu - The big China slump!

If you compare it with the US stock markets, the stock market in Hong Kong is already almost in free fall. While Europe and the US keep climbing to new highs, the HangSeng has lost a full 20% since February. Is the great Asian rally now over? The reason for the panic on the markets is the ever stronger intervention of the Chinese regulators. These regulators do not want to tolerate the flourishing business of large domestic corporations. More or less unfounded and drastic measures to restrict the tutoring industry have also unsettled investors. We calculate whether the current prices may be considered entry prices.

ReadCommented by Armin Schulz on July 28th, 2021 | 12:03 CEST

BP, Saturn Oil + Gas, Gazprom - Oil companies offer great opportunities

The oil price came under pressure in mid-July following an OPEC meeting. Starting in August, production will be increased by 400,000 barrels per day. This arrangement is to apply initially until September 2022. From May 2022, the United Arab Emirates, Kuwait, Iraq, Saudi Arabia and Russia all want to increase their production capacities, which would mean additional production of around 1.6 million barrels per day. The price of crude oil subsequently slumped by around USD 10 to USD 65. However, the downward trend was already broken on July 20, and the price has since climbed back up to USD 72. Today we highlight three companies that produce oil.

ReadCommented by Carsten Mainitz on July 28th, 2021 | 11:10 CEST

ProSiebenSat.1, Aspermont, Facebook - Winning with highly scalable business models

With highly scalable business models, in which content produced once can be resold as often as desired, companies can achieve high profitability, which is usually reflected in a rising share price. For marketing of advertising to a large mass or a specific target group, the same is true. The following three companies fit into this picture and stand for good prospects. Who is the favorite?

ReadCommented by Nico Popp on July 28th, 2021 | 10:14 CEST

Barrick Gold, Mineworx, TUI: Summertime is investment time

Invest or consume? Given the difficult months many of us have had, it would be understandable to unwind now: sun, beach and sea beckon despite rising numbers. But it may also make sense to think more long-term in the face of rapid change. Central banks are allowing more inflation and the printing press continues to run fast. Especially in the current summer lethargy, this can be an opportunity for people with foresight.

ReadCommented by Stefan Feulner on July 27th, 2021 | 13:01 CEST

BioNTech, XPhyto Therapeutics, MorphoSys - Here we go again

The numbers of new SARS-CoV-2 infections in Germany are rising again, albeit still at a relatively low level. Due to the spread of the Delta variant, Health Minister Jens Spahn warns of incidences beyond the 800 mark as early as this fall. In addition to masking and spacing, the issues surrounding vaccines against the various mutations and regular, reliable testing are returning to the front pages of the news pages.

ReadCommented by Carsten Mainitz on July 27th, 2021 | 11:47 CEST

Vonovia, Barsele Minerals, Aixtron - That will move the prices!

Takeovers can move share prices. That is true for the acquisition of entire companies as well as for individual divisions or projects. Often the prices of the buyer and the takeover candidate react positively. But even if takeovers fail, it is no big deal because there are usually alternatives. These three shares are currently in an exciting phase. Which value has the greatest potential?

ReadCommented by André Will-Laudien on July 27th, 2021 | 11:12 CEST

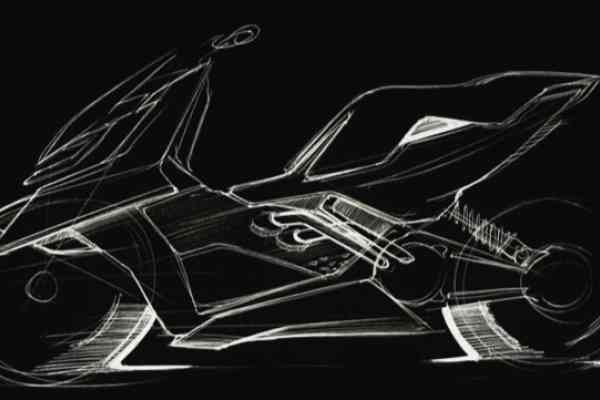

BYD, EuroSports Global, NIO - The age of electric vehicles!

Mobility will be rethought in the future with greater climate protection, new markets and less dependence on fossil fuels. The age of electric vehicles has begun. The further development of electromobility and the reinvention of the car as a rolling computer with new functionalities are a central future topic of the automotive and supplier industry. The innovative power here no longer requires long development cycles; often, even a software update is enough to anchor new features. Moreover, by linking the charging infrastructure with the energy networks, electromobility can become the key to the energy transition and climate-friendly mobility. We look at three representatives of the e-industry.

Read